US Economy Optimism: Navigating Market Volatility Risks

In recent headlines, there is a palpable sense of US economy optimism, highlighted by statements from the White House claiming that strengths remain evident despite ongoing market volatility. While the US stock market experiences fluctuations, attributed largely to geopolitical tensions and the impact of Trump’s tariffs, many analysts maintain a hopeful outlook towards economic growth. The underlying fundamentals of the economy, coupled with signs of resilience from investors, suggest that confidence may ultimately prevail. As the world watches closely, there are indications that investor confidence is beginning to stabilize, which could lead to renewed growth opportunities. Even amidst the uncertainty, the prevailing attitude reflects a belief that proactive measures and sound financial strategies will bolster the US economy in the coming months.

Exploring the current economic landscape, we find a strong narrative of positivity surrounding the American financial system, despite the presence of significant market fluctuations. The steady pulse of the US marketplace is responding to external pressures, particularly the ramifications of tariff policies initiated by the Trump administration. Observations show a rebound in certain sectors, indicating that while challenges exist, there remains a foundation for growth. Furthermore, advocates for fiscal resilience point to rising investor morale as a key factor in navigating through these trying economic times. The narrative of recovery and growth, coupled with strategic adaptations to tariff impacts, emphasizes a broader trend towards stabilization despite the backdrop of international unease.

US Economy Optimism Amid Market Volatility

Despite the tumultuous backdrop of market volatility, the White House has expressed strong optimism regarding the US economy’s resilience. This optimistic outlook comes as US stock markets have faced declines, triggered by concerns over recession and the repercussions of Trump’s tariff policies. Investors have been nervously watching the fluctuations in the market, yet the administration believes that these tariffs embody a proven economic formula that will ultimately bolster growth and restore investor confidence in the long term.

As economics typically demonstrate, periods of volatility often precede positive change. The optimism from officials argues that the foundation for economic growth remains solid, fueled by strong consumer spending and corporate investments despite the market’s erratic behavior. Analysts emphasize that the forward-looking confidence suggested by the White House could play a crucial role in stabilizing markets, giving investors fresh reasons to believe in the potential for recovery, particularly following disappointing stock performances.

Impact of Trump Tariffs on Economic Dynamics

The implementation of Trump’s tariffs has sparked significant debates regarding their influence on the US economy. While tariffs are intended to protect domestic industries, they carry the risk of escalating tensions with trading partners, leading to retaliatory measures. Financial markets have reacted negatively as investors absorb the potential impacts on profit margins and economic growth. Concerns surrounding inflation, coupled with fears of a trade war, have injected uncertainty into the stock market, affecting overall investor confidence.

Despite these challenges, analysts argue that tariffs can also create opportunities for domestic industries to flourish, potentially offering a silver lining in a volatile economic climate. Keeping a pulse on these tariff outcomes becomes crucial, as they will determine not only the trajectory of economic growth but also the broader sentiment within the US stock market. Monitoring these dynamics will help investors make informed decisions as they navigate an increasingly complex market landscape.

Navigating the Current US Stock Market Landscape

The current landscape of the US stock market exhibits a contrasting picture of optimism and concern. Following a brief rally, the market has seen declines, primarily influenced by economic forecasts and geopolitical events, notably Trump’s tariff policies. Investors are attempting to make sense of this volatility, with fluctuations in stocks amplifying feelings of uncertainty among stakeholders. Many are watching for signals from the Federal Reserve and other financial institutions, which could provide insights into future monetary policies and their potential impacts on market conditions.

As the market faces potential downturns, investor confidence hinges on the ability of economic fundamentals to withstand external shocks. Analysts suggest that while the short-term outlook may appear challenging, adherence to solid economic policies and continuous monitoring of market movements can pave the way for potential recovery. Engaging in diversified investments and staying informed about macroeconomic indicators will be vital as investors navigate through these periods of unpredictability.

Market Reactions to Global Economic Trends

Market reactions are increasingly influenced by global economic trends as investors weigh various external factors affecting the US economy. International tariffs, particularly those enacted by China on American goods, have spurred fears of a broader economic slowdown. The interconnectivity of global markets means that changes elsewhere can create ripple effects that influence domestic economic performance and investor behavior. Today’s mixed results in the US stock markets reflect this nuanced relationship between domestic and international economic soundness.

Ultimately, how the US adapts to these international challenges will directly impact the investor landscape. With ongoing discussions about trade agreements and global supply chains, companies must stay agile and responsive to ensure their competitiveness. Increased awareness and preparation for geopolitical developments are crucial for mitigating risks associated with market volatility and enhancing economic resilience.

The Broader Implications of Economic Strategies

The ongoing economic strategies, particularly the approach towards tariffs and trade policies, have broad implications for the future of the US economy. Legislative actions and tariff implementation can shape the competitive advantage of domestic industries, influencing their global market position. As outlined by economic experts, navigating these policies effectively is essential to maintaining positive investor sentiment and fostering robust economic growth.

