Stagflation: Rising US Economy Concerns Amid High Inflation

Stagflation has become a pressing concern for the US economy as financial experts sound the alarm over the potential for high inflation coupled with slow economic growth. Recently, Federal Reserve Chair Jerome Powell highlighted the risks associated with tariffs on goods imported to the U.S., hinting they could exacerbate this troubling economic condition. While Powell didn’t explicitly use the term “stagflation,” his warnings reflect a real fear that inflation rates could soar while economic expansion stagnates, creating a challenging environment for consumers and policymakers alike. This combination not only fuels inflation but could also lead to increased unemployment, placing immense pressure on the Federal Reserve to strike a balance between combating rising prices and supporting economic recovery. As the situation evolves, understanding the dynamics of stagflation becomes crucial for navigating the current challenges facing the U.S. economy.

The term “economic malaise” is often used to describe a scenario similar to stagflation, where high price levels persist alongside lackluster growth in the economy. This situation can also be referred to as an inflationary recession, characterized by rising costs and declining productivity, raising concerns among economists about its potential return to the U.S. market. Experts point to interventions such as tariffs on imports, which may inadvertently stymie growth and inflate prices, aggravating the economic conditions. This dual-edged sword poses a dilemma for the Federal Reserve, which must carefully calibrate its strategies to address both rising inflation and efforts for economic revitalization. Ultimately, understanding these interrelated factors is vital as they inform discussions on the future trajectory of the U.S. economy.

Understanding Stagflation: A Historical Perspective

Stagflation is a complex economic condition that combines stagnation and inflation, which can create significant challenges for policymakers and consumers alike. Historically, the U.S. faced stagflation during the late 1970s and early 1980s, characterized by an economy hampered by high unemployment and soaring prices, particularly due to oil embargoes. This combination is particularly problematic as it tends to create a toxic environment for economic growth, where increased prices reduce consumer spending power while businesses struggle to maintain profit margins.

The implications of stagflation extend far beyond mere economic statistics. When inflation and unemployment rise simultaneously, the societal impact can be profound, creating pockets of distress across the workforce and resulting in slower economic growth. In this context, examining today’s economic landscape—where tariffs on goods may drive up prices and dampen consumer demand—becomes crucial for understanding the potential risks that could lead the U.S. into another period of stagflation.

Financial experts emphasize the importance of recognizing how current fiscal policies, especially regarding tariffs, might emulate the circumstances that led to historical stagflation. During the 1970s, oil prices skyrocketed due to geopolitical unrest, severely impacting the economy. Similarly, as tariffs imposed under the Trump administration continue to manipulate the prices of imported goods and materials, the worry is that we could see a reemergence of stagflation—an economic scenario no one wants to revisit.

Another crucial aspect of understanding stagflation includes the role of the Federal Reserve in managing economic conditions. During periods of stagflation, the Fed’s limited tools become a double-edged sword as it struggles to combat inflation without further slowing economic growth. By delving into past episodes of stagflation, analysts hope to uncover insights that could inform current strategies for avoiding similar pitfalls. Coupled with the ongoing discussions about monetary policy and tariffs, it is evident that understanding this historical perspective is vital to navigating the current economic uncertainty.

Current Economic Indicators of Potential Stagflation

The current economic indicators present a troubling picture as experts voice increasing concerns regarding a creeping stagflation scenario. Recent remarks by Federal Reserve Chair Jerome Powell point to a potential correlation between the rising tariffs on imported goods and the inflationary pressures gripping the U.S. economy. As higher tariffs are imposed, the costs of goods are likely to surge, resulting in decreased consumer spending, a vital component of economic growth.

Moreover, the latest jobs report indicates a mild rise in unemployment, hinting at a slowdown in economic expansion. Such trends highlight the precarious balance the Fed must maintain; acting too aggressively on interest rates may exacerbate unemployment while leniency could lead to unchecked inflation. This balancing act underscores the delicate situation the economy currently faces, further emphasizing fears that—if unchecked—these trends could spark a stagflation crisis.

Economic analysts are also keenly observing trends in consumer behavior as inflation continues to rise. Retail sales and consumer confidence indicators suggest that households are beginning to tighten their belts due to higher prices, a common behavioral shift seen in periods of high inflation. A drop in consumer confidence can stifle economic growth as decreased spending leads to lower business revenues, potentially resulting in layoffs and further increases in unemployment—key ingredients for stagflation.

