Vote Buying in DAO Governance Raises Serious Integrity Concerns

Vote buying in DAO governance has surfaced as a pressing issue, especially highlighted by recent incidents within the Arbitrum ecosystem that raise alarms about governance integrity. The promise of decentralized governance is now overshadowed by the risks associated with vote manipulation, alarming holders and stakeholders alike. A notable case involved an individual leveraging 5 ETH to amass approximately 19.3 million Arbitrum votes, underscoring the potential for significant financial influence within DAO decisions. Such occurrences not only disrupt the democratic nature of decentralized governance but also trigger deep-seated concerns about the legitimacy of elections and decision-making processes. When vote buying infiltrates governance, it not only jeopardizes DAO integrity but also reveals cracks in the very foundations of systems designed to promote transparency and accountability, echoing broader challenges seen in various decentralized governance frameworks, including ETH vote manipulation and LobbyFi vote buying.

The practice of purchasing influence within decentralized organizational structures, commonly referred to as vote procurement in DAO governance, highlights a worrying trend that fundamentally challenges the principles of equality and fairness in decision-making. This form of governance manipulation manifests as entities exploit their financial capabilities to sway outcomes, reminiscent of broader governance issues faced by systems like Arbitrum. When major stakeholders can quickly amass voting power through platforms promoting financial transactions for governance influence, a pattern emerges that can undermine confidence in these decentralized systems. The looming threats of governance exploitation, such as those posed by LobbyFi and similar mechanisms, raise critical questions about how to safeguard against potential abuse while preserving the integrity of DAOs. Ultimately, as these governance structures evolve, they must confront the decentralized governance risks that accompany vote-buying practices and strive to establish frameworks that can effectively combat them.

The Impact of Vote Buying in DAO Governance

Vote buying in DAO governance has emerged as a pressing issue, raising significant questions about the integrity and security of decentralized organizations. When individuals exploit their financial resources to acquire voting power, it undermines the foundational principles of decentralization and fairness that DAOs espouse. An example of this is the recent incident in which a single user spent 5 ETH to purchase approximately 19.3 million ARB voting tokens, demonstrating not just the potential for financial manipulation but also exposing the broader risks associated with the one-token-one-vote system.

This manipulation can lead to skewed decision-making, where choices reflect the interests of a few wealthy individuals rather than the collective will of the community. The financial ramifications of such actions could deter legitimate participation among token holders who might feel their votes hold little value against deep-pocketed actors. Increasing awareness and transparency, along with robust governance policies, are essential in safeguarding against these vulnerabilities and ensuring that DAOs can fulfill their intended purpose without falling victim to corrupt practices.

Understanding Arbitrum Governance Issues

Arbitrum, as a prominent layer-2 platform for Ethereum, is at the forefront of the evolving landscape of blockchain governance. However, the recent evidence of vote buying has raised critical governance issues within its DAO structure. Concerns peak when one observes that the influential user managed to surpass the voting power of established delegates like L2Beat and Wintermute, a move that could demonstrate serious flaws in how governance power is distributed and executed. This incident signals that if unchecked, such governance issues could hinder strategic initiatives within the DAO.

Moreover, Arbitrum’s governance system is reflective of wider trends within the blockchain ecosystem. Problems often arise when the governance model relies excessively on wealth concentration, leading to potential manipulation. To enhance DAO governance in Arbitrum and similar platforms, integrating additional checks and balances, along with encouraging diverse participation, is vital. This would not only mitigate the risks linked to power imbalances but also promote a healthier, more transparent governance culture.

LobbyFi and Its Role in DAO Vote Buying

LobbyFi has gained notoriety for its role in decentralized governance, particularly following the vote buying incident within the Arbitrum DAO. This platform facilitates governance token holders to lease their voting power, which raises ethical concerns about the legitimacy of the decision-making processes within DAOs. The disturbing instance where hitmonlee.eth leveraged LobbyFi to secure votes for a crucial seat illustrates that this system may inadvertently encourage financial incentives over community-centered governance objectives. It begs the question: Are we witnessing the monetization of governance power?

