Trump Tariff Formula: Economists’ Critique of Flawed Rates

The Trump Tariff Formula has sparked extensive debate among economists, who critique its underpinnings and implementation. Critics argue that this complex methodology leads to inflated tariff rates, as it relies on a miscalculated elasticity factor. Analysts emphasize that the formula, which calculates tariffs based on trade deficit and exports, overlooks crucial elements, ultimately misrepresenting the actual financial implications of the tariffs. This misalignment could exacerbate the trade deficit and complicate international relations further. As discussions continue surrounding the efficacy of Trump’s tariffs analysis, many are calling for a reevaluation of tariff rates explanations, particularly the assumptions related to elasticity in tariff calculations.

The tariff structure introduced under President Trump’s administration has incited significant scrutiny in economic circles. By employing a controversial calculation method that many economists view as flawed, the administration’s trade policy raises questions about its sustainability. Terms like “trade barriers” and “import duties” circulate widely in this discourse, as experts dissect the implications of miscalculated tariff rates on global trade dynamics. Discussions around the relationship between trade deficits and imposed tariffs have gained momentum, particularly concerning the elastic nature of goods in trade tariffs. As stakeholders assess this unprecedented tariff approach, critiques abound regarding the foundational metrics driving these trade policies.

Understanding Trump Tariff Formula: A Flawed Economic Framework

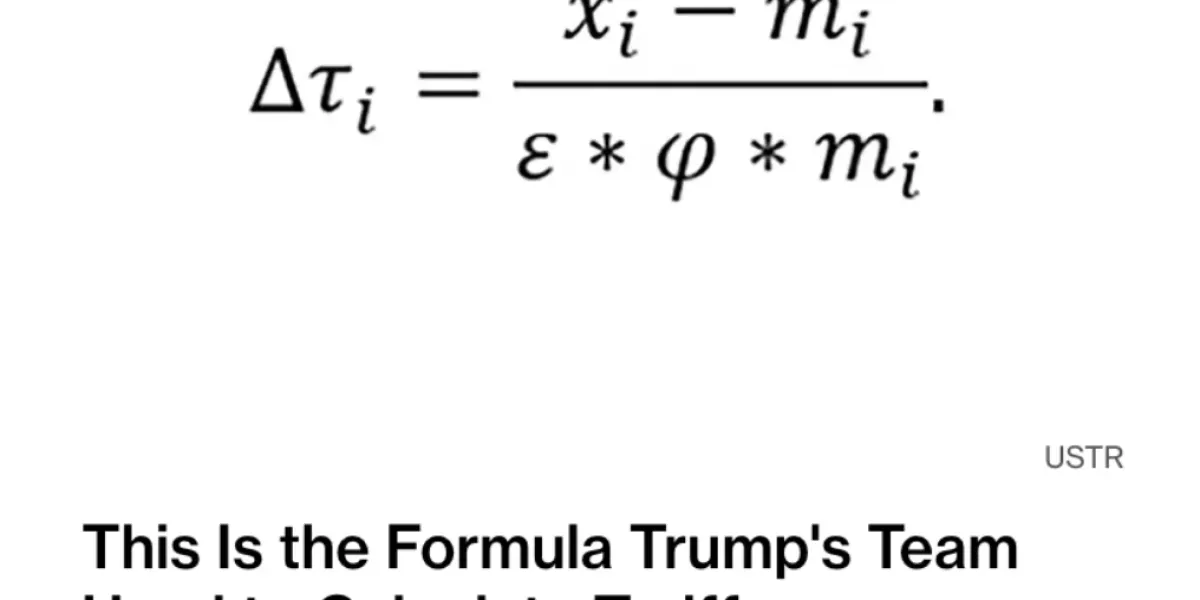

The Trump tariff formula, as articulated during the previous administration’s trade initiatives, has been met with skepticism and scrutiny from the economics community. Economists indicate that the foundational assumptions within this formula are significantly flawed, leading to an inflated perception of tariff impacts. At the heart of this analysis is an overlooked factor: the elasticity of import prices in response to tariffs. The formula suggests that tariffs are derived from the U.S. trade deficit, divided by exports, and this simplistic approach has raised concerns among professionals who study trade dynamics extensively.

Critics argue that if the government were to adjust the elasticity factor in Trump’s calculations, the price effects of tariffs would be much less severe. As the elasticity rate was set at a meager 0.25, many experts agree that a more realistic figure could be around 1.0. This reevaluation could drastically alter predictions about tariff impacts, potentially capping American tariffs at approximately 14%, a significant decrease from the current rates that some countries face—this suggests a substantial need for reform in how tariffs are calculated in future policies.

