Tariff Impacts on Financial Markets: Key Takeaways

The recent turbulence in financial markets can be largely attributed to tariff impacts on financial markets, a phenomenon that has sparked concern among investors globally. As tariffs are introduced or threatened, we witness a ripple effect that influences stock prices and market stability, often resulting in significant market fluctuations. Trade deficits also play a role in this dynamic, painting a complex picture that goes beyond simple numbers. For businesses, investment in the U.S. becomes uncertain as the politics of tariffs dictates corporate strategies, leading companies to rethink their approaches amid fluctuating tariffs. Understanding these factors is crucial for navigating the ever-evolving landscape of global finance and trade.

The implications of tariff policies extend deep into the heart of financial ecosystems, affecting everything from market stability to corporate investment decisions. When nations impose tariffs, they often trigger a series of responses that reverberate throughout international markets, causing both financial volatility and economic speculation. These trade barriers not only alter the cost structure for goods, leading to potential trade deficits, but also complicate strategic planning for investments within the U.S. economy. Moreover, the political discourse surrounding tariffs can sway investor confidence, prompting fluctuations that reflect broader economic realities. Thus, it’s essential to grasp how these fiscal measures intertwine with the broader fabric of global finance and business.

Understanding Tariff Impacts on Financial Markets

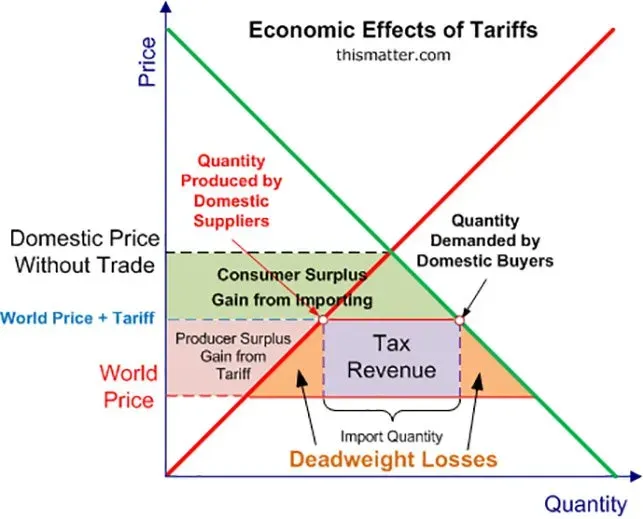

The ongoing discussions surrounding tariffs and their potential implementation have a significant impact on financial markets globally. As investors react to tariff proposals and the prevailing economic climate, we see pronounced fluctuations in market indices. Tariff threats often trigger uncertainty among investors, leading them to recalibrate their portfolios, especially within sectors most susceptible to trade barriers. For instance, companies relying on imported goods for manufacturing face potential cost increases, prompting stock prices to shift accordingly. This volatility highlights how tariff discussions can reverberate throughout financial markets, influencing everything from trade relationships to individual stock valuations.

Moreover, these fluctuations may not be confined to the immediate market reactions. The broader implications of tariff policies extend to investment trends and economic stability. Increased tariffs can lead to higher prices for consumers, which can, in turn, dampen consumer spending and economic growth. As financial markets respond to these tariff policies, investors must remain vigilant and adaptable, understanding that the winds of trade policy can shift rapidly, impacting market sentiment and investment strategies.

Navigating Trade Deficits and Their Economic Narratives

In the world of trade, deficit figures often dominate the conversation, but they fail to capture the entire economic narrative. Take the case of many popular goods, such as the Toyota Tacoma, which is often discussed in the context of trade deficits. While the Tacoma is assembled in Mexico, the reality is that its parts come from various locations, including significant portions manufactured in the U.S. This complexity means that a tariff on it may not solely reflect an increase in imports but will likely have multifaceted repercussions on U.S. jobs and pricing structures. Understanding this intricacy is crucial for assessing the real impact of trade policies.

Examining trade deficits requires a holistic approach that considers multiple factors at play, including supply chains and manufacturing bases. Policymakers often point to trade deficits as symptomatic of broader economic issues, yet they overlook how interconnected global economies can mitigate or exacerbate these deficits. If firms are compelled to source components locally due to increased tariffs, the initial price hike may lead to job preservation in some areas, while harming corporate competitiveness overall—creating ripple effects that influence the financial markets as well.

The Role of Companies in U.S. Economic Investments

Amid tariff debates, it’s vital to recognize that companies, not governments, drive the bulk of economic investments. Despite claims that tariffs encourage local manufacturing, decisions about expansions or new facilities typically require years of planning and consideration of various external factors. For instance, Hyundai’s recent announcement regarding a substantial investment in a steel plant in the U.S. reflects long-term strategic planning rather than an immediate response to tariff rhetoric. Companies analyze market conditions, labor costs, and supply chains well in advance, and tariffs alone are seldom the sole motivator behind their investments.