The Federal Reserve’s next steps remain critical in shaping whether the U.S. can sidestep the looming specter of stagflation. The delicate interplay between managing inflation and fostering economic growth demonstrates the importance of strategic policymaking. As observers look to the Fed for direction, the potential implications of tariffs on goods and consumer spending bear close monitoring, with economic stakeholders intent on avoiding the historical missteps that led the U.S. into past stagflation scenarios. Thus, the careful analysis of current economic indicators is paramount in creating a sustainable growth trajectory.

Federal Reserve’s Response to Inflation and Economic Slowdown

The Federal Reserve plays a pivotal role in navigating through the complicated waters of inflation and potential economic slowdown. With recent signals from Chair Jerome Powell emphasizing the need for a careful assessment of the economic landscape, the Fed faces a daunting challenge: to either act on multiple fronts without triggering stagflation, or to stall and risk allowing inflation to spiral out of control. The balancing act demands not only strategic thought but also agile responses to shifting economic conditions.

In an environment where tariffs are impacting prices, inflationary pressure is likely to rise, which also creates ongoing discussions about interest rate adjustments. A raised interest rate may help curb inflation but could also compromise economic growth, trapping the economy in a cycle reminiscent of stagflation. Powell’s comments reflect an awareness of the precarious nature of these interdependencies, and the pressure on the Fed mounts as they work to decide on the best course of action.

Furthermore, while some segments of the economy appear to be growing, such as the recent addition of jobs, the overall landscape remains clouded by inflation concerns and rising costs. The Fed’s dual mandate of promoting maximum employment and stable prices becomes pivotal in these discussions. Immediate action may be necessary to prevent high inflation from sapping consumer confidence, yet premature moves could stifle the very growth needed to sustain job creation.

In conclusion, the Federal Reserve’s response in this climate is essential not just for managing current inflation but for preventing a return to the stagflation of the past. As financial experts analyze Powell’s remarks and the overall economic indicators, the need for prudent decision-making becomes increasingly pronounced. In a world where tariffs on goods continue to influence market dynamics, the Fed must promote sustained economic growth while skillfully navigating the inflationary pressures alongside the potential risks of stagflation.

Frequently Asked Questions

What is stagflation and how does it affect the US economy?