By normalizing the purchasing of votes, platforms like LobbyFi may inadvertently erode trust in the DAO framework. The dynamics of rent-seeking behavior could lead to governance outcomes driven more by financial clout than by authentic stakeholder engagement. As similar practices proliferate across various DAOs, stakeholders must grapple with the implications of vote buying and reconsider the viability of models that enable such practices. Ensuring that governance remains transparent and equitable must become a priority in addressing these emerging challenges.

Identifying Decentralized Governance Risks

The rise of decentralized autonomous organizations is accompanied by notable governance risks that need addressing to preserve their integrity. The case of Arbitrum highlights how susceptible these systems can be to unethical manipulation tactics like vote buying, which could ultimately compromise the decentralized ethos. When subjects of governance can be swayed by financial incentives, the underlying principle of collective decision-making is jeopardized, as evidenced by the incident reported where a small financial investment led to substantial governance influence.

Furthermore, the implications of such risks extend beyond individual DAOs to the wider ecosystem of decentralized governance. If left unchecked, this trend can deter users from participating in DAOs, fearing their votes may be rendered insignificant in the face of financial power. As calls for more robust and resistant governance structures grow, it becomes essential to explore strategic interventions that might include regulatory frameworks or inherent checks against vote manipulation to foster a fair environment for all stakeholders.

The Consequences of ETH Vote Manipulation

Vote manipulation with ETH in decentralized governance not only compromises the democratic elements of DAOs but also threatens the broader cryptocurrency ecosystem. The case in Arbitrum where a user leveraged 5 ETH to acquire almost 19.3 million ARB tokens serves as a stark reminder of how just a small amount of currency can yield disproportionate influence. Such actions cause valid concerns about the longevity and durability of decentralized governance models if they can easily be exploited for personal gain.

Moreover, the potential consequences of these practices go beyond one isolated incident, as they impact user trust and confidence across all DAOs. When individuals feel that decision-making power can be easily bought, it may discourage participation and engender disillusionment among stakeholders. Addressing ETH vote manipulation through stronger governance protocols and promoting a culture of transparency can help restore faith in decentralized systems, paving the way for more stable and equitable governance models.

Strategies to Enhance DAO Integrity

In light of the vote buying issues surfacing in DAOs like Arbitrum, it is crucial to explore strategies that can reinforce the integrity of decentralized governance structures. Establishing transparent governance practices, regular audits, and community-driven development processes are crucial in ensuring that all stakeholders feel represented and valued. These strategies should aim to create a more level playing field, diminishing the leverage that wealthier participants wield in decision-making and enhancing community trust.

Additionally, incorporating mechanisms such as real-time voting data transparency and rewards for active and honest participation could encourage a more engaged community. Enhancing DAO integrity also requires embracing user education around the implications of vote buying. By equipping participants with the knowledge and tools to navigate potential pitfalls, we can foster a more resilient ecosystem where governance remains true to its decentralized ideals and user-driven vision.

The Future of DAO Governance Amidst Challenges

With the emergence of unprecedented challenges such as vote buying, the future of DAO governance remains uncertain yet full of potential. DAOs were envisioned as the answer to centralized control, but as we’ve seen with Arbitrum, they are not immune to manipulation. Thus, the ongoing evolution of governance frameworks must take into account these challenges, adapting to incorporate more stringent controls and governance mechanisms that can withstand attempts at financial coercion.

However, the future is not bleak. The discourse surrounding improving DAO governance structures presents opportunities to innovate and reinforce the democratic ideals at their core. By harnessing community input and leveraging technologies that increase transparency and accountability, DAOs can take meaningful strides towards cultivating an environment free from the threats of vote buying and power concentration. Ensuring the fidelity of DAO governance will ultimately define its success in the blockchain space.

