US Chocolate Prices Surge Amid Cocoa Cost Rise

US chocolate prices are experiencing a significant surge, driven largely by increasing cocoa costs and the impact of tariffs imposed by the current administration. As the price of cocoa—the essential ingredient for chocolate—continues to rise, consumers are feeling the pinch at the checkout line. The ongoing inflation concerns in the US economy are exacerbated by these rising costs, raising questions about the long-term effects on chocolate manufacturers and retailers. Additionally, the Trump tariffs on imported goods have contributed to the rising price of chocolate, further complicating the situation amid a global economic slowdown. As these factors collide, it’s clear that the landscape of chocolate pricing in the US is being reshaped dramatically.

The rising expenses surrounding confectionery products in the United States have become a pressing topic of discussion, particularly as cocoa prices soar and trade tariffs remain a dominant factor. Chocolate lovers are grappling with escalating purchase prices, a consequence of both domestic inflation and international economic pressures. Reports indicate that the financial burden is likely to affect not only consumers but also the broader food industry, as companies navigate the complexities brought on by tariffs and shifting market conditions. Additionally, the forecast for economic growth hints at challenges ahead, raising further concerns regarding the stability of chocolate pricing amidst these turbulent times. Understanding the implications of these trends is essential for staying informed about the ever-evolving market dynamics affecting sweet treats.

The Surge in US Chocolate Prices: Understanding the Current Market Dynamics

The surge in US chocolate prices is a direct consequence of soaring cocoa costs, which have climbed steadily over the past year. Cocoa, being the key ingredient in chocolate, is significantly affected by fluctuations in global supply and demand. With the ongoing economic changes, the price of cocoa has reached new heights. Coupling this with tariffs imposed on cocoa imports have further exacerbated the situation, leading manufacturers to pass on these increased costs to consumers. As a result, chocolate lovers in the US are facing higher prices at the checkout counter, with many brands adjusting their prices to maintain profit margins.

In addition to increased cocoa prices, inflation concerns are also playing a significant role in the rising costs of chocolate. With the Federal Reserve taking measures to combat inflation, interest rates have risen, and consumers are feeling the impact on their wallets. Those affected by the Trump tariffs on imports are also witnessing a shift in market dynamics, as businesses adapt to the new economic landscape. This perfect storm of rising cocoa prices, inflationary pressures, and import tariffs has created a challenging environment for both manufacturers and consumers in the chocolate market.

The Impact of Trump Tariffs on the Chocolate Market

The introduction of Trump tariffs has significantly impacted the chocolate industry in the United States, leading to higher prices and a complex economic environment. Tariffs on various imports, including cocoa products, have made it increasingly expensive for manufacturers to source their raw materials. This additional cost is often passed down to consumers, leading to skyrocketing prices for chocolate products across retail channels. As the global economic slowdown continues to affect trade relations, manufacturers are forced to reassess their supply chains and pricing structures to remain competitive.

Moreover, the tariffs implemented by the Trump administration have created uncertainty in the market, making it difficult for businesses to plan for the future. This uncertainty comes at a time when inflation concerns are already high, further complicating the landscape for manufacturers and consumers alike. The prospect for growth in the chocolate sector remains uncertain as businesses navigate these challenging economic waters, leading to ongoing discussions about the need for potential government support or a reevaluation of trade policies in the future.

