Trump China Tariff: New 50% Tax Threatened Amid Trade War

The Trump China tariff debate has taken center stage as President Trump threatens to impose an additional 50% tariff on imports from China. This bold move comes in response to China’s proposed 34% retaliatory import fee on U.S. goods, highlighting the tensions in current US China relations. As the trade war escalates, the implications of this tariff increase are becoming increasingly evident, with potential economic impacts that could ripple across the globe. Import fees are not just numbers; they can significantly affect American consumers and businesses alike by raising prices on everyday goods. Analysts warn that such a trade conflict could stifle economic growth and reignite inflation, making the stakes higher than ever for both nations involved.

The ongoing trade conflict between the United States and China, often referred to as the tariff standoff, has captured the attention of economists and policymakers alike. With President Trump proposing a staggering 50% tariff on Chinese imports, tensions are flaring as both nations prepare for a possible escalation. The looming threat of increased duties could have far-reaching consequences, prompting concerns over the potential escalation of import tariffs that impact everyday consumers. As each side retaliates, the economic ramifications of this trade skirmish are becoming increasingly pronounced. The situation raises questions about the future of international trade dynamics and the delicate balance of global economic relations.

Understanding Trump’s Proposed 50% Tariff on China

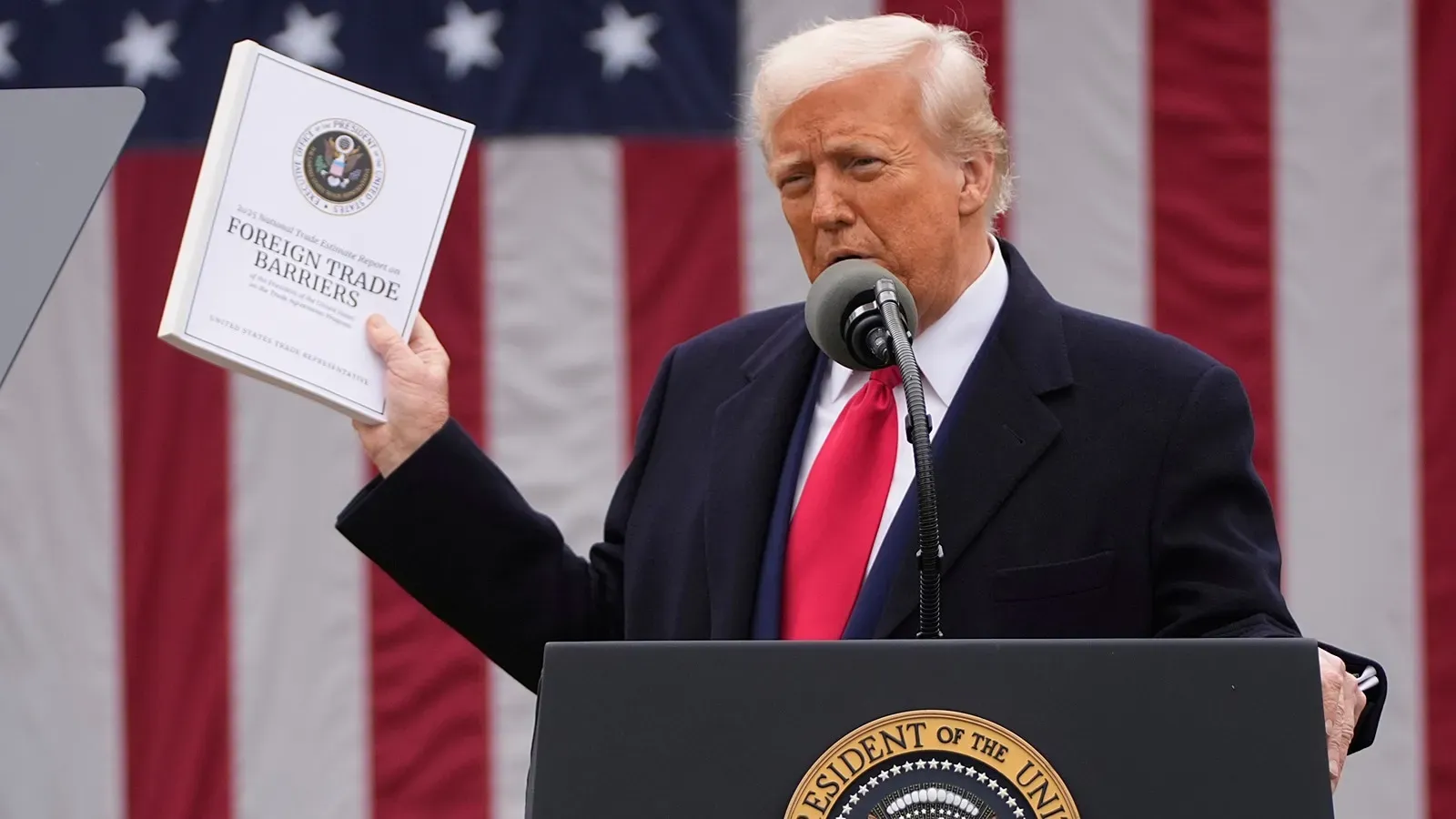

President Trump’s announcement to impose an additional 50% tariff on Chinese imports has sent shockwaves through global markets. This drastic measure is contingent upon China’s retraction of its own planned 34% tariff increase on U.S. goods, showcasing the escalating tensions in U.S.-China relations. The intention behind these tariffs is to reshape trade dynamics and address perceived trade abuses. Economists are closely monitoring this move, as the increased costs associated with these tariffs could have serious economic repercussions on both sides.