Exploring Community Responses to Governance Challenges

In response to the recent issues triggered by vote buying in DAO governance, community voices are escalating, pushing for substantial reform and proactive measures. Stakeholders realize that a spontaneous approach to governance can foster a breeding ground for unethical practices like those seen in the Arbitrum case, calling for collective action towards enhancing trust and transparency. Engaging community members through polls and discussions can facilitate a shift towards a more inclusive governance model.

Moreover, the broader conversation around decentralization is essential to align interests within the community. By encouraging peer-to-peer dialogues and collaborative efforts in designing governance frameworks, DAOs can mitigate risks and develop a sustainable governance approach. This collective initiative, rooted in transparency and a commitment to fairness, plays a vital role in addressing contemporary challenges while ensuring that the integrity of the community remains intact.

Building Robust Governance Models for DAOs

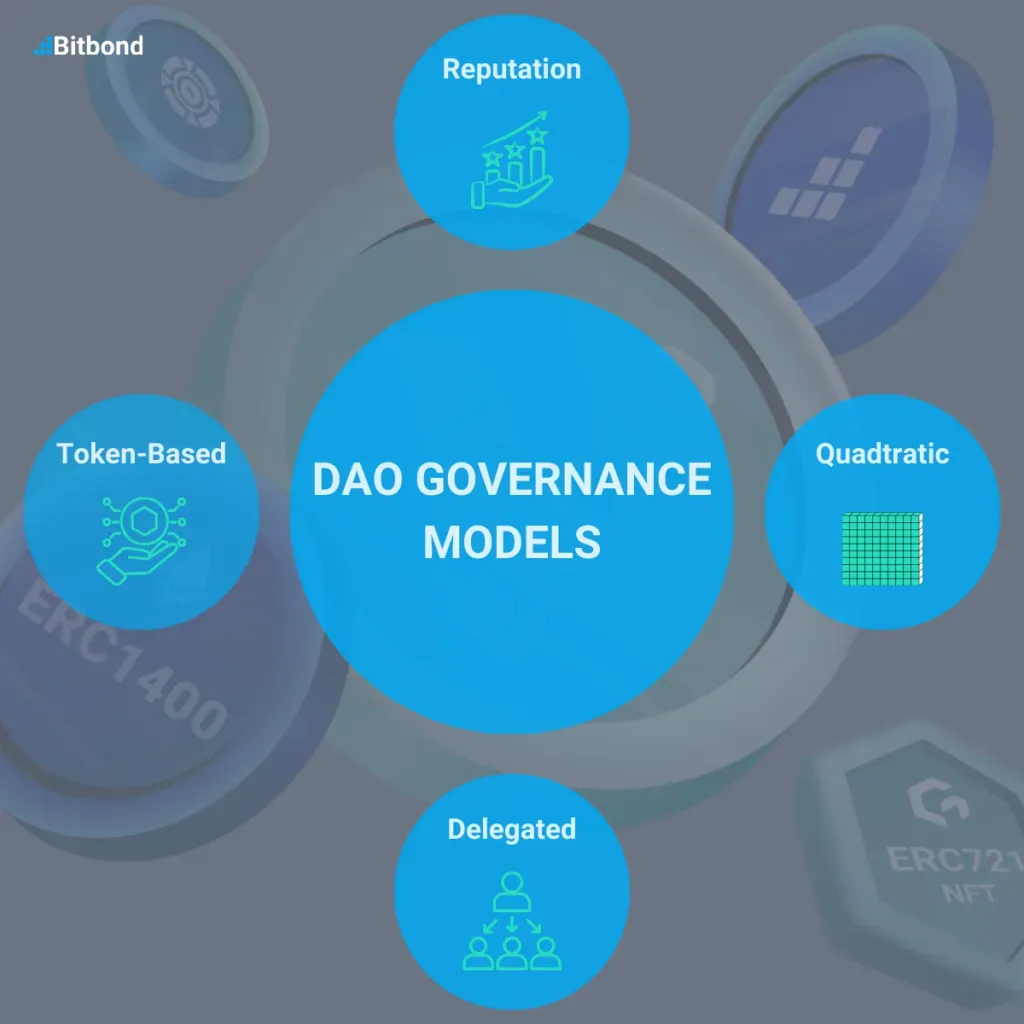

Constructing robust governance models for DAOs is a critical step in addressing the vulnerabilities exposed by vote buying incidents. These models should focus on creating diverse decision-making bodies that include representation from various stakeholders, thereby reducing the influence of wealth concentration in governance. A move towards implementing a weighted voting system based on participation rather than mere token ownership may be beneficial, ensuring that community voices carry significant weight in decision-making processes.

