Liberation Day Tariffs: CBP Enforces New Trade Regulations

Liberation Day tariffs are set to reshape the landscape of U.S. trade, as U.S. Customs and Border Protection (CBP) enforces significant new tariffs under President Trump’s directive. The agency is already generating over $200 million daily in additional revenue as part of this enforcement, demonstrating the high stakes involved in international tariffs. These measures, grounded in U.S. Customs enforcement authority, aim to secure economic sovereignty while adjusting to changing global trade policies. The recent implementation of substantial tariffs, including a 25% charge on passenger vehicles and a sweeping 10% global tariff, marks a bold move to confront challenges posed by imports, particularly from China. Stakeholders in global commerce will need to stay vigilant as CBP continues to adjust these tariffs, thereby influencing international trade dynamics.

The recent wave of tariffs known as Liberation Day tariffs represents a pivotal moment in the evolution of America’s trade policies. As U.S. Customs and Border Protection (CBP) steps up its enforcement efforts, the implications for international commerce are profound. This initiative, often associated with the economic strategies of the Trump administration, includes measures like increased duties on vehicle imports and broad global tariffs impacting numerous countries. In this context, the U.S. seeks to navigate its economic landscape while managing external trade relations and ensuring compliance through robust customs enforcement. The ongoing updates from CBP signal a significant shift in how the U.S. interacts with the global market and prioritizes its economic interests.

Understanding Liberation Day Tariffs in the Context of U.S. Customs Enforcement

The recent announcement of the ‘Liberation Day’ tariffs marks a significant shift in U.S. trade policy as enforced by the U.S. Customs and Border Protection (CBP). Under President Trump’s administration, the CBP has ramped up its enforcement efforts, collecting over $200 million a day from these new tariffs. This substantial revenue illustrates not only the financial impact of these tariffs but also the underlying strategy to bolster America’s economic sovereignty against perceived unfair trade practices from various nations, especially China. As part of this initiative, CBP is leveraging its authority under key legislations such as the Trade Expansion Act and the International Emergency Economic Powers Act, demonstrating a robust mechanism for tariff implementation and compliance enforcement in the international trade arena.

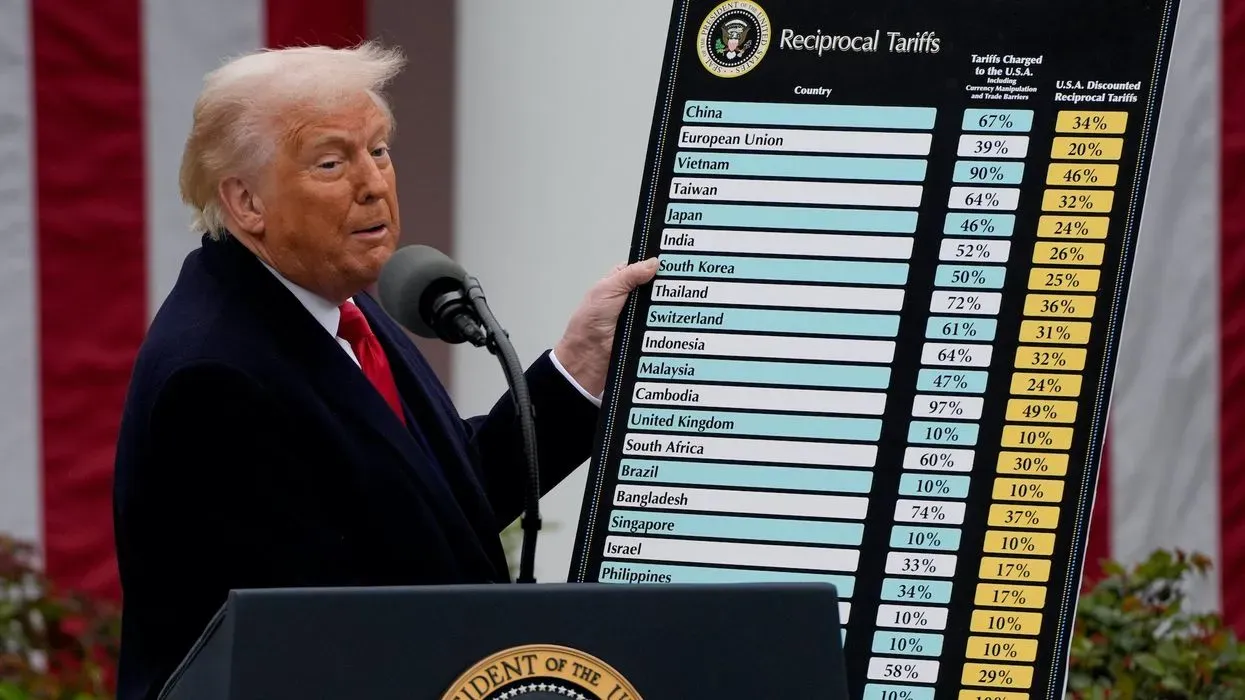

The Liberation Day tariffs introduce a tiered structure affecting imports from 86 countries, with rates ranging from 11% to 50%. This systematic application of tariffs aims to level the playing field, particularly against nations that have historically benefited from lenient trade policies. By collaborating closely with various federal agencies, CBP is ensuring that these tariffs not only generate revenue but also serve as a strategic tool for negotiating better trade terms globally. The influx of revenue underscores the effectiveness of such tariffs in safeguarding U.S. interests in the ever-complex landscape of international tariffs and global trade.