In times of uncertainty, economic strategies must prioritize adaptability and resilience. Policymakers need to balance the short-term advantages posed by tariffs against potential long-term consequences on trade relationships and domestic economic stability. Developing a clear economic vision for the future will be paramount in ensuring sustained growth and heightened investor confidence as the country works to navigate through market complexities.

Understanding Bond Market Dynamics in Current Conditions

Bonds have become a focal point of conversation in the current economic climate, particularly regarding their performance amidst stock market downturns. With yields fluctuating, many investors are turning to bonds as a safer investment alternative in light of market volatility. As a result, the bond market plays a critical role in shaping the overall investment landscape, providing insights into broader economic expectations and investor confidence.

The recent moves in the bond market highlight the growing apprehension surrounding inflation and potential recession risks. As entities like JP Morgan prepare for defaults, understanding the interconnectedness of bond performance and stock market health will be essential for investors. This dynamic approach can help mitigate risks associated with economic fluctuations while enabling a more informed investment strategy that aligns with changing market conditions.

Investor Confidence and Economic Growth Projections

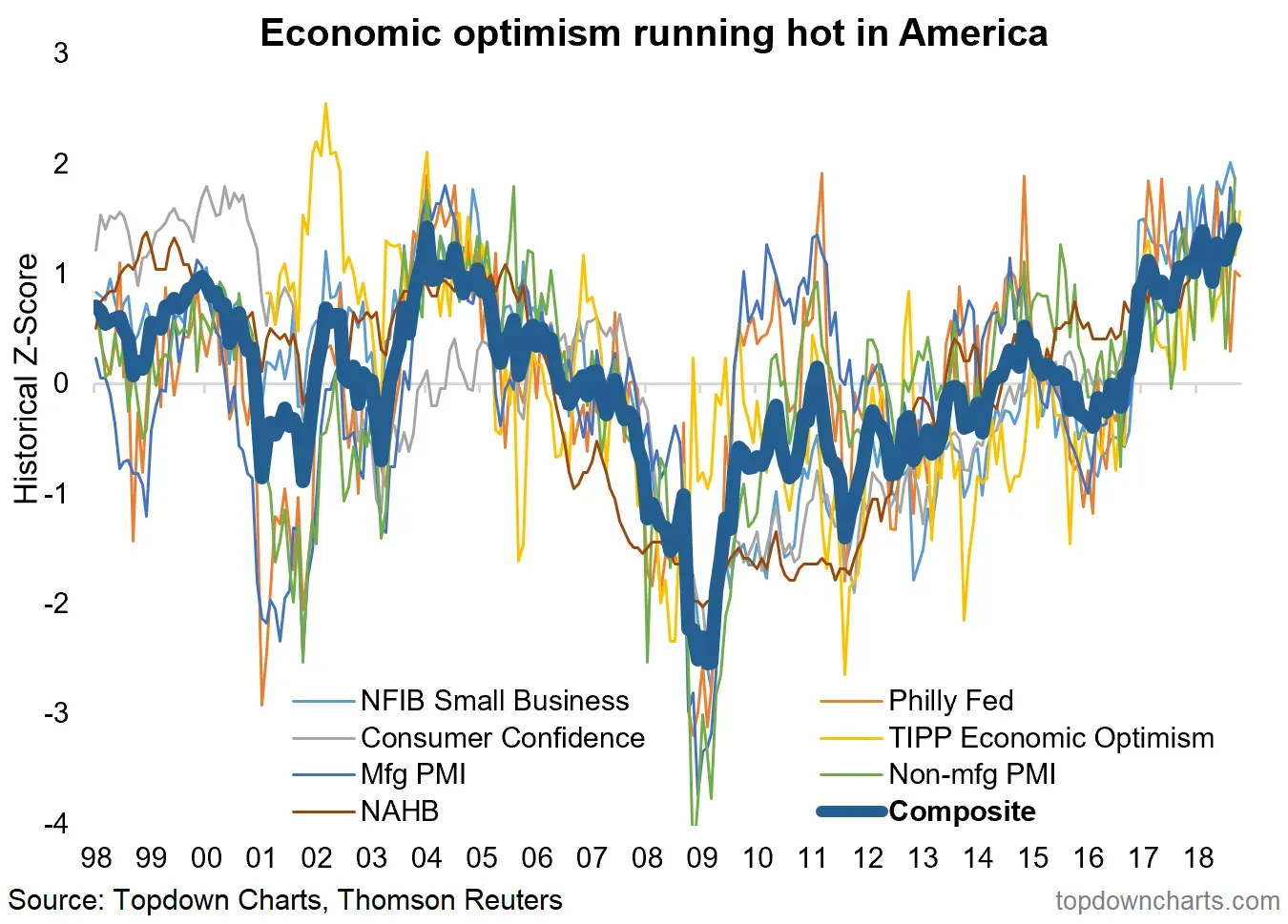

Investor confidence remains a vital element determining the trajectory of economic growth as business sentiment influences spending and investment behaviors. Recent statements from the White House, emphasizing great optimism in the economy, aim to instill confidence among stakeholders. The importance of such sentiments cannot be understated, as they drive market trends and ultimately affect economic output.