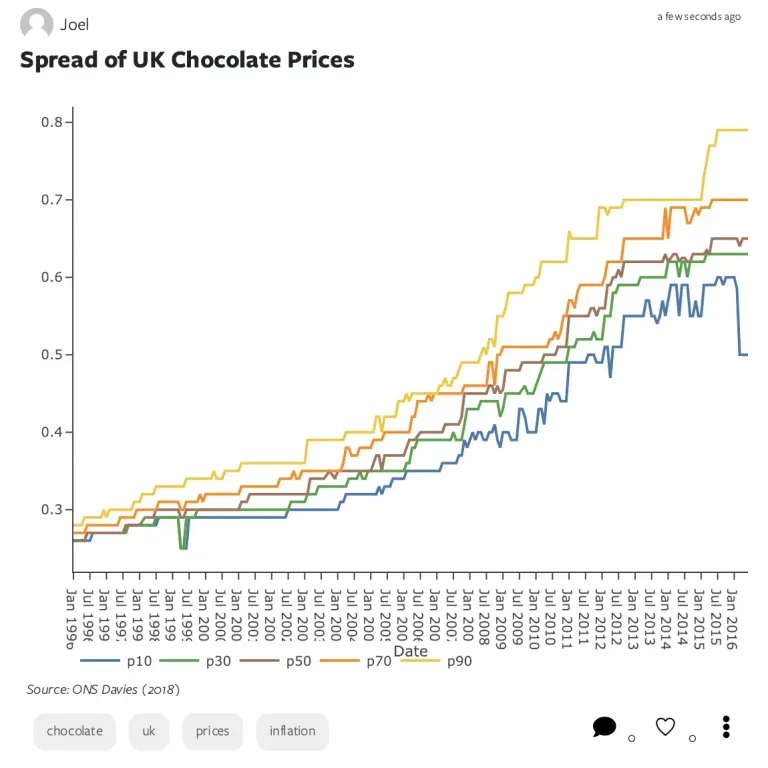

Cocoa Prices Increase: A Major Contributor to Inflation

The recent increase in cocoa prices is not just a blip on the radar; it reflects broader trends affecting the US economy. As cocoa becomes more expensive, the cost of producing chocolate inevitably rises, contributing to overall inflation in consumer goods. With the prices of everyday items climbing, consumers are more conscious of their spending habits, which can lead to a decrease in demand for premium chocolate products. Consequently, manufacturers are left to grapple with the effects of rising operational costs while trying to maintain sales volume.

In the context of a global economic slowdown, these rising cocoa prices present additional challenges. Countries heavily reliant on cocoa exports may experience economic setbacks, impacting their ability to supply the US market effectively. As the situation continues to evolve, stakeholders in the chocolate industry must stay informed about cocoa price trends and broader economic indicators to prepare for potential fluctuations and adjust their strategies accordingly.

Inflation Concerns and the Future of US Chocolate Prices

Inflation concerns loom large over the future of US chocolate prices, as continuing price hikes on essential goods create an atmosphere of uncertainty for consumers. With the Federal Reserve’s responses to rising inflation, including interest rate adjustments, consumers might see further increases in chocolate and other food product prices. This cycle of rising costs might force consumers to choose cheaper alternatives or reduce their chocolate consumption altogether, leading to significant shifts in market dynamics.

Furthermore, as cocoa prices rise amid these inflationary pressures, manufacturers might look to find efficiencies in production or consider alternative sources for their ingredients. Some companies are investing in sustainable agricultural practices that could offer more stable pricing in the long run. However, this adjustment takes time, and the immediate impact of inflation on consumer behavior may shape the chocolate market dynamics for years to come.

The Role of the Federal Reserve in Shaping Chocolate Prices

The Federal Reserve plays a crucial role in shaping economic conditions that can directly and indirectly affect chocolate prices in the US. As inflation rises, the Fed’s decisions on interest rates could lead to ripple effects throughout the economy, with consumers experiencing changes in their purchasing power. When interest rates rise, consumers may cut back on discretionary spending, including luxury items such as chocolate, which could impact sales for retailers and manufacturers alike.

Additionally, the Fed’s stance on monetary policy can influence the cost of borrowing for chocolate manufacturers, affecting their operational costs and pricing strategies. If manufacturers face higher borrowing costs, they may pass on those expenses to consumers in the form of elevated prices for chocolate products. Understanding the Fed’s influence on the economy and chocolate prices is imperative for consumers and investors who are keen to navigate this complex economic environment.

Global Economic Slowdown: Implications for US Chocolate Pricing

The ongoing global economic slowdown has profound implications for US chocolate pricing, as interconnected markets experience varying degrees of struggle. With declining growth across numerous sectors, companies involved in chocolate production are not insulated from these pressures. The slowing economy can lead to decreased consumer spending and alter demands for chocolate, where consumers may prioritize essential goods over luxury items.

In a global context, the US chocolate industry imports a considerable amount of cocoa from affected countries. If those countries experience economic hardship, it could hinder their ability to produce and supply cocoa, leading to tighter supplies and higher prices. Import tariffs imposed as a result of trade wars only serve to intensify these challenges, making it crucial for consumers and businesses to remain aware of how global events impact domestic chocolate pricing.

Consumer Behavior and Chocolate Prices Amid Economic Changes

As the economic landscape in the US evolves, consumer behavior concerning chocolate purchases is likely to follow suit. Faced with rising prices due to soaring cocoa costs and inflation, consumers may become more discerning in their choices. Premium chocolate brands may struggle as shoppers opt for more budget-friendly options, impacting overall sales across the market. Consumers may also look for discounts or alternative products that promise similar satisfaction at a lower price.