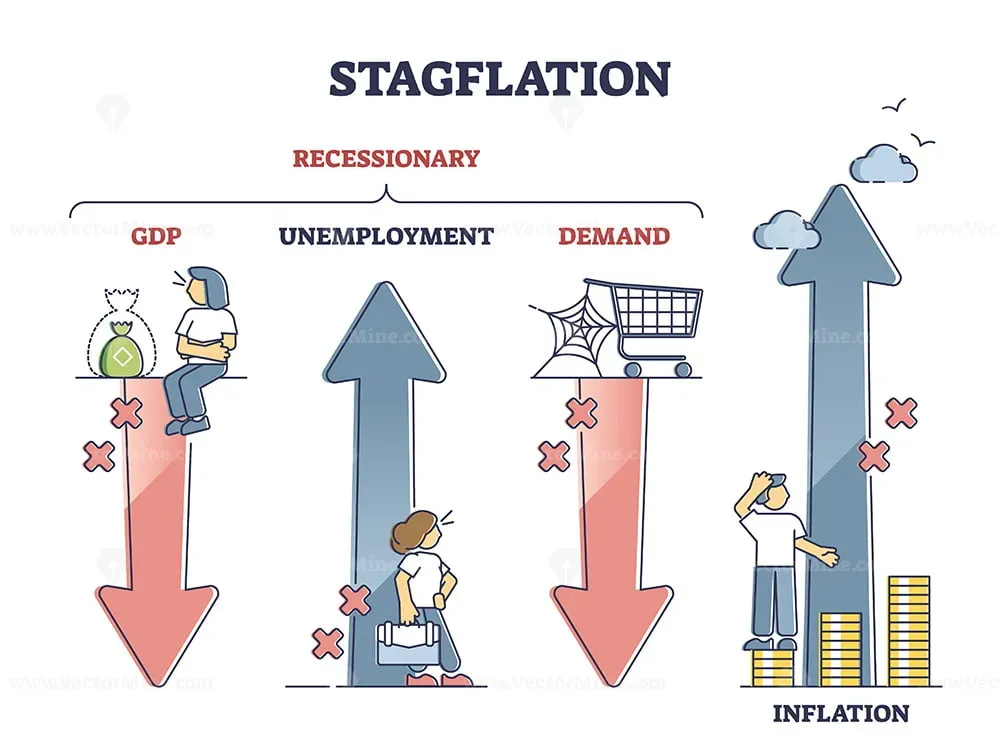

Stagflation is an economic condition characterized by high inflation and slow economic growth, often accompanied by high unemployment. It represents a challenging scenario for the US economy because it combines rising prices and stagnation, making it difficult for policymakers to stimulate growth without exacerbating inflation.

Are tariffs on goods contributing to stagflation in the US?

Yes, tariffs on goods can contribute to stagflation in the US by raising prices and reducing consumer spending. When import costs increase due to tariffs, it can lead to higher overall inflation rates, while simultaneously slowing economic growth due to decreased demand.

What role does the Federal Reserve play in managing stagflation?

The Federal Reserve (Fed) plays a crucial role in managing stagflation by adjusting interest rates to control inflation and stimulate economic growth. In a stagflation scenario, the Fed faces a challenge because increasing interest rates can help combat inflation but may further impede economic growth.

What are the historical precedents of stagflation in the US economy?

Historically, stagflation occurred in the US during the late 1970s and early 1980s, primarily due to oil embargoes that caused rapid increases in oil prices. During this period, both inflation and unemployment surged, highlighting the dual challenges of rising prices and economic stagnation.

How does high inflation link to stagflation in the current US economy?

High inflation in the current US economy can link to stagflation when price increases occur alongside stagnant or declining economic growth. This scenario can lead to reduced consumer spending and investment, creating a vicious cycle that makes recovery difficult.

What indicators show that the US might be facing stagflation?

Indicators such as rising inflation rates, decreasing GDP growth, and increasing unemployment can signal that the US economy is at risk of stagflation. Experts monitor these metrics closely, especially in light of tariff policies and their potential impact on economic conditions.

How do consumer price increases correlate with stagflation in the US economy?

Consumer price increases correlate with stagflation as they signal rising inflation amidst poor economic performance. If prices rise rapidly while economic growth remains stagnant, it exacerbates the condition of stagflation, affecting consumer purchasing power and overall financial stability.

What economic policies can be effective against stagflation?

Effective economic policies against stagflation may include targeted fiscal measures to stimulate growth without exacerbating inflation, adjusting interest rates carefully, and implementing strategies to reduce regulatory burdens that hinder economic activity while managing inflationary pressures.

What impact does slow economic growth have on stagflation in the US?

Slow economic growth exacerbates stagflation in the US by limiting job creation and income growth, which can lead to higher unemployment rates. When combined with inflation, it diminishes consumer confidence and spending, creating a challenging environment for economic recovery.

| Key Point | Details |

|---|---|

| Definition of Stagflation | Occurs during high inflation and slow economic growth, often with high unemployment and rising prices. |

| Current Economic Situation | The Fed chair warns that current tariffs may lead to stagflation, suggesting rising inflation and slow economic growth. |

| Historical Context | Stagflation last occurred in the U.S. during the late 1970s and early 1980s, marked by high inflation and unemployment. |

| Impact of Tariffs | Current tariffs could increase prices and lead to reduced consumer spending and investment uncertainty. |

| Federal Reserve’s Response | The Fed is assessing economic conditions to decide on interest rate adjustments, balancing the need to combat inflation against economic growth. |

Summary

Stagflation is a significant concern for the U.S. economy as recent comments from the Federal Reserve chair highlight the potential for rising inflation coupled with slow economic growth. With tariffs increasing uncertainties and possibly leading to higher prices, financial experts warn that we could be heading into a period characterized by stagflation. The implications of this economic condition are profound, as high unemployment and decreased consumer spending could ensue, mirroring troubling times from the past. Understanding stagflation is vital for policymakers and consumers alike, as it presents unique challenges that require careful navigation.