Moreover, the imposition of such a hefty tariff may exacerbate the existing trade war between the U.S. and China, which has already seen numerous rounds of tariff increases over the past few years. With the potential for retaliatory measures, some analysts are warning about the ramifications on global supply chains and international trade stability. The impending rise in import fees could also result in higher prices for U.S. consumers, prompting fears of inflation as businesses adjust to increased costs.

The Economic Impact of Increased Tariffs

The increase in tariffs, particularly a 50% tariff on Chinese goods, represents a critical juncture in U.S.-China economic relations. Economists predict that this move will not only strain bilateral trade but could also negatively impact the broader global economy. As companies recalibrate their operations to account for new import fees, we may witness disruptions in supply chains and elevated prices for everyday goods. This situation introduces a high degree of uncertainty that can dampen consumer confidence and slow economic growth.

Additionally, the proposed tariffs are likely to aggravate the issues of inflation in the U.S. market. As importers bear the burden of these increased fees, they typically pass on these costs to consumers. This indirect effect means that everyday items could see price hikes, further tightening household budgets. Such economic strain could ultimately lead to a slowdown in consumer spending—the backbone of the U.S. economy—prompting a reconsideration of trade policies to avoid a potential recession.

Reactions from Beijing and the Retaliatory Tariff Strategy

In response to President Trump’s threats, China’s immediate proclamation of a 34% tariff on U.S. imports marks a significant escalation in the ongoing trade dispute. This retaliatory strategy indicates that Beijing is prepared to defend its economic interests vigorously, further complicating negotiations between the two economic giants. The potential for an accelerated tariff spiral raises concerns about the long-term implications for global trade relations, as both countries appear locked in a tit-for-tat strategy.

Moreover, this retaliatory move signals the potential for broader economic repercussions, not just confined to the U.S. and China. The imposition of tariffs can create ripple effects across various industries and trading partners, leading to a generalized trade war that may reshape international trade norms. As both nations brace for impact, global markets remain on edge, assessing the risks and opportunities that may arise from these developing situations.

The Implications for U.S. Consumers and Businesses

U.S. consumers and businesses need to be mindful of the effects stemming from increased tariffs on imports from China. As the potential 50% tariff becomes a reality, businesses relying on Chinese imports may find themselves facing higher production costs. These costs are likely to be transferred to consumers through higher retail prices. This situation could significantly impact household budgets, influencing spending behavior at a time when economic recovery is still fragile.

Additionally, the higher costs associated with tariffs could prompt businesses to seek alternative suppliers, which may lead to significant shifts in global supply chains. Companies might find themselves in a position where they have to explore domestic sourcing or engage in partnerships with other countries that offer more favorable import conditions. Such strategic pivots could either buffer against the impacts of tariffs or lead to new economic challenges as they navigate an evolving marketplace.

Navigating the Consequences of Trade Wars

Navigating the consequences of ongoing trade wars demands a nuanced understanding of the intricacies of U.S.-China relations. As tariffs escalate, both consumers and businesses must adapt to the emerging realities of a global economy increasingly defined by competitive trade practices. The strategic responses from both nations signal a long-term conflict that may require innovative approaches to foster international cooperation and sustainable trade frameworks.

Furthermore, policymakers are tasked with finding a balance between protecting domestic interests and engaging in productive global trade. Building an environment conducive to fair trade, where both countries can thrive, may be essential to mitigating the risks of a prolonged economic downturn. As the situation develops, stakeholders from various sectors should remain vigilant and responsive to changes that could define the future landscape of global commerce.

Focus on Bilateral Trade Relations Amid Tariff Increases

Amid the framework of escalating tariffs, the emphasis on bilateral trade relations remains more critical than ever. The United States and China are entwined in a complex web of economic dependency, where changes in trade policies affect not only the two nations but also the global economy at large. The back-and-forth imposition of tariffs can undermine mutual economic growth and escalate tensions that ripple across international markets.

Additionally, fostering dialogue and negotiation remains pivotal in maintaining a semblance of stability between these two powerhouse economies. Tariff increases can have unintended consequences, often hurting the very businesses they aim to protect. Understanding the nuances of these relationships can ultimately guide more effective policymaking that prioritizes cooperative trade while addressing legitimate concerns about unfair practices.

Long-Term Effects on Global Supply Chains

The imposition of significant tariffs by the United States and the subsequent retaliations from China are likely to have lasting effects on global supply chains. Industries that heavily rely on Asian manufacturing may face disruptions as businesses seek to adapt to new pricing realities. The quest for more resilient supply networks could lead companies to diversify their sourcing strategies, anticipating potential future trade barriers.