Brand loyalty might also shift during times of economic uncertainty as consumers prioritize value over indulgence. This shift could force chocolate manufacturers to adapt their marketing strategies to retain their loyal customer base while attracting price-sensitive consumers. Understanding how consumer behavior changes can provide insights for manufacturers looking to navigate the challenges posed by rising prices and economic instability, fostering sustainable growth despite heightened competition.

Exploring Substitutes: Solutions to Rising Chocolate Prices

In light of increasing chocolate prices driven by rising cocoa costs and tariffs, manufacturers are beginning to explore various substitutes to mitigate expenses. This shift might involve experimenting with different ingredients that can help replicate the taste and texture of chocolate without compromising quality. By incorporating alternatives such as carob or cocoa powder in their products, companies can potentially reduce production costs while still appealing to consumer preferences.

Moreover, utilizing technology to enhance the efficiency of chocolate production processes can also contribute to controlling prices. Innovations in sourcing ingredients or reformulating recipes to reduce reliance on high-cost inputs can make a significant difference in keeping chocolate affordable for consumers. As the market continues to fluctuate, finding viable substitutes while ensuring high-quality standards will be essential for maintaining competitiveness and consumer satisfaction.

Navigating Challenges: Future-Proofing the Chocolate Industry

To remain viable amid rising prices and economic uncertainties, the chocolate industry must focus on future-proofing their operations. This may involve adopting sustainable practices that can positively impact both costs and pricing. For example, investing in fair trade cocoa sourcing can not only appeal to socially conscious consumers but also stabilize supply chains. By ensuring a more consistent and predictable cost structure, manufacturers can better navigate price fluctuations in the chocolate market.

Furthermore, collaboration across the entire supply chain—from farmers to manufacturers—will be vital in addressing the challenges posed by increasing cocoa prices and tariffs. By investing in technology, improving logistics, and fostering communication among stakeholders, the chocolate industry can create a more resilient network that can adapt to changing economic conditions. These strategies will be essential for maintaining competitiveness and meeting consumer demands as the landscape continues to evolve.

Frequently Asked Questions

How are cocoa prices affecting US chocolate prices?

Cocoa prices have significantly increased over the past year, driven by various factors including supply chain disruptions and increased demand. As cocoa is the primary ingredient in chocolate production, these rising costs directly contribute to a surge in US chocolate prices. This trend is expected to continue if cocoa prices remain high.

What impact do Trump tariffs have on US chocolate prices?

Trump tariffs on cocoa and chocolate imports have exacerbated the increase in US chocolate prices. These tariffs raise the cost of importing key ingredients, leading chocolate manufacturers to pass on these costs to consumers, further inflating chocolate prices in the US market.

Are inflation concerns related to US chocolate prices?

Yes, inflation concerns play a significant role in the rising US chocolate prices. The combination of increased cocoa costs, tariffs, and overall inflationary pressures in the US economy drives up production costs for chocolate manufacturers, resulting in higher prices for consumers.

How does the global economic slowdown affect US chocolate prices?

The global economic slowdown can lead to fluctuations in commodity prices, including cocoa. If demand for chocolate decreases globally due to economic conditions, it can impact cocoa prices indirectly. However, current high cocoa prices may still keep US chocolate prices elevated regardless of the global economy’s state.

What should consumers expect for US chocolate prices in the coming months?

Consumers can expect US chocolate prices to remain high in the coming months due to the persistent increase in cocoa prices and Trump tariffs. As these factors continue to influence the cost of chocolate production, price stability may be difficult to achieve.

| Key Point | Details |

|---|---|

| Surge in Chocolate Prices | US chocolate prices are rising significantly due to increased cocoa costs and tariffs on imports. |

| Rising Cocoa Costs | Cocoa, the main ingredient in chocolate, has seen a price increase over the past year, impacting the overall cost of chocolate products. |

| Impact of Tariffs | Tariffs imposed on chocolate imports are contributing to the sustained high prices of chocolate in the US market. |

| Economic Climate | The broader economic environment, including Trump’s tariffs, is affecting inflation and could lead to a slowdown in global economic growth. |

| Trade Relations | The ongoing trade tension between the US and China has implications for US chocolate prices, particularly through mutual tariffs affecting imports. |

| Impact on Farmers | Farmers are adversely affected by tariffs, indicating a need for financial assistance to cope with increased costs and market pressures. |

Summary

US chocolate prices are experiencing a significant surge primarily due to rising cocoa costs and the impact of import tariffs. These factors collectively contribute to the higher price of chocolate products in the market, affecting both consumers and producers. As the economic landscape evolves with ongoing tariffs and trade negotiations, the US chocolate pricing could face further fluctuations.