Financial Literacy: Smart Strategies for Your Future

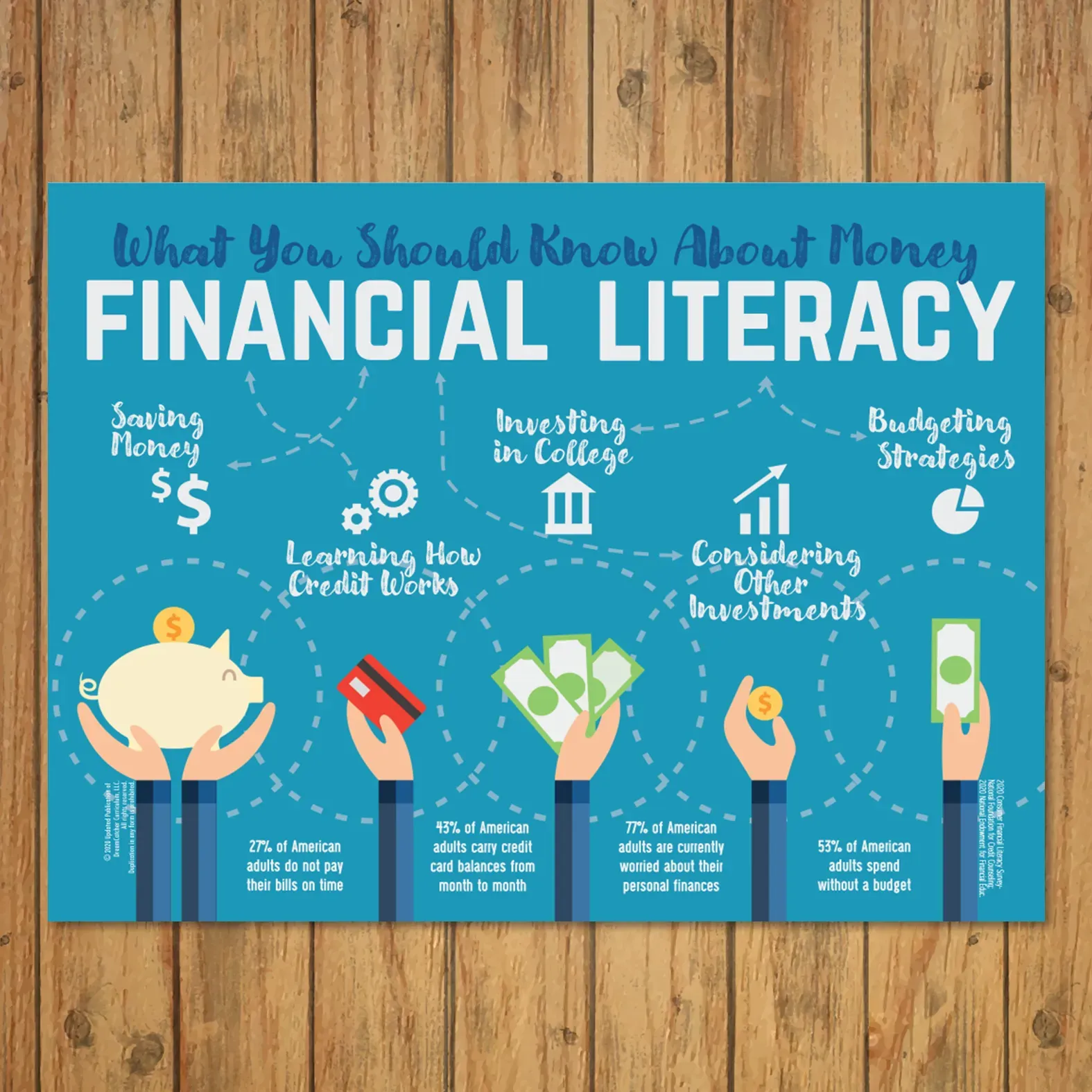

Financial literacy is an essential skill that enables individuals to make informed decisions about their economic well-being. With the ever-changing landscape of the stock market, understanding financial planning tips is more critical than ever. By honing your financial literacy, you can develop saving and spending habits that reflect your long-term goals. Additionally, maximizing employee benefits and implementing savvy 401K best practices can enhance your financial portfolio significantly. April, celebrated as Financial Literacy Month, serves as a perfect reminder to assess your financial strategies and make adjustments where necessary.

Understanding personal finance, often referred to as economic competence, is crucial for achieving financial stability and success. This encompasses various aspects such as investing wisely in the stock market, employing strategic financial planning advice, and cultivating effective saving and spending practices. Those who grasp the nuances of their financial ecosystem, including the optimization of employer-sponsored benefits, lay a solid groundwork for their future. Moreover, being knowledgeable about retirement planning, including best practices for managing your 401K, can ensure a secure financial future. As we recognize the importance of enhancing our financial knowledge, it’s vital to reevaluate and refine our financial habits regularly.

