Trump Tariffs: Economic Fallout and Market Reactions

Trump tariffs have ignited a fierce debate over their economic implications and the future of U.S. trade relations. As President Trump implements his controversial trade policies, the effects are palpable across various market sectors, creating a ripple effect in the U.S. stock market. In response, countries like China have announced retaliatory measures, raising tariffs by over 30% on American goods. This escalating trade war raises concerns about inflation and potential recession, reflecting the complex economic impacts of tariffs. Moreover, ongoing Vietnam trade negotiations illustrate how U.S. allies are navigating the turbulent waters created by Trump’s policies.

The recent trade policies under the Trump administration, often referred to as protective tariffs, have stirred significant discussions about their impact on international commerce. These economic measures have led to aggressive counteractions from global trade partners, particularly from China, triggering a series of retaliatory tariffs. The repercussions of these tariffs extend beyond immediate financial markets, influencing everything from manufacturing processes to consumer prices. As companies engage in trade discussions to mitigate tariffs, such as those with Vietnam, the landscape of global trade continues to shift dynamically. The overarching effects of Trump’s trade maneuvers raise crucial questions about the sustainability of these strategies and their long-term implications for the U.S. economy.

The Impact of Trump Tariffs on U.S. Trade Relations

The implementation of Trump tariffs has significantly altered the landscape of U.S. trade relations, particularly with major partners like China. The tariffs have sparked a wave of retaliatory measures from countries affected by these policies, leading to a complex web of economic consequences. For instance, China’s introduction of a 34% tariff on American goods is a direct response that not only impacts trade balance but also puts pressure on domestic industries relying on exports. This tit-for-tat scenario has raised concerns about escalating trade tensions and the potential for a full-blown trade war.

Additionally, the repercussions of these tariffs extend beyond China. Countries like Vietnam are now engaging in their own trade negotiations to offset the impacts of U.S. policies. As manufacturers look to relocate or adjust their supply chains, the U.S. stock market reacts negatively. Investors are left wary, marking significant declines amid fears of slowing economic growth, as companies grapple with the rising costs associated with tariffs and the uncertainty they bring.

Economic Impacts of Tariffs on the U.S. Stock Market

The recent U.S. tariffs implemented under President Trump have had a pronounced effect on the stock market, contributing to steep declines over consecutive trading days. After news of China’s retaliatory tariffs broke, the Dow Jones Industrial Average experienced a shocking plunge, highlighting the fragile state of investor confidence. Critics, including financial analysts, have pointed out that heightened tariffs may lead to inflationary pressures, further deterring investment within the U.S. market. As companies like Nintendo delay product launches due to tariff uncertainties, the ripple effect creates an overall bearish sentiment among investors.

Moreover, analysts warn of the potential for a recession as the economic impacts of tariffs unfold. With Fed Chair Jerome Powell indicating that these trade policies could lower growth and increase inflation, the stage is set for a challenging environment for economic recovery. As businesses reassess their strategies in response to these tariffs, further fluctuation in the stock market seems inevitable, calling into question the long-term viability of the current trade policies.

China’s Retaliatory Tariffs: Consequences for American Industries

China’s counter-measures against the Trump tariffs signify more than just worsening bilateral relations; they illustrate critical consequences for various American industries. The introduction of substantial tariffs on U.S. goods creates an immediate burden for exporters who face increased costs and decreased competitiveness in the global market. Industries that rely heavily on exports, such as agriculture and automotive, are particularly vulnerable, potentially leading to reduced profits and workforce cutbacks as companies strive to maintain their margins in the face of rising operational costs.

Moreover, the retaliatory tariffs could accelerate the restructuring of supply chains as U.S. companies seek to mitigate risks associated with dependency on Chinese markets. This shift might open doors to new markets, such as Vietnam, which are eager to negotiate trade terms that favor foreign investment; however, it also comes with its own set of challenges and uncertainties for manufacturers accustomed to existing trade routes. The complexity of these emerging trade relationships undoubtedly complicates the economic landscape even further.

