2024 Stock Market Performance: Winners and Losers Revealed

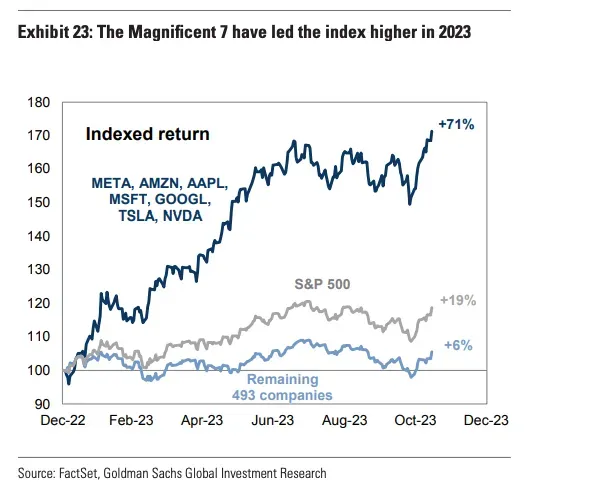

As we delve into the 2024 stock market performance, it’s clear that this year has been nothing short of remarkable for investors. The stock market in 2024 has experienced an impressive rally, with the S&P 500 trends 2024 reflecting a significant upward trajectory amidst a backdrop of resilient economic indicators. The so-called “Magnificent 7” tech stocks have played a pivotal role, yet more than 70% of the S&P 500 stocks saw gains, indicating a broad-based recovery. With exciting developments like the meteoric rise of AI stocks performance, including Nvidia and Super Micro Computer, investors are keenly watching how these trends will unfold. However, challenges remain, particularly with notable declines such as Tesla stock decline 2024, which raises intriguing questions about future investment strategies in 2024.

In 2024, the focus on equity markets highlights a vibrant and fluctuating landscape for financial assets. This year, the equity performance has shown remarkable resilience, marked by strong earnings reports and shifts in investor sentiment. Key analytics suggest a surge in technology and artificial intelligence sectors, shaping investment decisions as we observe the dynamics of stocks such as those of the so-called “Magnificent 7.” Meanwhile, adversities faced by specific players, including declines in stocks like Tesla, provide a complex narrative for investors navigating their strategies. As we approach the mid-year mark, understanding these financial trends is essential for anyone looking to capitalize on opportunities in investing for 2024.

Overview of the 2024 Stock Market Performance

The year 2024 has marked a remarkable resurgence for stock markets globally, indicating a strong bullish trend across major indices. Investors have witnessed record highs in several markets, prominently featuring the S&P 500, which has surged by 10% year-to-date. This performance goes hand-in-hand with advancements in the broader economy, suggesting that factors like consumer confidence and corporate performance are rallying alongside stock prices. As the bull market continues, analysts are evaluating what motivates this robust growth and how long it can sustain.

Particularly captivating is the dominance of the ‘Magnificent 7’ tech companies, which have been at the forefront of the upturn. However, it’s essential to recognize that over 70% of S&P 500 stocks have shown positive returns, which illustrates a more comprehensive economic recovery. The optimism in the 2024 stock market performance also reflects renewed trust among investors, which can encourage further investment in various sectors, including technology and AI.

Frequently Asked Questions

What are the key trends influencing stock market performance in 2024?

In 2024, key trends influencing stock market performance include the rise of AI stocks, with companies like Nvidia and Super Micro Computer Inc. achieving significant gains. The S&P 500 has also benefited from a broad market rally, with over 70% of its constituents posting gains. The overall positive sentiment is further bolstered by easing trade tensions and encouraging earnings reports.

How is the S&P 500 expected to perform throughout 2024?

The S&P 500 has had a robust start in 2024, rising about 10% year-to-date. Analysts predict continued strength as more companies report strong earnings and investor interest remains high, especially in sectors like technology and renewable energy. The performance of major tech stocks will be crucial in maintaining this upward trajectory.

What factors are contributing to Tesla’s stock decline in 2024?

Tesla’s stock has faced challenges in 2024, primarily due to an overall slowdown in the electric vehicle market and fierce competition. The company is currently the worst performer in the S&P 500, with shares down 26% year-to-date. Factors like production issues and market saturation have significantly impacted investor confidence.

Which AI stocks are leading the market in 2024?

In 2024, AI stocks are leading the market with impressive growth, particularly Nvidia, which has surged by 82%, and Super Micro Computer Inc., which has gained over 250%. The hype around artificial intelligence and its potential for technological advancements continues to drive investor interest and stock performance in this sector.

Is investing in the stock market a good idea for 2024?

Investing in the stock market in 2024 appears promising, with strong overall performance indicated by major indexes like the S&P 500. However, investors should exercise caution and conduct thorough research on individual stocks and sectors, particularly the tech and AI industries, which are showing significant growth potential.

How are global economic factors affecting stock market performance in 2024?

Global economic factors, including trade negotiations and consumer sentiment, are significantly affecting stock market performance in 2024. Positive news regarding tariffs and trade deals, particularly between the U.S. and China, has further fueled market optimism, leading to strong gains in major stock indices, including the S&P 500.

What challenges are traditional media companies facing in the 2024 stock market?

Traditional media companies like Paramount Global and Warner Bros are facing challenges in 2024, with their stocks dropping due to canceled mergers and ongoing streaming service losses. The dynamics of viewer preferences and competition in digital content are putting pressure on these companies to adapt or risk further declines.

| Key Point | Details |

|---|---|

| Overall Market Performance | 2024 has seen a strong upward trend in global stock markets, with significant gains in indices such as the S&P 500, Nikkei 225, and Nifty 50. |

| Major Contributors | The ‘Magnificent 7’ tech stocks have led the charge, but over 70% of S&P 500 stocks have also gained ground this year. |

| Tesla’s Struggles | Tesla is the worst performer in the S&P 500, down 26% as the EV market slows. |

| AI Hype Winners | Nvidia has surged to $2.26 trillion market cap, while Super Micro Computer Inc has seen growth of over 250%. |

| Disney & Uber | Disney’s stock rose by reversing streaming losses; Uber gained 25% after achieving profitability. |

| Losers in the Market | Paramount Global and Warner Bros shares fell after a merger was called off, losing 20% and 24%, respectively. |

| Recent Market Trends | U.S. stocks experienced significant gains amid positive tariff discussions, marking a strong week for major indexes. |

| Earnings Season | JPMorgan reported strong earnings; TSMC reported a sales increase of 42% year-on-year. |

Summary

In 2024, stock market performance has been notably robust, showcasing strong gains across major indices. Amidst the Year of the Dragon, investors have embraced a bullish outlook, propelling markets like the S&P 500 and the Nikkei 225 to record highs. Key players in technology, especially those associated with artificial intelligence, are driving extraordinary growth, highlighting a vibrant investment climate. The downward trend for specific companies, such as Tesla and several entertainment firms, underscores the volatility within sectors. Overall, 2024 is shaping up to be a promising year for stocks, characterized by both considerable gains and notable challenges.