Understanding Stock Market Strategies

Navigating the stock market can feel overwhelming, especially during periods of volatility. Understanding core stock market strategies is vital for both novice and seasoned investors. A strategic approach involves diversifying your portfolio rather than putting all your funds into one or two stocks. By spreading out your investments across different sectors, you can mitigate risks and potentially enhance returns over time. Additionally, adopting a long-term perspective can help weather the ups and downs of daily market fluctuations.

Staying informed about market trends and economic indicators is equally crucial. For instance, interest rates, inflation data, and employment figures can all influence stock performance. Investors should focus on fundamental analysis, which examines a company’s financial health and performance metrics, as well as technical analysis, which looks at historical price trends. By combining these strategies, you can make well-rounded investment decisions that align with your financial goals.

Financial Literacy: A Key to Economic Empowerment

April is celebrated as Financial Literacy Month, a reminder of the importance of understanding personal finance management. Financial literacy extends beyond mere budgeting; it includes comprehending how investments work, the implications of debt, and the benefits of saving for retirement through vehicles like 401Ks. An educated approach to finance empowers individuals to make informed decisions that ultimately enhance their financial well-being. Without this knowledge, people can easily fall prey to poor financial habits that might jeopardize their long-term wealth accumulation.

Enhancing your financial literacy can lead to more strategic financial planning. Individuals who grasp concepts such as compound interest, asset diversification, and risk management are better placed to develop a sound financial strategy that includes maximizing employee benefits and leveraging their 401K plans. Creating a personalized financial plan that reflects your values and goals becomes feasible, enabling you to allocate your resources effectively toward savings and investments.

Essential Financial Planning Tips for Young Professionals

As young professionals embark on their careers, establishing solid financial foundations is crucial. One of the first financial planning tips is to create a budget that tracks both income and expenses. This awareness helps identify areas where spending can be curtailed and savings maximized. Additionally, young adults should prioritize building an emergency fund, typically covering three to six months’ worth of living expenses, to navigate unexpected financial challenges without relying on credit.

Moreover, young professionals should not shy away from exploring investment opportunities, even in uncertain times. Starting early with investments in a diversified portfolio can yield significant benefits due to compound growth over time. Utilizing employer-sponsored retirement plans, such as 401Ks, can further enhance your financial health, especially when combined with any matching contributions offered by employers. Understanding these fundamentals today paves the way for a secure financial future.

Maximizing Employee Benefits: Strategies for Success

Maximizing employee benefits is an often overlooked aspect of personal finance that can significantly boost one’s overall financial health. Many employers offer a range of benefits, from health insurance to retirement savings plans. Taking full advantage of these benefits means not only enrolling in necessary programs but also understanding how they contribute to long-term financial goals. For instance, fully utilizing a 401K plan, especially with employer matching, can lead to substantial savings over the years.

Employees should also investigate additional benefits such as flexible spending accounts or health savings accounts that offer tax advantages. Understanding how to navigate these options can result in lower out-of-pocket costs for healthcare and allow more significant contributions to retirement accounts. By exploring all available employee benefits, individuals can effectively enhance their financial situation while ensuring they are well-prepared for possible future uncertainties.

The Importance of Saving and Spending Habits

Establishing sound saving and spending habits is fundamental to achieving financial security. One essential habit is to differentiate between needs and wants, which can help in making informed purchasing decisions. Allocating a certain percentage of your income to savings can foster a habit of saving that accumulates wealth over time. This discipline is particularly vital as life circumstances change, requiring a flexible mindset towards budgeting as income or family situations evolve.

On the spending side, aligning your expenditures with personal values and goals is crucial. For example, if sustainability is a core value, investing in environmentally friendly products may take priority over more conventional options. Regularly reviewing spending patterns can bring awareness to unnecessary expenses and encourage reallocation of funds to savings or investments that contribute to long-term financial independence. Such awareness not only builds financial literacy but also enriches quality of life.

401K Best Practices for Retirement Success

With retirement approaching, optimizing your 401K is one of the best practices to ensure financial comfort in later years. Understanding the contribution limits and tax advantages associated with 401K accounts can significantly enhance your retirement savings. It’s advisable to contribute enough to receive any employer matching offer, as this essentially represents free money that can compound over time. Many financial experts suggest increasing your contribution rate incrementally to maximize growth.

Another vital aspect of 401K management is the investment choices you make within the plan. Individuals need to review their investment options periodically and adjust based on their risk tolerance, age, and retirement timeline. Diversification within the 401K, ensuring a mix of stocks, bonds, and other assets, can safeguard against market volatility. Following these best practices will enable you to build a robust nest egg that supports a comfortable retirement.

Essential Steps for Effective Financial Planning

Effective financial planning involves setting clear, actionable goals and devising strategies to achieve them. The first step is assessing your current financial situation, including assets, liabilities, income, and expenses. This provides a baseline from which you can identify areas of improvement. Including specific goals, such as saving for a house or funding education, can guide your financial planning process.