Additionally, deploying on-chain governance resources can provide improved tracking of voted outcomes and participant contributions, creating an environment where transparency prevails. A comprehensive approach to governance reform, informed by insights gathered from the community, can foster resilience against manipulation tactics and generate trust among token holders. As DAOs navigate a complex landscape, building strong governance pools is imperative for their survival and effectiveness.

Frequently Asked Questions

What are the risks of vote buying in DAO governance on platforms like Arbitrum?

Vote buying in DAO governance, especially on platforms like Arbitrum, poses significant integrity concerns. It undermines the foundational principles of decentralization, as seen in a recent incident where one individual spent 5 ETH to acquire substantial voting power. Such activities can manipulate decisions and compromise the efficacy of decentralized governance.

How does LobbyFi facilitate vote buying in DAO governance?

LobbyFi is a platform that enables token holders to monetize their governance power by renting it out, which can lead to vote buying in DAO governance. This creates an environment where users can gain influence over governance decisions for a fraction of the actual cost, raising concerns about the legitimacy and security of the governance model.

What examples highlight decentralized governance risks related to vote buying?

An example of decentralized governance risks is the recent vote buying case in Arbitrum and a governance attack on Compound DAO, where a major COMP holder influenced a vote that granted $24 million to an outside protocol. These incidents illustrate how vote buying can lead to significant financial manipulations within DAOs.

Why is vote manipulation a concern for DAO integrity?

Vote manipulation, such as that seen in the Arbitrum case, is a major concern for DAO integrity because it allows individuals to unduly influence governance decisions. This not only challenges the democratic nature of decentralized systems but also exposes holders to risk, as strategic financial incentives may divert from the collective good.

Can vote buying in DAO governance be incentivized?

Yes, vote buying in DAO governance can indeed be financially incentivized. In the case of Arbitrum, the oversight role for which votes were bought pays around $7,500 per month, demonstrating that financial benefits can motivate individuals to engage in vote buying, further threatening the security of decentralized governance.

What measures can be taken to prevent vote buying in DAO governance?

To prevent vote buying in DAO governance, measures such as implementing stricter voting protocols, increasing transparency in governance processes, and educating the community about the risks involved can be adopted. Organizations must address the vulnerabilities exposed by platforms like LobbyFi to enhance DAO integrity and protect token holders.

| Key Points | Details |

|---|---|

| Vote Buying Incident | 5 ETH was used to buy 19.3 million ARB voting power, amounting to around $10,000. |

| Influence on Governance | Votes were used to support a candidacy for Arbitrum’s Oversight and Transparency Committee, impacting decisions worth $6.5 million. |

| Financial Incentives | The oversight role could pay $7,500 per month, suggesting financial motivations behind vote buying in DAOs. |

| Manipulation Risks | DAOs using one-token-one-vote models are vulnerable to manipulation and governance attacks, as highlighted by previous incidents in other DAOs like Compound. |

| LobbyFi’s Role | Platforms like LobbyFi lower the cost for malicious actors to influence DAO governance decisions, posing a significant security risk. |

Summary

Vote buying in DAO governance poses a serious threat to the integrity of decentralized organizations. The recent case on Arbitrum has highlighted how vulnerable these systems are to manipulation, leading to calls for stricter measures to ensure fair governance. This incident exemplifies the urgent need for reforms in DAO structures to protect the community and maintain trust in decentralized governance. Achieving a balance between democratization and legitimacy remains a critical challenge for DAOs moving forward.