Singapore Monetary Policy Eases Amid Global Trade Woes

In a significant move reflecting the challenges faced by the global economy, Singapore monetary policy was recently adjusted by the Monetary Authority of Singapore (MAS), which opted for further monetary easing amid faltering global trade. With the U.S. tariffs creating ripple effects across international markets, the MAS has revised its Singapore economic forecast downwards, aligning it with a more cautious outlook. The newly adjusted GDP growth forecast for 2025 now stands between 0% and 2%, a stark decline from earlier expectations. Additionally, the MAS has lowered its Singapore inflation forecast, indicating an anticipated drift toward lower price pressures. As Singapore continues to navigate these turbulent economic waters, the impact on sectors dependent on global trade remains a focal point for economists observing the implications of these policies on economic stability and growth.

Singapore’s economic strategies, particularly those governing its financial mechanisms, are crucial elements in a global context. Known for its dynamic and open market, Singapore’s central bank, MAS, has taken steps to amend its monetary strategies in response to external economic pressures. This adjustment reflects a broader trend impacting nations reliant on international trade, as sector-specific forecasts and growth trajectories are closely monitored. The implications of such policy shifts resonate not just locally, but also reflect on the global stage, where trade dynamics and inflationary trends play a pivotal role in shaping economic outcomes. As Singapore recalibrates its monetary policy amidst a backdrop of uncertainty, understanding these shifts offers vital insights into its future economic landscape.

Understanding Singapore’s Monetary Policy Adjustments

In recent months, Singapore’s central bank, the Monetary Authority of Singapore (MAS), has made significant adjustments to its monetary policy in response to the shifting economic landscape. The recent decision to loosen the monetary policy is striking, especially as it marks the second adjustment this year. With the global economic prospects dimming due to escalating trade tensions, the MAS has opted to reduce the rate of appreciation for its nominal effective exchange rate (S$NEER). This strategic move intends to alleviate some pressure on the monetary system while ensuring stability in domestic trade and investment.

The MAS has highlighted that the country’s reliance on exports makes it particularly vulnerable to external shocks, such as U.S. tariffs. These adjustments in monetary policy are not taken lightly, as they are aimed at supporting Singapore’s economy amidst contracting GDP figures and a continuous recalibration of global financial conditions. The MAS’s stance reflects its attempt to balance the immediate need to support growth while monitoring inflation and long-term economic health.

Frequently Asked Questions

What is Singapore’s monetary policy and how is it managed by the MAS?

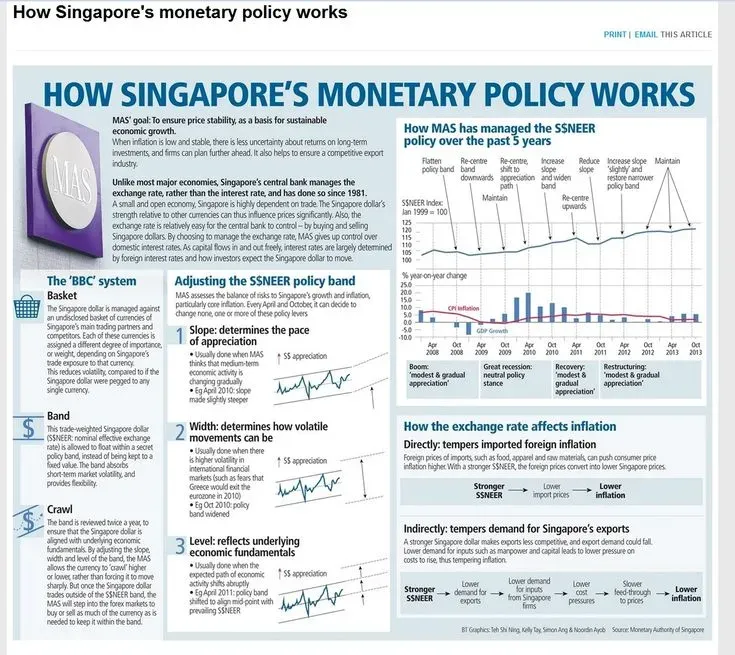

Singapore’s monetary policy is managed by the Monetary Authority of Singapore (MAS) primarily through the Nominal Effective Exchange Rate (S$NEER). Rather than using traditional interest rates, MAS adjusts the S$NEER band to influence currency appreciation and control inflation.

How has MAS monetary easing impacted Singapore’s economic forecast for 2025?

MAS monetary easing has led to a downward revision of Singapore’s economic forecast, with expectations now set at a GDP growth rate of 0% to 2% for 2025 due to weakened global demand and trade uncertainties.

What factors influenced the recent Singapore economic forecast revisions?

Recent revisions of Singapore’s economic forecast were influenced by dimmed prospects for global growth, particularly due to U.S. tariffs which have impacted international trade dynamics and resulted in a GDP contraction of 0.8% in the first quarter.

What is the significance of the global trade impact on Singapore’s monetary policy decisions?

Global trade impact plays a crucial role in Singapore’s monetary policy decisions, especially as the country’s economy is highly export-dependent. A downturn in global trade often results in weaker demand and pricing pressures, prompting adjustments in MAS’s monetary stance.

How does MAS’s current monetary policy relate to Singapore’s inflation forecast for 2025?

MAS’s current monetary policy, which includes easing to mitigate economic slowdown, has resulted in a revised inflation forecast, lowering core and headline inflation estimates for 2025 to a range of 0.5% to 1.5%, reflecting a cautious outlook amidst the economic uncertainties.

What are the expectations for Singapore’s GDP growth amidst ongoing economic challenges?

Economists suggest that with ongoing economic challenges, Singapore’s GDP growth may slow, with current forecasts around 2.1%, just above the revised range of 0% to 2%, indicating a cautious stance on potential further monetary easing.

How does the MAS plan to address risks associated with global trade?

The MAS plans to address risks associated with global trade by monitoring economic conditions closely and allowing for some currency appreciation to maintain flexibility in its monetary policy while avoiding overreactions to fluctuating tariff policies.

What are the anticipated effects of further MAS monetary easing later in 2025?

Further MAS monetary easing is anticipated to provide additional support to Singapore’s economy if external conditions worsen, potentially leading to a neutral bias in monetary policy to safeguard against a technical recession.

| Key Points | Details |

|---|---|

| Monetary Policy Loosening | Singapore’s central bank loosened its monetary policy for the second time in 2025 due to weakened global growth and trade. |

Summary

Singapore’s monetary policy has been adapted in light of unfavorable global economic conditions. With the Monetary Authority of Singapore easing its monetary stance, it reflects the government’s response to lowered growth forecasts and external market pressures, particularly from U.S. tariffs. This proactive measure underscores Singapore’s role as a global economic barometer, emphasizing its reliance on international trade. As the central bank anticipates potential further easing if conditions worsen, it is clear that Singapore’s monetary policy remains dynamic and responsive to the challenges posed by external economic factors.