Impact of Trump Tariffs on Global Trade Policies

The implementation of Trump tariffs, including those associated with the ‘Liberation Day’ initiative, signifies a broader shift in international trade policies. Countries facing these tariffs are compelled to reassess their trade strategies and explore countermeasures or negotiations to mitigate the impact. This ripple effect is particularly noticeable across sectors reliant on imports from affected nations, leading to potential price increases for consumers and businesses across the U.S. market. As the tariffs impose higher costs on foreign goods, domestic industries may face both challenges and opportunities to capture market share previously dominated by imports.

Critics argue that such aggressive tariffs could ignite trade wars, where retaliation from other countries leads to an escalation of tariffs and increased costs for consumers. However, supporters maintain that these measures are critical for rectifying trade imbalances and protecting U.S. jobs from foreign competition. As global trade policies evolve in response to the Trump tariffs, the role of U.S. Customs enforcement becomes even more pivotal in maintaining a fair and competitive market, ensuring compliance, and minimizing the influx of subpar goods to the American market.

The Role of U.S. Customs in Enforcing International Tariffs

U.S. Customs and Border Protection (CBP) plays a crucial role in maintaining compliance with international tariffs, particularly those implemented under President Trump’s leadership. With the collection of over $200 million daily attributed to the enforcement of policies like the ‘Liberation Day’ tariffs, CBP is at the forefront of safeguarding U.S. economic interests. The agency’s rigorous enforcement measures are designed to adapt to the complexities of global trade policies, ensuring that all imports are scrutinized for compliance under the newly established tariff structures.

CBP’s efforts also reflect a commitment to transparency and communication with the trade community. By regularly updating stakeholders on tariff adjustments and compliance requirements, CBP is fostering an environment that allows for smooth operations amidst these regulatory changes. Collaboration with other federal agencies is essential in this endeavor, as it helps to address the multifaceted challenges presented by international tariffs and the resulting need for thorough customs enforcement strategies in an increasingly interconnected global market.

Reciprocal Tariffs and Their Economic Implications

The newly introduced reciprocal tariffs as part of the ‘Liberation Day’ initiative are expected to significantly affect both domestic and international markets. Ranging from 11% to 50%, these tariffs place a financial burden on foreign goods entering the U.S., compelling companies to either absorb costs or pass them on to consumers. As these tariffs take effect, it will become increasingly important for American businesses to evaluate their supply chains and consider the potential for increased production costs and shifting consumer behaviors.

The economic implications extend beyond immediate costs; they also signal a potential reshaping of trade relations worldwide. Countries impacted by these tariffs may resort to retaliatory measures, further complicating trade dynamics. Businesses that rely heavily on international suppliers could face disruptions, necessitating a strategic pivot to domestic sourcing or alternate markets. Understanding these interconnected factors will be essential for companies looking to navigate the evolving landscape of tariffs and international trade policies.

Evaluating the Financial Impact of Trump Executive Orders

Under President Trump’s executive orders, particularly those relating to tariffs such as the ‘Liberation Day’ initiative, the U.S. has generated billions in revenue. Notably, CBP has reported collections amounting to over $4.8 billion specifically targeting synthetic opioids from China through EO 14195. Such financial metrics not only highlight the immediate effects of these tariffs on federal revenue but also underscore the administration’s strategy of addressing critical issues through economic pressure.

The financial impact of these executive orders extends into various sectors, influencing both government funding and market dynamics. For instance, over $2 billion collected under EO 14194 addresses significant trade concerns at the southern border, illustrating how tariffs can serve dual purposes—financial generation and national security. As CBP continues to implement these measures, ongoing evaluation of their long-term economic effects will be critical for understanding the future landscape of U.S. trade and tariff policies.

Navigating Changes in Duty-Free Treatment Regulations

The recent changes in duty-free treatment regulations, particularly those impacting shipments from China and Hong Kong, are pivotal advancements as part of the CBP’s enforcement strategy under the ‘Liberation Day’ tariffs. Effective May 2, goods valued at $800 or less will no longer qualify for duty-free status, which is a significant shift for both consumers and businesses accustomed to previous exemptions. This adjustment also includes increased duties on postal shipments, with fees rising to $30 or more depending on the item, fundamentally altering the cost price for imported goods.

Businesses must now navigate these regulatory changes with vigilance, as the implications of increased duties could lead to higher retail prices or reduced competitiveness against domestic products. Furthermore, the strategic considerations for importers in terms of sourcing and pricing tactics must adapt to these new tariffs and regulations. Understanding the nuances of these duty-free changes is essential for businesses looking to maintain favorable pricing while ensuring compliance with U.S. Customs enforcement policies.