Vietnam Trade Negotiations in the Wake of Tariffs

As the U.S. implements stricter tariffs under the Trump administration, countries like Vietnam are stepping up to negotiate trade agreements that could offer an alternative route for American companies looking to avoid the fallout from rising tariffs. These trade negotiations are vital as they present opportunities for American businesses to shift production and supply chains, responding to increased costs imposed by tariffs on goods exported from traditional partners like China. Such strategic adjustments could help sustain American competitiveness in international markets.

Additionally, Vietnam stands to gain significantly from these negotiations, as it positions itself as an attractive destination for manufacturing and investment. The potential influx of U.S. businesses seeking cost-effective production solutions can catalyze Vietnam’s economic growth. However, navigating these trade negotiations requires careful consideration of both U.S. interests and the evolving landscape of global trade dictated by Trump tariffs, making it crucial for diplomats and negotiators to craft agreements that benefit all parties involved.

Political Fallout from Trump’s Tariff Policies

The political ramifications of Trump’s tariff policies are significant and multifaceted. As market anxieties mount, voices from both sides of the political aisle have emerged, urging a reevaluation of these aggressive trade strategies. Notably, Senate Minority Leader Chuck Schumer has publicly criticized Trump’s handling of the situation, claiming a lack of connection between the President’s policies and the economic realities faced by everyday Americans. This political strife underscores the deep divisions within U.S. Congress over the appropriateness and effectiveness of tariff-based trade policies.

Moreover, the ongoing political discourse surrounding tariffs has potential implications for upcoming elections, as constituents weigh the economic impacts of these policies against their intended goals. With Congressional Democrats pushing for amendments to rescind certain tariffs that burden essential goods, the pressures on the Trump administration intensify, leading to a complex interplay between policy implementation and political survival.

Investors Grapple with Turbulence After Tariff Announcements

In the wake of tariff announcements by President Trump, investors are contending with unprecedented turbulence in the stock market. The immediate effects of these tariffs have led to drastic fluctuations in stock prices, as companies reassess their earnings outlook amid uncertainties surrounding trade relations. For many investors, the steep drops in major indices signal alarm bells, prompting questions about the sustainability of American economic growth in light of escalating trade conflicts.

Additionally, the psychological impact of the markets reacting swiftly to policy changes cannot be underestimated. Investor sentiment directly correlates to perceptions of economic stability, and the introduction of new tariffs has created an environment rife with skepticism. As analysts continue to monitor the situation, investors are being advised to exercise caution, keeping a close eye on both domestic policies and international reactions, especially as countries like China and Vietnam adjust their trade strategies in response to U.S. actions.

Long-term Economic Consequences of Tariffs

The long-term economic consequences of Trump tariffs are complex and still unfolding. As companies respond to increasing operational costs and shifting trade dynamics, the U.S. economy could face a restructuring phase marked by rising costs for consumers and businesses alike. Economists are particularly concerned about the potential for sustained price increases on everyday goods, which could not only affect individual budgets but also slow down overall consumer spending — a critical driver of economic growth.

In addition, as industries grapple with the broader implications of tariffs, there is a possibility of significant shifts in employment patterns. Sectors that rely heavily on imports may face job losses, while others, potentially benefitting from a reduced reliance on foreign goods, may see growth. This evolving economic landscape challenges policymakers to adapt to these new realities, ensuring that support systems are in place for affected workers and industries.

International Trade Dynamics Post-Trump Tariffs

The reshaping of international trade dynamics following the implementation of Trump tariffs is a critical issue for global economics. The aggressive stance taken by the U.S. has prompted other nations to reconsider their trade agreements and partnerships, seeking avenues that mitigate the impacts of American tariffs. As countries enter negotiations and pivot their economies in response to tariffs, the global trade order may witness significant shifts, with new alliances potentially emerging.

Following the trade tensions, nations are likely to place greater emphasis on building strong bilateral relationships to cushion against the volatility associated with tariff fluctuations. This evolving landscape may also encourage countries previously reluctant to enter trade agreements to reconsider, fostering a more interconnected global economy that emphasizes resilience against domestic trade policies.