Once goals are defined, developing a budget and sticking to it becomes imperative. Incorporating additional strategies such as automating savings or contributions towards retirement helps in maintaining discipline. Regularly revisiting these goals and adjusting plans as life circumstances change ensures that your financial strategy remains relevant and effective. By prioritizing consistent reviews, you are more likely to stay on track and reassess as necessary.

Creating an Emergency Fund: A Financial Safety Net

Building an emergency fund is often regarded as a foundational element of personal finance. This fund serves as a financial safety net, covering unexpected expenses such as medical bills or car repairs without derailing your overall financial strategy. Ideally, an emergency fund should encompass three to six months’ worth of living expenses, allowing individuals to navigate financial disruptions without resorting to high-interest debt.

To create an emergency fund, begin by setting aside a small, manageable amount each month. Automating transfers to a dedicated savings account can simplify this process and ensure consistent contributions. As your fund grows, you can adjust the target amount based on changing life circumstances. Having this financial cushion not only provides peace of mind but also aligns with prudent financial planning principles, reinforcing resilience in uncertain times.

Aligning Financial Goals with Personal Values

Aligning financial goals with personal values is a transformative approach to budgeting and spending. This alignment ensures that your financial decisions reflect your true priorities, rather than merely responding to societal expectations. When your financial plan resonates with your core beliefs, you are more likely to feel satisfied with your spending habits and motivated to stick to your savings goals.

To achieve this alignment, start by identifying what you value most in life—be it family, travel, education, or philanthropy. From there, analyze your current expenditure patterns and adjust them to support those values. For example, if travel is a priority, budgeting for it might mean reducing discretionary spending in other areas. By consciously aligning finances with personal values, individuals can cultivate a purposeful approach to their economic future.

Frequently Asked Questions

What are some effective financial literacy tips for optimizing my 401K?

To optimize your 401K, it’s essential to start by taking full advantage of any employer matching contributions. Additionally, review your investment choices regularly to ensure they align with your retirement goals. Diversify your portfolio to include a mix of stocks and bonds, and consider increasing your contributions as you receive raises or bonuses. Regularly educate yourself about 401K best practices to maximize your retirement savings.

How can I develop better saving and spending habits as part of my financial literacy journey?

To develop better saving and spending habits, start by tracking your monthly expenses and identifying areas where you can cut back. Create a budget that reflects your financial goals and prioritize saving for emergencies and future investments. Utilize financial literacy resources to educate yourself on sound budgeting practices, and don’t hesitate to adjust your habits as your income or circumstances change.

What stock market strategies should beginners consider for improving their financial literacy?

Beginners should focus on stock market strategies that emphasize long-term investing rather than short-term trading. Understand the importance of diversifying your investments to mitigate risk, and consider index funds or ETFs as a cost-effective way to enter the market. Regularly educating yourself about market trends and fundamental analysis will enhance your financial literacy and help you make informed decisions.

Why is financial planning important for maximizing employee benefits?

Financial planning is crucial for maximizing employee benefits because it allows you to strategically evaluate and utilize your available options, such as health insurance, retirement plans, and flexible spending accounts. By understanding how to integrate these benefits into your overall financial strategy, you can significantly decrease your tax liabilities and optimize your savings, ensuring you’re getting the most value out of your employment compensation.

How can assessing my financial literacy help me during Financial Literacy Month?

Assessing your financial literacy during Financial Literacy Month allows you to identify your strengths and weaknesses in managing money. This reflection can guide proactive changes in your saving and spending habits, as well as enhance your understanding of financial concepts like investment strategies, budgeting, and retirement planning. It’s an excellent opportunity to set realistic financial goals and educate yourself further through workshops or online resources.

| Key Point | Details |

|---|---|

| Market Stability | New York Stock Exchange ended positively after a week of uncertainty. |

| Financial Strategy | Stay calm and focus on personal financial habits instead of news headlines. |

| Young Professionals | Should take greater financial risks when starting their careers. |

| Near Retirement | Should optimize benefits and utilize 401K matching. |

| Spending and Saving Habits | Habits should evolve over time and align with personal values and goals. |

| Financial Literacy Month | April is a good time to evaluate and adjust spending habits. |

| Emergency Funds | Adapt financial planning as family needs change, setting aside more for emergencies. |

| Employee Benefits | Maximizing benefits and 401K contributions to ensure all money is utilized effectively. |

Summary

Financial literacy is essential for making informed decisions about managing your money. By understanding that market fluctuations happen and focusing on your financial habits, you can create a solid foundation for your financial future. Whether you are just starting your career and taking on more risks or approaching retirement and optimizing your savings, evaluating your spending habits, especially during Financial Literacy Month in April, is crucial. Aligning your financial decisions with your core values and being proactive about savings and benefits can significantly improve your financial health.