The Economic Implications of Tariff Rates Explained

Tariffs have far-reaching consequences for both the U.S. economy and international trade relationships. The complexities surrounding Trump’s tariff policy have engendered a significant dialogue about the essence of tariff rates and their real economic implications. With varying rates, sometimes as high as 50% imposed on certain countries like Lesotho, the reciprocal tariffs often provoke retaliation, leading to trade wars that can disrupt global markets.

Economists emphasize a balanced understanding of tariff rates. A critical analysis highlighted that in many instances, the tariffs justified by the Trump administration did not align with real-world trade averages. For example, the Cato Institute reported a stark contrast between the claimed tariff rates and actual data; the administration’s assertion of a 67% tariff rate – based on a flawed formula – contrasts sharply with China’s actual trade-weighted average tariff of merely 3%. Such discrepancies signal the need for a comprehensive re-examination of how tariffs are justified and the importance of accurate data in shaping trade policies.

Elasticity in Tariff Calculations: Key Insights from Economists

The concept of elasticity is pivotal in understanding how tariffs affect prices and consumer behavior. Economists argue that the elasticity of demand for imports should play a strategic role in tariff calculations. Underestimating this elasticity, as seen in Trump’s tariffs, creates a scenario where predicted outcomes—such as consumer price increases—may be grossly exaggerated. The current elasticity figure of 0.25 suggests very little responsiveness to price changes, thus amplifying the perceived burden of the tariffs.

A more accurate representation of elasticity would account for the behaviors of consumers and businesses in response to these tariffs. The suggestion that a range of 0.9 to 1.0 may be more realistic highlights an essential critique against the existing formula and poses an inquiry on whether tariff adjustments could lead to more moderate changes in overall price levels. As economists refine their understanding of elasticity, future tariff policies could benefit from incorporating these insights to create balanced trade environments.

Critiques of Trump’s Tariff Strategy by Economists

The broader economic community has expressed sharp critiques concerning the rationale behind Trump’s tariff strategy. Economists, including those from the American Enterprise Institute, have noted that the simplistic approach taken in calculating tariff rates fails to grasp the intricate interdependencies of global trade. Assertions that the trade deficit is a primary driver for tariffs often overlook other nuanced economic factors. In particular, the reliance on a formula that effectively inflates rates demonstrates a lack of consideration for the actual economic landscape.

Furthermore, professional critiques suggest that without acknowledging the nuanced nature of trade relationships—where factors like comparative advantage and trade balances play roles—these tariffs may do more harm than good. Efforts to revamp tariff policy must prioritize economic data integrity and a comprehensive understanding of international trade mechanisms, rather than rely on flawed formulas that misrepresent reality.

The Role of Trade Deficit in Tariff Calculations

At the core of Trump’s tariff initiatives lies a deep concern regarding the United States’ trade deficit. By tying tariffs directly to trade deficit figures, the administration positioned itself as a defender of U.S. economic interests. However, this approach is fraught with challenges, particularly when the calculations depend heavily on a potentially misleading metric. Economists caution that linking tariffs so directly to the trade deficit can steer policy in a direction that creates more harm than anticipated.

The fundamental problem arises when policymakers use the trade deficit as a scapegoat for broader economic issues rather than addressing the underlying causes. A narrow focus on the deficit often neglects the complexities of trade dynamics that might provide alternative solutions to economic concerns. It indicates a need for a sophisticated approach to understanding trade balance, moving beyond mere numbers to consider the implications of policy decisions on a global scale.

Policy Implications of Tariffs and Trade Wars

The policy implications stemming from Trump’s tariff formula and overall trade strategy have created ripples not only across American markets but also globally. The immediate effects of the tariffs have prompted retaliatory economic measures from affected nations, compounding the issues faced by American exporters and consumers alike. Economists agree that the escalating trade wars initiated through such unilateral tariffs often result in increased costs for consumers and threaten the stability of domestic industries reliant on global supply chains.

These trade disputes underscore the fragility of economic relationships in an interconnected world. Policymakers must tread carefully, weighing the short-term gains of tariff imposition against long-term market stability. A more thoughtful approach to trade policy that emphasizes negotiation and multilateral agreements, rather than divisive tariffs, could lead to healthier economic outcomes and foster improved international ties.

Evaluating the Effectiveness of Tariff Policies

Determining the effectiveness of the tariff policies previously implemented under Trump requires a multifaceted approach. Economists advocate for a thorough analysis of market responses post-tariff implementation to evaluate whether these measures achieved their intended economic objectives. Initial reports indicated that while tariffs aimed to bolster American manufacturing, the net effect on industries and employment rates remains a topic of ongoing debate among experts.

Another angle to consider involves examining consumer behavior in response to tariff-induced price increases. Increased tariffs on imported goods often translate to higher prices for consumers, potentially reducing overall consumption and economic growth. It becomes crucial to scrutinize whether the purported benefits of protecting domestic industries counterbalance the costs imposed on consumers and businesses alike. Fresh data and continuous monitoring will be essential in assessing the real impact of these tariffs over time.