Looking ahead, tracking investor confidence levels will be paramount for assessing potential growth trajectories. Analysts are keenly observing consumer behavior as well, as spending plays a crucial role in stimulating economic activity. Confidential insights derived from market surveys can provide an early gauge of evolving confidence levels, serving as an essential tool in economic forecasting and planning.

Future Prospects for the US Economy Amidst Uncertainty

The future prospects for the US economy highlight a complex interplay of factors, including domestic policies, market conditions, and global interactions. With ongoing uncertainties stemming from trade relations and tariffs, the administration must engage in proactive measures to cultivate a stable economic environment. As uncertainties loom, the focus will need to shift towards fostering resilience and bolstering investor confidence to sustain long-term economic growth.

Looking forward, it becomes crucial for policymakers to implement strategic frameworks that not only address immediate concerns but also facilitate sustainable development. By encouraging innovation, enhancing trade relationships, and carefully managing economic risks, the US can navigate through challenging waters towards a more prosperous future. Balancing optimism with caution will be essential as the economy aims to recover from past instabilities and embrace new opportunities.

Frequently Asked Questions

What is the current sentiment of US economy optimism amid market volatility?

Despite recent market volatility, there is a significant sentiment of US economy optimism. The White House has expressed that there is ‘great optimism’ in the economy, suggesting that strong economic fundamentals still underpin growth prospects. This optimism may help bolster investor confidence in the stock market, even as external factors, like tariffs, contribute to market fluctuations.

How do Trump tariffs impact US economy optimism?

Trump’s tariffs have created uncertainty, which can dampen investor confidence and contribute to market volatility. However, the White House maintains that these tariffs are part of a ‘proven economic formula’ intended to promote domestic growth. While some view this impact negatively, there remains a thread of US economy optimism as policy adjustments are pursued to mitigate adverse effects.

What role does investor confidence play in shaping US economy optimism?

Investor confidence is a critical component of US economy optimism, as it drives market investments and economic growth. In turbulent times marked by market volatility and changing geopolitical dynamics, maintaining high levels of investor confidence can help stabilize stock markets and encourage continued economic activity. Positive messaging from policymakers can enhance this confidence.

How does economic growth influence overall US economy optimism?

Economic growth is a fundamental indicator that boosts US economy optimism. Recent reports indicating growth can foster a favorable outlook, helping to counterbalance fears of recession and market volatility. When economic activity remains strong, it reinforces the belief in a resilient economy, encouraging investments and supporting the stability of the US stock market.

What are the implications of market volatility on US stock market performance and economy optimism?

Market volatility can create uncertainty for investors, potentially impacting US stock market performance. However, the overarching narrative of US economy optimism persists, as strong economic indicators and supportive fiscal policy can lead to recovery and growth, even amidst fluctuations. This dynamic interplay between volatility and optimism shapes investor strategies and market responses.

Are recent economic indicators contributing to US economy optimism?

Yes, recent economic indicators, including unexpected growth rates and overall economic resilience, contribute positively to US economy optimism. Such indicators suggest that despite ongoing challenges, there is potential for continued recovery and strength, which is crucial for enhancing investor confidence in the stock market.

How can investors navigate US economy optimism despite economic challenges?

Investors can navigate US economy optimism by focusing on sound research, diversifying their portfolios, and remaining informed about market trends and fiscal policies. Understanding the balance between optimism and the underlying challenges, such as tariffs and inflation, can provide investors with strategic insights essential for decision-making in a volatile environment.

| Key Point | Details |

|---|---|

| White House Statement | There is ‘great optimism’ in the US economy despite market volatility. |

| Market Reaction | US stocks showed slight recovery after earlier declines, influenced by fears of recession but buoyed by the optimism from the administration. |

| Tariff Impacts | Trump’s tariffs are described as a ‘proven economic formula,’ despite causing plummeting stock values and increased market volatility. |

| Investor Sentiment | Concerns about defaults and consumer confidence continue to rise as tariffs impact the economy. |

| European Market Trends | While US markets face downturns, European indices show slight gains, signaling mixed global sentiment amid trade tensions. |

Summary

US economy optimism remains a topic of discussion as the White House projects confidence amid challenges like market volatility and tariffs. Despite the fluctuations in stock values and rising economic concerns, the administration’s perspective aims to foster resilience in investor sentiments. As geopolitical factors and fiscal policies evolve, the underlying belief in the economic recovery signals potential growth pathways ahead. Stakeholders are urged to monitor developments closely, as the combination of strategic policy adherence and market responses will shape the future landscape of the US economy.