Consequently, businesses may begin investing in alternative markets or enhancing domestic production capabilities, leading to a long-term shift in global supply chain dynamics. Such changes could reshape patterns of trade and economic interactions across regions, emphasizing the need for businesses to remain agile and forward-thinking in the face of fluctuating international trade landscapes.

Potential for Economic Recession Amid Heightened Trade Tensions

The heightened trade tensions resulting from increasing tariffs raise legitimate concerns over the potential for an economic recession. As businesses and consumers react to fluctuating prices and uncertainty in trade policies, spending habits may shift, impacting overall economic growth. If consumers begin to tighten their belts in response to rising costs or diminished confidence in the economy, a slowdown could ensue.

Furthermore, the possibility of a recession could be compounded by the external pressures of the global economy, particularly as other nations respond to the changing landscape of trade with their own tariffs and trade barriers. Navigating through these challenges may require policymakers to consider innovative fiscal and monetary strategies to stabilize the economy and foster growth, even amid ongoing trade disputes.

Impacts on Inflation and Consumer Prices

One of the most immediate consequences of the proposed 50% tariffs on Chinese goods is the anticipated impact on inflation and consumer prices. Tariffs typically lead to an increase in the cost of imported products, which may indicate that retailers will pass these costs onto consumers, resulting in higher prices for everyday items. As inflationary pressures mount, consumers may find themselves paying more at the checkout line.

Addressing inflation amid trade conflicts can be particularly challenging for policymakers, as they must weigh the benefits of tariff protection against potential detrimental effects on the purchasing power of consumers. Furthermore, the risk of prolonged inflation may influence interest rates, adding another layer of complexity to economic management in this turbulent trade environment.

Frequently Asked Questions

What are the implications of Trump’s China tariff increase on US-China relations?

Trump’s China tariff increase, especially the proposed additional 50% tariff, adds strain to US-China relations. This move reflects escalating tensions, particularly in response to China’s retaliatory tariffs. The trade war initiated by these tariffs could further complicate diplomatic conversations and economic cooperation between the two nations.

How will Trump’s proposed tariffs affect the US economy?

The proposed tariffs by Trump, including a potential 50% tariff on China, can have significant economic impacts. Tariffs are typically borne by U.S. importers, leading to increased import fees which are usually passed on to consumers through higher prices. This may contribute to inflation and potentially hinder economic growth, as noted by economists.

What is the timeline for the new Trump China tariffs?

The new Trump China tariffs are set to take effect on April 9, 2025, if China does not withdraw its planned 34% retaliatory tariff on American goods by April 8. This added pressure in the trade war highlights the urgency and escalating nature of tariff negotiations between the U.S. and China.

What are import fees and how do they relate to Trump’s tariffs on China?

Import fees are taxes applied to goods brought into a country. In the context of Trump’s tariffs on China, these fees are expected to increase due to proposed tariff hikes, such as the 50% tariff. This change aims to address trade imbalances and may lead to higher costs for American consumers.

How might consumers be affected by Trump’s tariffs on Chinese goods?

Consumers are likely to feel the impact of Trump’s tariffs on Chinese goods through higher prices. As importers face increased tariff costs, they may pass these additional charges onto consumers, potentially raising prices for various goods and intensifying inflationary pressures.

What is the significance of the term ‘trade war’ in the context of Trump’s tariffs on China?

The term ‘trade war’ describes the escalating series of tariffs and retaliatory measures between the U.S. and China, initiated by Trump’s tariffs. These heightened economic tensions can result in reduced trade volumes, increased costs for consumers, and a potential slowdown in economic growth, illustrating the far-reaching consequences of such policies.

Why has Trump threatened further tariffs against China?

Trump has threatened further tariffs against China in response to their planned 34% import fee on U.S. goods. He views this as a retaliatory action stemming from what he describes as ‘longstanding trading abuses’ by China, which has prompted his administration to consider imposing higher tariffs as leverage in the ongoing trade negotiations.

| Key Point | Details |

|---|---|

| Trump’s Threat | Imposing a 50% tariff on China if it does not revoke its planned 34% tariff on U.S. goods. |

| Deadline | China must comply by April 8, 2025, or additional tariffs will be imposed effective April 9, 2025. |

| Retaliation | China plans to impose a 34% tariff on U.S. imports starting April 10, 2025, in response to U.S. tariffs. |

| Global Reactions | Concern among Wall Street and economists about potential economic downturn and inflation due to tariffs. |

| Tariff Impact | Tariffs are borne by U.S. importers, which could lead to increased prices for consumers. |

Summary

The Trump China tariff situation continues to escalate as President Trump threatens an additional 50% tariff on China in response to its planned retaliatory tariffs. This escalating trade conflict raises concerns regarding economic growth and inflation as both nations enact significant import fees, underscoring the complexities of international trade relations. As we approach the key deadlines, markets remain anxious about the implications of these tariffs.