Long-Term Predictions for Tariff Strategies

As the trade landscape evolves, the future of tariff strategies will likely require reassessment and realignment with more robust economic theories. Predictions regarding Trump’s tariff policies suggest that a restructuring may be necessary to align with contemporary economic indicators. Continued revelations around the inefficiencies and inaccuracies in the current tariff formula indicate that policymakers will have to pivot towards a more holistic understanding of trade agreements.

Economists predict that a shift towards clearer, more data-driven tariff calculations can lead to improvements in trade relations and economic outcomes. By adopting practices that better reflect market mechanics—such as true elasticity of demand and realistic assessments of trade balances—future administrations may avoid the pitfalls experienced during the Trump era while steering trade policies towards sustainable growth.

The Trade-Offs of Tariffs: Balancing Domestic and Global Interests

Navigating the balance between domestic industry protection and the realities of global trade remains a complex challenge for policymakers. Tariffs serve to protect certain sectors of the economy but can simultaneously stifle competition and innovation. Economists argue that while short-term protectionist measures may benefit specific industries, they often come at the cost of broader economic health and consumer welfare.

The global nature of markets today underscores the necessity of crafting tariff policies that embrace the benefits of open trade while judiciously protecting national interests. As tariff strategies are re-evaluated, a more integrated approach that considers long-term implications for both consumers and industries will be critical. Such strategies would ultimately aim to balance the dual needs of supporting domestic businesses while engaging effectively in the global marketplace.

Frequently Asked Questions

What is the Trump Tariff Formula used to calculate tariff rates?

The Trump Tariff Formula calculates tariffs based on the U.S. trade deficit with a country divided by its exports, halved to determine the applicable tariff rate. A baseline tariff rate of 10% is introduced for almost all nations, but economists critique that this formula leads to inflated tariff rates due to flawed elasticity assumptions.

How do economists critique the elasticity in Trump’s Tariff Formula?

Economists argue that the elasticity rate used in Trump’s Tariff Formula is set too low at 0.25. They suggest it should be closer to 1.0, particularly arguing that the elasticity should be based on import prices rather than retail prices. This miscalculation results in exaggerated tariff rates on various countries.

What is the relationship between the trade deficit and tariffs according to Trump’s Tariff Formula?

According to Trump’s Tariff Formula, tariffs are directly linked to the U.S. trade deficit with a country. The formula calculates a tariff rate by dividing the trade deficit by the country’s exports, which reflects the perceived imbalance in trade, thus justifying higher tariff rates.

Why are some tariff rates under Trump’s administration considered inflated?

Tariff rates under Trump’s administration are considered inflated because the assumptions in his tariff formula, particularly regarding elasticity, miscalculate the actual economic impact. Independent analyses reveal that if adjusted for realistic elasticity figures, the tariffs would be much lower, demonstrating a misleading justification for high tariff rates.

What is the significance of the baseline 10% tariff in Trump’s Tariff Formula?

The baseline 10% tariff in Trump’s Tariff Formula serves as a starting point for almost all countries. It sets a minimum tariff rate applied universally, but economists express concerns that it is set without adequately considering the actual trade relationships and economic data.

How does the trade-weighted average tariff rate apply in the context of Trump’s tariffs?

The trade-weighted average tariff rate serves as a benchmark to evaluate the justification of Trump’s reciprocal tariffs. Reports indicate discrepancies between reported rates, such as a 67% claim for China’s imports versus a calculated rate of 3%. This highlights issues of accuracy and inflated perceptions of tariff impacts.

What would happen to the tariffs if the Trump Tariff Formula’s elasticity assumptions were adjusted?

If the assumptions around elasticity in the Trump Tariff Formula were corrected, it has been stated that no country’s tariff would exceed 14%. Most would likely revert to the baseline 10% rate, illustrating that current tariffs are significantly higher due to flawed calculations.

| Key Points | Details |

|---|---|

| Trump Tariff Formula | Economists find it perplexing due to flawed assumptions leading to inflated tariff rates. |

| Elasticity Assumption | Current elasticity assumed is 0.25; should be closer to 1.0 (0.945). |

| Baseline Tariff | A 10% baseline tariff is imposed on almost all countries. |

| Tariff Rates Range | Tariffs range from 10% to 50% depending on the country. |

| Flawed Calculation | Cato Institute highlighted discrepancies in the trade-weighted average tariff rates. |

Summary

The Trump Tariff Formula is under scrutiny as economists critique its inflated calculations stemming from flawed assumptions. This formula, which affects international trade policy and economic stability, significantly miscalculates tariff rates. With the incorrect elasticity value of import prices used in the formula, it is evident that revisions could align tariffs closer to realistic rates, suggesting that better assessments are needed to address how these tariffs impact global trade.