Moreover, while tariffs may create certain advantages for domestic manufacturing, they can also introduce significant risks. The uncertainty surrounding tariff policies can lead global firms to reconsider their investment strategies, potentially resulting in reduced capital flows to the United States. This duality illustrates the complexities of how tariffs influence corporate behavior and financial markets, demonstrating that while some companies may benefit in the short term, the overall investment landscape could shift, leading to long-term consequences for the economy.

Understanding the Politics Behind Tariff Policies

The contemporary politics of tariffs extend beyond economic rationale to include elements of political persuasion and strategy. Leaders in foreign countries often engage in flattery and public praise of U.S. policies, particularly those aimed at increasing manufacturing within American borders. This political dynamic creates an environment where decisions at the national level may be influenced more by political motives than by strict economic considerations. The meeting between the executive chair of Hyundai Motor Group and President Trump exemplifies this, showcasing how political interactions can shape economic decisions.

This politicization of tariffs can lead to a confusing state of affairs for businesses and investors alike. For instance, while tariffs aim to protect domestic industries, they can also create a hostile environment for foreign investment. Companies must navigate a landscape where political alliances and favoritism play crucial roles in determining market access and competitiveness—adding another layer of complexity to the financial markets, where reactions might be more tied to political developments than economic fundamentals.

Looking for Nonpartisan Solutions in Trade

Historically, trade policy discussions were less partisan, with substantial agreement on the need for thoughtful economic strategies. Today, however, partisan divisions are apparent around tariff policies, which has created an urgent need for nonpartisan solutions. Lawmakers from both parties increasingly recognize the necessity for a comprehensive approach to trade that addresses long-term structural issues. This consensus is vital for creating a stable trade environment that minimizes risks and uncertainties amid ongoing tariff threats.

In the face of economic challenges posed by tariffs, there must be a concerted effort to seek collaborative solutions that transcend political lines. Initiatives that foster dialogue among diverse stakeholders, including businesses, legislators, and trade organizations, can lead to more innovative and sustainable outcomes. As financial markets react to trade uncertainties, the pursuit of bipartisan initiatives may ultimately lead to a more predictable economic landscape that benefits U.S. investment and maintains the stability of global markets.

Frequently Asked Questions

How do tariff threats influence financial market fluctuations?

Tariff threats can create significant uncertainty in financial markets, leading to increased volatility. When governments announce potential tariffs, investors often react by adjusting their portfolios, which can trigger price fluctuations across stocks, bonds, and commodities. Investors may fear higher costs for goods and decreased sales for companies reliant on global trade, causing market instability.

What are the implications of tariffs on trade deficits and financial markets?

Tariffs can exacerbate trade deficits by raising the costs of imported goods, resulting in higher consumer prices and potentially reduced domestic demand. This can negatively impact financial markets, as companies may report lower earnings, leading to stock price declines. Additionally, higher tariffs can stifle international trade, further influencing market fluctuations.

How might increased tariffs affect investment in the US?

Increased tariffs can deter foreign investment in the US as businesses face higher operating costs and unpredictability. Companies may choose to postpone or downsize their investment plans due to concerns over future trade policies, which can adversely affect financial markets by limiting growth and innovation within key sectors.

What role does the politics of tariffs play in financial market trends?

The politics surrounding tariffs significantly impact financial markets, as investor sentiment can shift based on political developments. Announcements from government officials regarding trade negotiations or tariff policies can trigger immediate reactions in market indices, reflecting investors’ perceptions of economic stability and trade relations.

Why are tariff impacts on financial markets seen as a nonpartisan issue?

Tariff impacts on financial markets are considered nonpartisan because both major political parties recognize the fundamental issues regarding international trade and investment. The need for stable trade policies transcends political affiliation, and there is consensus on the potential negative consequences of fluctuating tariffs, which can influence economic well-being and market performance.

| Key Point | Details |

|---|---|

| 1. Trade Deficits and Product Origins | Tariffs on products like the Toyota Tacoma, which has components sourced from various locations, impact prices and can lead to job losses if consumer demand declines. |

| 2. Investments by Companies | Companies, not governments, drive investments; decisions take years due to factors beyond tariffs. |

| 3. Economics vs. Investment | Higher tariffs could deter foreign investment, particularly from Japanese firms that contribute significantly to the U.S. economy. |

| 4. Political Influences on Trade | Trade strategies are heavily influenced by political dynamics, requiring leaders to navigate relationships carefully. |

| 5. Need for Bipartisan Solutions | There is a growing recognition among lawmakers of the structural issues in trade that need bipartisan attention amidst rising tariff concerns. |

Summary

Tariff impacts on financial markets have become increasingly pronounced as volatile economic conditions unfold. The interplay of tariffs and trade dynamics significantly influences consumer prices and corporate investment decisions. Understanding these impacts is vital for anticipating future market behaviors, particularly for regions like Hawaiʻi that rely heavily on both imports and exports. As the global economy continues to shift in response to tariff policies, stakeholders must remain vigilant to adapt to the evolving landscape.