The Future of Global Trade in the Post-Liberation Day Era

As the ‘Liberation Day’ tariffs reshape America’s approach to global trade, businesses and policymakers alike must consider the long-term implications of such a significant shift. The future of global trade in a post-Liberation Day context hinges on how effectively countries can adjust to these tariffs while navigating potential retaliatory measures from other nations. The ongoing adjustments will require American companies to adapt strategically in anticipation of evolving trade policies worldwide, which may include changes to sourcing, pricing, and even market entry strategies.

Moreover, as the global economy becomes increasingly interconnected, the collective response to these tariffs will play a crucial role in shaping future trade agreements and relationships. The decisions made today in response to the Trump tariffs will influence the balance of trade between the U.S. and its trading partners. Staying ahead in the global market will necessitate not just adherence to current tariff structures but also proactive engagement with international allies to forge favorable trade agreements that enhance competitiveness without compromising economic integrity.

Understanding the Harmonized Tariff Schedule and its Importance

The Harmonized Tariff Schedule of the U.S. is an essential tool that provides vital information regarding the classification of imported goods and the corresponding tariff rates. As U.S. Customs enforces these tariffs, particularly the newly implemented rates under the ‘Liberation Day’ initiative, a comprehensive understanding of this schedule is crucial for importers and exporters. It not only determines the duties owed but also plays a significant role in ensuring compliance with CBP regulations, thereby minimizing risks associated with international trade.

Investing the time to understand how commodity classifications impact tariffs under this schedule will empower businesses to operate more effectively within the U.S. customs framework. The Harmonized Tariff Schedule helps importers strategize their purchasing and pricing based on predictive tariff landscapes, ensuring they remain competitive while also adhering to enforcement guidelines from CBP. In a volatile global trade environment, leveraging this resource is key to navigating the complexities of international tariffs and maximizing business potential.

Frequently Asked Questions

What are the new Liberation Day tariffs imposed by U.S. Customs and Border Protection?

The Liberation Day tariffs refer to a recent wave of tariffs enforced by U.S. Customs and Border Protection (CBP) under President Trump’s initiative. These tariffs primarily target a variety of imports, particularly from countries like China, with significant rates including a 25% tariff on passenger vehicles and a new 10% global tariff effective under the International Emergency Economic Powers Act (IEEPA).

How much revenue is being generated from the Liberation Day tariffs?

Currently, U.S. Customs and Border Protection is collecting over $200 million per day in revenue resulting from the enforcement of the Liberation Day tariffs. This revenue accumulation highlights the significant economic impact of these tariffs on international trade.

Which countries are affected by the Liberation Day tariffs?

The Liberation Day tariffs impact imports from 86 countries with reciprocal tariffs ranging from 11% to 50%. Notably, China and Hong Kong are specifically targeted, particularly with upcoming duties on shipments valued at $800 or below, which will soon be subject to standard duties.

What are the implications of Trump tariffs on global trade policies?

The Trump tariffs, including the Liberation Day tariffs, have significant implications for global trade policies as they reshape trade dynamics, enforce stricter import regulations, and alter the cost structures for goods coming into the U.S. These policies are designed to safeguard American economic interests and assert the country’s economic sovereignty.

How is U.S. Customs enforcement adapting to the changes brought by Liberation Day tariffs?

U.S. Customs enforcement is adapting to the changes brought by Liberation Day tariffs by closely collaborating with other federal agencies to ensure effective implementation. CBP has committed to keeping the trade community informed through updates in their online messaging system and is fully equipped to collect the associated duties accurately.

What specific goods are subjected to higher tariffs under the Liberation Day initiative?

Under the Liberation Day initiative, specific goods such as passenger vehicles, light trucks, and certain consumer products from countries like China face enhanced tariffs ranging from 10% to 50%, depending on the product category and value, according to the Harmonized Tariff Schedule of the U.S.

How will the enforcement of these tariffs affect American consumers and businesses?

The enforcement of the Liberation Day tariffs may lead to increased costs for American consumers and businesses as higher import duties tend to pass through to retail prices. This shift can affect overall consumer spending and may compel businesses to reevaluate their supply chains and sourcing strategies.

| Key Point | Details |

|---|---|

| CBP Revenue Collection | CBP collects over $200 million daily from tariff enforcement. |

| Recent Tariff Implementation | A 25% tariff on passenger vehicles and light trucks and a 10% global tariff took effect in early April. |

| New Reciprocal Tariffs | Starting April 9, 86 countries will have tariffs from 11% to 50%. |

| China and Hong Kong Shipments | From May 2, goods valued up to $800 will no longer be duty-free; postal shipments will incur a 30% duty. |

| Historical Revenue Generation | Billions collected from previous tariffs under various executive orders including drugs and steel. |

| CBP’s Enforcement Role | CBP is positioned and equipped to enforce the President’s tariffs effectively. |

Summary

Liberation Day tariffs are a significant measure being enforced by CBP, resulting in more than $200 million in daily revenue. Under President Trump’s plan, CBP has implemented various tariffs aiming to bolster economic sovereignty through strict enforcement of trade laws. As these tariffs span multiple countries and products, they highlight the administration’s focus on controlling imports and raising funds to support domestic economic interests.