Trump’s Tariffs and Tax Cuts: A Path to Rebuild the Economy

Trump’s tariffs and tax cuts represent a pivotal moment in shaping the future of the U.S. economy. As America grapples with the need for economic revitalization, these measures aim to protect domestic industries while reducing the tax burden on individuals and businesses alike. The ambitious tariff strategy is designed to ensure that American goods are favored in the marketplace, promoting growth and job creation. Coupled with significant tax reforms, the focus is on enhancing investment opportunities and fostering a pro-business environment. Moreover, the combined effect of Trump’s tariffs and tax cuts may lead to a substantial reconfiguration of federal spending and economic policy to benefit ordinary Americans.

The recent economic strategies embraced by the Trump administration, including import duties and tax reductions, signal a fundamental shift in economic governance. These initiatives are poised to challenge traditional economic norms, invigorating the ongoing debate about fiscal responsibility and trade fairness. With a focus on conservative fiscal policies, the administration aims to reposition the U.S. economy in the global marketplace. This approach integrates modest reductions in federal expenditures while encouraging business deregulation, potentially leading to enhanced economic stability. By navigating through the complexities of tariffs and tax reforms, the administration strives to restore American competitiveness and safeguard the nation’s economic interests.

The Economic Rationale Behind Trump’s Tariffs

Trump’s tariffs represent a strategic maneuver designed not only to protect American industries but also to amplify the nation’s economic power on the global stage. By imposing tariffs on imports, particularly from countries like China, the initiative seeks to level the playing field for U.S. manufacturers unable to compete with heavily subsidized foreign goods. This protective measure creates an environment conducive for domestic businesses to thrive, fostering innovation and job creation. Moreover, the tariffs are anticipated to generate additional revenue that can be redirected into the American economy, crucial for funding tax cuts and reducing the overall fiscal burden on citizens.

However, the key to unlocking the full potential of these tariffs lies in their integration with comprehensive economic reforms, particularly significant tax cuts. When paired with strategic reductions in federal taxes, the tariffs ensure that American businesses receive the support they need to grow and hire. This combined approach aims at revitalizing the US economy by stimulating domestic production and decreasing reliance on foreign imports, ultimately resulting in a robust job market and an invigorated small business sector.

Tax Cuts: Essential for Economic Revival

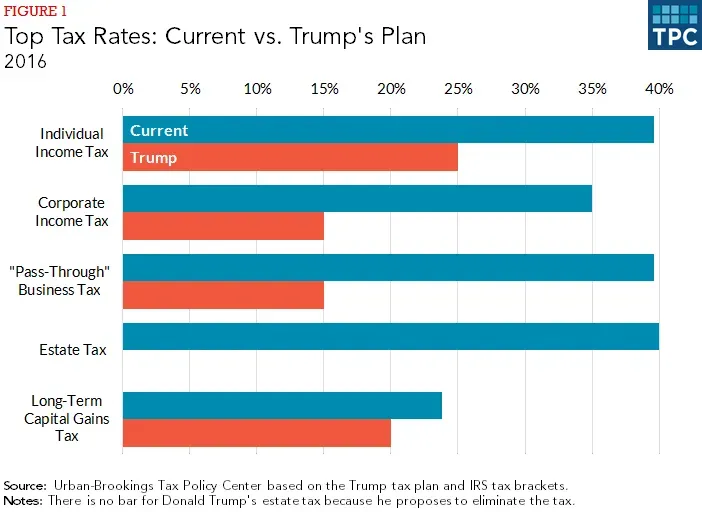

As Congress debates the future of tax policy, it has become imperative that the focus remains on making Trump’s tax cuts permanent. The Tax Cuts and Jobs Act of 2017 significantly lowered tax rates for individuals and corporations, which in turn sparked increased investments and spending within the economy. To continue this momentum, lawmakers need to eliminate barriers to hiring and investment, and introduce policies that foster a pro-business environment. A simplified flat tax system could further enhance efficiency and fairness, ensuring that all Americans benefit from a fairer tax structure and that businesses have the incentive to expand their operations eagerly.

Moreover, deepening tax reform aligns perfectly with the goals of Trump’s tariffs. The revenue generated from these tariffs can be a crucial component in offsetting the costs associated with lower tax rates, thus maintaining federal revenue without imposing additional burdens on the American taxpayer. A cohesive strategy that marries tariffs with tax cuts will not only provide immediate economic relief but will also lay the groundwork for long-term growth by increasing disposable income for families and enabling businesses to invest in new projects, ultimately driving economic expansion.

Federal Spending Cuts: A Necessary Step

Achieving economic revitalization is not solely about tax reductions; it also requires a thorough reevaluation of federal spending. Conservatives throughout Congress have called for a determined approach to significantly cut wasteful and excessive government expenditures. By focusing on meaningful structural reforms to mandatory spending, lawmakers can reclaim fiscal integrity and ensure that taxpayer dollars are spent efficiently. The process must encompass a full audit of government programs, rooting out inefficiencies and prioritizing funding for crucial economic drivers instead.

