China US Tariff Increase: Impacts on Trade & Economy

The recent announcement of the China US tariff increase, set to take effect on April 10, 2025, has sent ripples through global markets and intensified the ongoing China US trade war. This move, where China will impose a 34% reciprocal tariff on all US imports, marks a significant step in the escalating trade conflict between the two largest economies. China’s decision comes as a direct response to the United States’ implementation of similar tariffs, highlighting the deepening tensions and reciprocal tariffs that have characterized their economic interactions. As both nations leverage tariffs as tools of negotiation, concerns about their long-term economic impacts—on the China economy and beyond—continue to mount. Analysts warn that this trade war could reshape supply chains and have far-reaching implications for businesses and consumers alike.

In the latest chapter of the escalating trade tensions between China and the United States, both countries have adopted harsh measures that can be described as tit-for-tat tariffs. China’s latest move to significantly raise fees on US imports echoes the prior initiatives taken by the US, indicating a broader strategy in this ongoing trade dispute. The implications of these actions extend beyond just tariffs, as they threaten to disrupt international commerce and influence the global economic landscape. With both sides firmly entrenched in their positions, the ramifications of this trade conflict could alter patterns of investment and trade flow significantly. As the situation evolves, stakeholders are keenly observing how each country’s economic policies will adapt to these challenging circumstances.

China’s Reciprocal Tariffs: A Response to US Actions

In a decisive move, China has announced that it will impose reciprocal tariffs of 34% on all imports from the United States starting April 10, 2025. This action is a direct response to the unilateral tariffs imposed by the United States, which recently set a similar 34% tariff rate on all Chinese products. The intensification of this trade conflict marks a significant escalation in the already fraught relationship between the two economic powerhouses. Both countries are ensnared in a tit-for-tat scenario that reflects deeper concerns over trade balances, economic stability, and national interests in global markets.

The Chinese government’s State Council Tariff Commission has criticized the U.S. tariffs as violations of international trade agreements, branding them as forms of intimidation. Historically, China had taken a more calculated approach to retaliation, specifically targeting American agricultural exports and energy resources, but the recent developments suggest a shift toward a comprehensive retaliation strategy. This change underscores the growing tensions in U.S.-China relations, where reciprocal tariffs could potentially lead to a major overhaul of trade dynamics.

Frequently Asked Questions

What is the significance of the recent China US tariff increase on trade relations?

The recent China US tariff increase marks a significant escalation in the ongoing trade conflict between the two largest economies. By imposing reciprocal tariffs of 34% on US imports, China is responding to similar US tariff measures, increasing the complexity of trade relations and potentially disrupting global supply chains.

How do reciprocal tariffs affect US imports from China?

Reciprocal tariffs directly impact US imports from China by increasing costs for American businesses that rely on Chinese goods. The recent 34% tariff levied by China can lead to higher prices for consumers and reduced market demand, further complicating the trade war dynamics.

What are the potential economic implications of the China US trade war on both countries?

The China US trade war could potentially slow economic growth in both nations. Analysts predict that China’s economy might experience a growth reduction of up to 2.5 percentage points due to decreased US demand. Similarly, increased tariffs can strain US businesses reliant on Chinese imports, possibly leading to job losses and economic uncertainty.

How might the China US tariff increase influence China’s economic strategy?

The China US tariff increase signals a shift in China’s economic strategy, indicating a broader response to US tariffs rather than targeted actions. This escalation may compel China to explore alternative trade partnerships and further develop domestic markets to mitigate the impact of the trade conflict.

What are the effects of the China US trade conflict on global stock markets?

The China US trade conflict has had negative effects on global stock markets, as seen in the recent drop in Dow futures by 1,000 points. As investors react to heightened uncertainty and potential economic slowdowns, market volatility is likely to continue until clearer trade policies are established.

What steps has China taken in response to the US tariff hikes amid the trade war?

In response to US tariff hikes, China has enacted a series of measures, including imposing 34% reciprocal tariffs, adding US companies to its ‘unreliable entity list,’ and initiating investigations into antidumping practices. These actions reflect a strategic shift aimed at countering US trade policies.

Will US businesses adapt to the new trade regulations arising from the China US tariff increase?

While the China US tariff increase presents challenges, businesses are expected to adapt over time to the new trade regulations. Secretary of State Marco Rubio noted that as trade policies become better defined, companies will find ways to navigate the impacts of the tariffs on their operations.

How is the global economy affected by the escalation of China US tariffs?

The escalation of China US tariffs affects the global economy by creating uncertainty that may disrupt international trade patterns. Experts believe that countries in Southeast Asia and Latin America could emerge as alternative markets for US businesses looking to bypass tariffs, leading to a potential realignment of global supply chains.

| Key Points | Details |

|---|---|

| China’s Tariff Implementation | China will impose a 34% tariff on all US imports starting April 10, 2025. |

| Response to US Tariffs | This move is in retaliation to the US’s similar tariff on Chinese goods which also stands at 34%. |

| Trade War Escalation | The tariff hikes signal an escalation in the ongoing trade war between China and the US. |

| Violation of Trade Rules | China claims that US tariffs violate international trade rules and undermine their legitimate rights. |

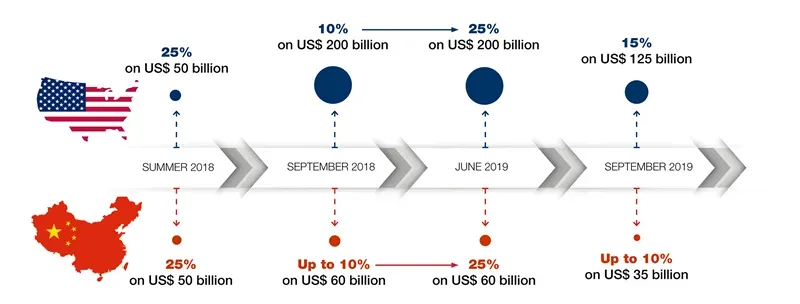

| Previous Tariff Rounds | President Trump has enacted two prior rounds of tariffs, each adding 10%. |

| Sector Impact | China previously targeted specific sectors but now adopts a broader strategy against the US. |

| Economic Consequences | Analysts predict a potential 2.5% slowdown in the Chinese economy due to tariffs. |

| Market Reactions | Stock markets showed negative reactions, with Dow futures dropping 1,000 points. |

| Supply Chain Shifts | Tariffs may lead US businesses to shift supply chains to Southeast Asia and Latin America. |

Summary

The China US tariff increase marks a significant escalation in the ongoing trade conflict between the two economic giants. Set to take effect in April 2025, the reciprocal 34% tariffs on imports from the US highlight China’s response to US trade measures. As both nations continue to impose tariffs, the economic consequences could lead to a restructuring of global supply chains, further impacting their respective economies and global trade dynamics.