Market Expectations Amidst Tariff Uncertainty

As uncertainty surrounding Trump tariffs continues to loom over the financial markets, investor expectations fluctuate greatly. Each new announcement or retaliatory measure sends ripples through the stock exchanges, prompting traders to recalibrate their strategies based on the perceived economic impact. Predicting market movements in such a volatile environment has become increasingly complex, compelling analysts to adopt cautious stances as they weigh potential outcomes.

In this stage, investors are increasingly focused on anticipating future government responses and shifts in policy. As market dynamics evolve, it remains essential for stakeholders to stay informed about the ongoing discourse surrounding trade negotiations and tariff regulations, as these factors will significantly influence market trajectories and economic stability.

Frequently Asked Questions

What are the main impacts of Trump tariffs on the U.S. stock market?

Trump tariffs significantly influenced the U.S. stock market, especially after the announcement of retaliatory tariffs from countries like China. This lead to increased volatility, as investors reacted to the potential for rising inflation and disrupted trade relations. The day after major tariff announcements saw steep losses, highlighting the direct correlation between tariff policies and market performance.

How did China respond to Trump tariffs with retaliatory measures?

China’s response to Trump tariffs included imposing retaliatory tariffs of 34% on a wide range of U.S. goods, which intensified trade tensions and significantly impacted American exports. This retaliatory stance is part of a broader strategy by China to signal its discontent with U.S. trade policies and protect its own economic interests.

What are the economic impacts of tariffs introduced by President Trump?

The economic impacts of Trump tariffs include potential inflation due to increased costs on imports, disruption in supply chains, and higher prices for consumers. Various sectors, such as manufacturing and agriculture, faced challenges as costs rose and access to foreign markets was hindered, raising concerns about the overall economic growth.

What role do Vietnam trade negotiations play in the context of Trump tariffs?

Vietnam trade negotiations are increasingly relevant in the context of Trump tariffs as Vietnam emerges as an alternative production hub for companies looking to mitigate the effects of tariffs on Chinese goods. As U.S. tariffs on China increased, discussions with Vietnam became crucial for businesses seeking to avoid higher costs and maintain supply chain continuity.

How did President Trump’s tariffs affect employment in the United States?

President Trump’s tariffs had mixed effects on employment in the U.S. While they aimed to protect domestic industries, many companies reported challenges that led to hiring freezes or layoffs in sectors reliant on imported materials. The auto and tech industries faced particular strain, as increased costs from tariffs forced some businesses to reconsider their workforce needs.

Are there any long-term effects of Trump tariffs on U.S. trade relations?

Long-term effects of Trump tariffs on U.S. trade relations may include a reevaluation of trade agreements, shifting alliances, and potential long-term tariffs that could inhibit trade growth. The scope of these tariffs has prompted discussions about future trade policies and the need for strategic negotiations to prevent economic isolation.

What is the likelihood of changes to Trump tariffs under new congressional measures?

Changes to Trump tariffs under new congressional measures face substantial challenges, as the President has significant authority over trade policies. While there have been calls from Democratic leaders to rescind certain tariffs, the administrational support and political landscape will largely dictate any potential adjustments.

How can one prepare for the economic effects of Trump tariffs?

Preparing for the economic effects of Trump tariffs involves businesses diversifying supply chains, exploring alternative markets, and closely monitoring tariff announcements for adjustments and opportunities. Consumers may also need to budget for potential price increases on goods affected by tariffs.

What strategies has the Trump administration implemented regarding tariffs on foreign goods?