The cuts in federal spending should not merely be cosmetic changes but rather a genuine commitment to reduce the size and scope of government. By slashing unnecessary expenditures and empowering the Department of Government Efficiency to oversee budgetary integrity, Congress can reinforce the message that the government is here to serve its citizens, not burden them. This fiscal discipline sets a precedent for responsible governance while also promoting economic confidence among taxpayers and investors alike, reinvigorating the foundations on which the U.S. economy stands.

Deregulation: Unleashing American Entrepreneurship

To truly liberate American businesses, a systematic approach to deregulation is essential. Over the years, bureaucratic red tape has stifled innovation and made it increasingly difficult for small enterprises to navigate the complex landscape of compliance. By dismantling outdated regulations that no longer serve the public interest or the economy, lawmakers can create a more favorable environment for entrepreneurship and growth. Advocating for legislative measures like the REINS Act would push for transparency and allow Congress to reclaim its regulatory authority from the executive branch, thus restoring checks and balances.

Furthermore, the removal of cestrictions will particularly benefit small businesses and startups that typically lack the resources to absorb the costs associated with compliance. Streamlined processes and reduced bureaucratic hurdles can lead to increased job creation and economic expansion. By cultivating a regulatory framework that encourages innovation and investment, America can position itself as a leader in global markets, ensuring its industries thrive without unnecessary government interference.

The Impact of Tariffs on Jobs and Wages

Trump’s tariffs can significantly influence the job market and wage levels across various industries. By protecting U.S. manufacturing from unfair foreign competition, these tariffs help to stabilize American jobs that might otherwise be at risk. This protectionist measure not only safeguards employment but also encourages upward wage pressure as businesses gain the leverage to offer more competitive salaries without the threat of losing their workers to cheaper, foreign alternatives.

As these tariffs take effect, it is crucial that Congress also focuses on policies that complement this approach, such as localized economic development initiatives. By investing in infrastructure and workforce development programs, lawmakers can ensure that American workers are equipped with the skills needed to thrive in an evolving job market. This multifaceted strategy will lead to more sustainable job growth, ultimately benefiting families and communities.

Conservative Economic Policy: The Path Forward

A cohesive conservative economic policy must unite various critical components: strategic tariffs, significant tax cuts, spending cuts, and deregulation. This holistic approach is vital to rebuilding the U.S. economy and enhancing American global competitiveness. Many Americans are struggling to make ends meet; consequently, it is essential to adopt policies that directly empower families and businesses to succeed. By focusing squarely on conservative principles, the policies enacted can lay the groundwork for a resilient economic landscape.

In this endeavor, it is paramount for conservatives to remain united behind a shared agenda. By embracing a comprehensive economic strategy that prioritizes growth and opportunity, lawmakers can foster a pro-business environment conducive to innovation and job creation. Overcoming partisan divisions is crucial; only through concerted effort and collaboration can the conservative agenda effectively translate into real-world change that enhances the livelihoods of ordinary Americans.

The Consequences of Inaction: Addressing Economic Challenges

The U.S. economy faces significant challenges stemming from years of fiscal irresponsibility, regulatory overreach, and ineffective trade agreements. If Congress fails to act now and implement the necessary reforms, the consequences could be dire. The lack of meaningful action will continue to facilitate the erosion of the American workforce, loss of manufacturing jobs, and stagnation of wage growth. It is vital to recognize that the current economic predicament is a direct result of policy failures and misplaced priorities; addressing these issues head-on is essential to ensure the success of future generations.

To prevent further deterioration of the economy, lawmakers must recognize the urgent need for proactive measures. This would involve a coordinated response that integrates effective tariffs with broad tax reforms, streamlined regulations, and reduced federal spending. If we fail to act decisively, we risk perpetuating the cycle of economic decline that has characterized the past several decades. It’s time for responsible leadership to reclaim the narrative and set the nation on a path toward sustained prosperity.

Understanding Global Trade Dynamics and Tariffs

The landscape of global trade is continually shifting, and understanding these dynamics is essential for crafting effective tariffs and trade policies. Trump’s tariffs are a strategic move to address longstanding imbalances and unearth fair trade practices. The focus should not only be on the tariffs themselves but also on the broader implications for U.S. trade relationships worldwide. If executed correctly, tariffs can serve as a tool to pressure trading partners to adopt fairer practices and become engaged in reciprocal trade agreements beneficial to the United States.

Incorporating a comprehensive understanding of global markets and trade relationships, policymakers can tailor tariffs to uniquely target problem areas while promoting exports from America. By doing so, the tariffs will not only provide temporary protection but will also encourage a shift in how global trade agreements are negotiated, advancing the interests of American industry and labor in the long run.

The Future of American Industry and Trade Policy

Looking forward, America’s trade policy must evolve to adequately reflect the needs of its industries and workforce. Sustaining a robust industrial base is paramount to national security and economic stability. By working alongside businesses and instituting targeted tariffs, lawmakers can ensure that vital industries remain competitive and sustainable in an increasingly interconnected world. The goal must be to create a balanced trade policy that promotes both import restrictions where needed and an attractive export market for American goods.

As we develop and refine our economic policies, it is essential to remain focused on how these decisions affect everyday Americans. A proactive holistic approach that intertwines trade, tax cuts, and deregulation can dramatically influence the trajectory of American industry. If Congress and the administration work collaboratively to craft policies that support manufacturing and encourage entrepreneurship, the future of American industries can indeed be bright, creating opportunities for all citizens.

Frequently Asked Questions

How do Trump’s tariffs and tax cuts impact the US economy?

Trump’s tariffs, designed to protect American industries, combined with tax cuts aim to rejuvenate the US economy by encouraging domestic production and investment. The administration’s approach is to boost American manufacturing while fostering economic growth through reduced tax burdens on businesses and individuals.

What are the key features of Trump’s tax cuts related to economic growth?

Trump’s tax cuts include significant reductions in corporate tax rates and personal income tax caps, aiming to stimulate investment and consumer spending. These measures are positioned to enhance economic activity and create job opportunities, aligning with conservative economic policy principles.

What is the significance of Trump’s tariffs on international trade?

Trump’s tariffs are seen as a strategy to level the playing field in international trade, particularly against countries like China. By imposing higher tariffs, the administration aims to reduce the trade deficit, protect American jobs, and encourage domestic manufacturing, directly impacting how American businesses compete globally.

How do Trump’s tariffs support federal spending cuts?

By generating revenue through tariffs, the Trump administration can offset potential losses from tax cuts. This strategy aims to balance federal spending while providing fiscal relief to American taxpayers and reducing the federal deficit, thus reinforcing conservative economic policies.

What role does business deregulation play in Trump’s economic strategy?

Business deregulation is central to Trump’s strategy to enhance economic growth. By reducing bureaucratic obstacles, the administration seeks to foster innovation, lower operational costs for companies, and encourage new investments, which are critical for revitalizing the US economy.

How can Trump’s tax cuts be made permanent, and what would be the implications?

Making Trump’s tax cuts permanent would solidify low tax rates and provide businesses with the certainty needed for long-term investments. This could enhance economic stability, promote job creation, and allow families to retain more of their earnings, ultimately leading to increased consumer spending.

What is the effect of Trump’s tariffs on American consumers?

While Trump’s tariffs are aimed at protecting domestic industries and promoting job growth, they can lead to higher prices for imported goods. This trade-off may affect consumer purchasing power, as tariffs can increase costs for retailers who rely on foreign products.

How does Trump’s economic policy address the issue of Chinese trade practices?

Trump’s administration uses tariffs as a tool to combat unfair Chinese trade practices, including intellectual property theft and currency manipulation. By increasing tariffs on Chinese imports, the goal is to pressure China into negotiating fairer trade agreements and protecting American businesses.

Why are conservative policies like spending cuts and deregulation necessary alongside Trump’s tariffs and tax cuts?

Conservative policies such as federal spending cuts and deregulation complement Trump’s tariffs and tax cuts by aiming to create a more efficient government and economic environment. These measures help reduce national debt, empower businesses, and promote a competitive market, aligning with the overall goal of strengthening the US economy.

What are the long-term objectives of combining Trump’s tariffs and tax cuts in economic policy?

The long-term objectives include revitalizing American manufacturing, reducing reliance on foreign goods, stabilizing the economy through tax relief, and ensuring a fair competitive landscape for American businesses. Together, these policies aim to secure a robust economic foundation for future generations.

| Key Point | Description |

|---|---|

| Trump’s Tariffs | Historic tariffs aimed at reducing foreign exploitation and boosting American industry. |

| Tax Cuts | Permanent tax cuts are essential to complement tariffs and stimulate economic growth. |

| Reducing Regulations | Deregulation is crucial to liberating businesses and fostering innovation. |

| Federal Spending Cuts | Genuine structural reforms are necessary to reduce wasteful and excessive federal spending. |

| Border Adjustment Tariff | Implementation of a 10% tariff on imports with a matching export credit to correct trade imbalances. |

Summary

Trump’s tariffs and tax cuts are integral to rebuilding the U.S. economy by enhancing American competitiveness in global markets. As President Trump has initiated significant tariffs to curb foreign exploitation, it is essential that Congress supports these efforts with permanent tax reductions and regulatory reforms. By coupling tariffs with comprehensive tax policies aimed at stimulating job growth and reducing federal oversight, America can revitalize its economic framework, empower communities, and safeguard prosperity for future generations.