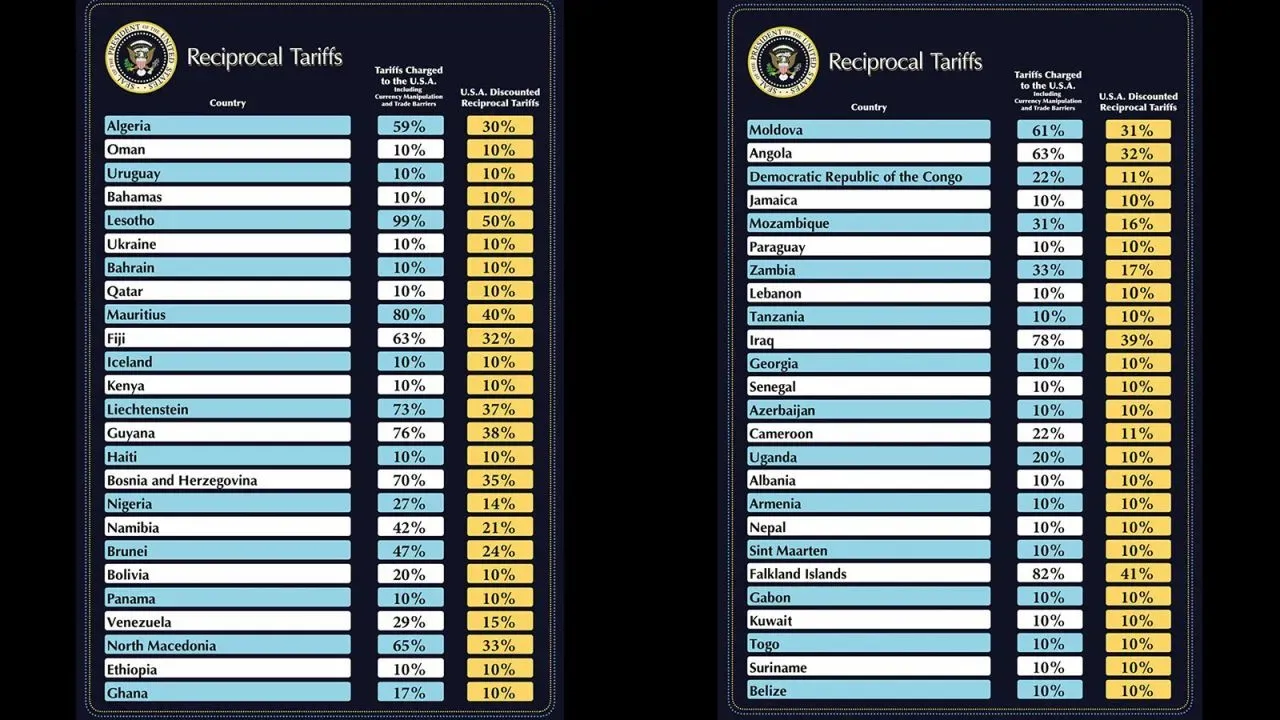

The Trump administration implemented a ‘reciprocal tariff’ policy, charging baseline tariffs on imports while claiming to protect American interests. This strategy aims to push for trade fairness, but it has also invited retaliation from trade partners, complicating global trade dynamics.

| Key Points | Details |

|---|---|

| U.S. Market Reaction | U.S. markets dropped significantly after China announced retaliatory tariffs of 34% on American goods. The Dow fell by 2,200 points, marking severe market distress. |

| Impact on Economy | Fed Chair Jerome Powell warned that Trump’s tariffs would raise inflation and lead to lower economic growth. |

| Trump’s Tariff Policy | The tariff policy included a 10% baseline tariff on many countries and higher duties on others, leading to significant trade tensions. |

| Political Responses | Prominent political figures like Chuck Schumer criticized Trump, suggesting efforts to rescind tariffs that increase costs for essential goods. |

| International Trade Negotiations | Countries like Vietnam and Korea are entering talks to mitigate the effects of U.S. tariffs and avoid increased costs. |

Summary

Trump tariffs have triggered a chain reaction in global markets, affecting trade relations and economic stability. The steep declines in the U.S. stock market and retaliatory measures from nations like China underscore the complexity of these tariffs. As both domestic and international parties react to these policies, the future landscape of trade remains uncertain, with potential ramifications that could shape economic strategies for years to come.