HyperLend: Powered by RedStone Oracles for Secure Lending

HyperLend is revolutionizing the landscape of decentralized finance (DeFi) by integrating the innovative RedStone Oracles, ensuring robust and secure price feeds for its lending operations. As the premier lending protocol designed on the Hyperliquid Ethereum Virtual Machine (EVM), HyperLend is setting new standards for efficiency and reliability in the crypto lending space. This cutting-edge platform leverages the proven capabilities of Aave integration, optimizing its services for both traders and market makers. With real-time leverage, dynamic interest rates, and superior liquidity, HyperLend provides a powerful foundation for users engaging in DeFi lending. Launching on March 24, this platform promises to deliver a seamless experience driven by accurate cryptocurrency price feeds from RedStone, marking it as a key player in the evolving ecosystem.

In the realm of digital finance, HyperLend embodies a groundbreaking approach to lending protocols, built upon the foundations of Aave and powered by the Hyperliquid ecosystem. By incorporating advanced oracle technology from RedStone, this platform ensures its users benefit from precise and dependable pricing data. As it caters to the needs of both casual and professional traders, HyperLend presents features like leveraged trading and fluctuating interest rates, bridging traditional finance solutions with the innovative world of DeFi. The successful deployment on the Hyperliquid EVM represents a significant milestone in the industry, enhancing liquidity and efficiency. With its focus on synergizing DeFi capabilities and cutting-edge technology, HyperLend stands out as a leader in the future of cryptocurrency lending.

Understanding RedStone Oracles in DeFi Lending

RedStone Oracles play a critical role in the decentralized finance (DeFi) landscape, especially in the context of lending protocols. By providing reliable and timely price feeds, RedStone ensures that lending operations can function smoothly without unexpected fluctuations. This capability is essential for platforms like HyperLend, which require accurate market data to facilitate transactions and maintain user trust. In a sector where precision is paramount, RedStone’s modular architecture allows for rapid adaptations to different DeFi challenges, setting a new standard for how oracles operate.

Furthermore, the integration of RedStone Oracles into platforms such as HyperLend is a game-changer in terms of security and reliability. The implementation of these advanced technology solutions not only enhances the operational framework of DeFi lending protocols but also aligns with the broader trend of increasing transparency in cryptocurrency markets. As users demand more accountability and accuracy, RedStone stands out by delivering the high-quality data necessary for secure lending, thereby reinforcing its value in the ecosystem.

HyperLend: Revolutionizing Cryptocurrency Lending

HyperLend represents a significant evolution in the cryptocurrency lending arena, utilizing innovative technology to improve user experience and operational effectiveness. Built on the Hyperliquid EVM, it leverages the strengths of the Aave protocol while introducing unique features tailored for traders and market makers. The allure of real-time leverage and dynamic interest rates offers users the flexibility they need to navigate the fast-paced crypto market. With its launch on March 24, HyperLend is at the forefront of the DeFi revolution, indicating that it is fully embracing the modular technology provided by RedStone.

By integrating robust price feeds from RedStone, HyperLend not only enhances its functional capabilities but also contributes to building a more resilient lending environment. This kind of synergy not only fosters user confidence but also attracts liquidity to the platform, making it a viable competitor in the DeFi lending space. As more platforms recognize the necessity of accurate pricing data, the ecosystem will likely shift towards integrating similar advanced oracle solutions, emphasizing the importance of collaborations that drive blockchain technology forward.

The HyperLend platform is particularly compelling for users looking for deep liquidity and immediate access to capital through a decentralized system. By utilizing the RedStone Oracles, it minimizes human error and external vulnerabilities, which are critical aspects in the volatile cryptocurrency markets. Consequently, HyperLend is positioned to not only meet the growing demand for sophisticated DeFi solutions but also to set new benchmarks for security and operational excellence in cryptocurrency lending.

Aave Integration and its Impact on HyperLend

The integration of Aave into HyperLend enhances the overall robustness of the lending protocol by incorporating one of the most trusted DeFi frameworks. Aave has established a solid reputation in the industry for its secure lending and borrowing mechanisms, which complement HyperLend’s innovative approach to real-time leverage and dynamic interest rates. As a result, HyperLend’s users gain additional reassurance from using a well-regarded underlying protocol, further solidifying their confidence in the platform.

Moreover, the Aave integration allows HyperLend to tap into the existing liquidity and user base of Aave, creating an ecosystem that benefits from established trust and infrastructural stability. This intersection not only attracts new users to HyperLend but also fosters an environment where existing Aave users can explore the additional features and benefits HyperLend has to offer. With both RedStone Oracles and Aave on board, HyperLend stands at the confluence of reliability and innovation, setting a high bar for future DeFi lending protocols.

The Importance of Cryptocurrency Price Feeds

In the rapidly shifting landscape of cryptocurrency markets, accurate price feeds are crucial for maintaining operational integrity in DeFi lending protocols. Price volatility can lead to significant risks, and thus, platforms like HyperLend depend extensively on the accuracy provided by oracles like RedStone. The rise of automated trading and lending mechanisms highlights the necessity for real-time data that can accurately reflect market conditions, reducing the chances of liquidation and improving user experience.

Furthermore, the stability provided by reliable price feeds not only impacts individual decisions but also contributes to the overall health of the DeFi ecosystem. By ensuring that price information is secure and up-to-date, platforms can attract more users, ultimately driving liquidity and fostering innovation. In essence, the quality of cryptocurrency price feeds directly correlates with the success of lending platforms like HyperLend, thereby reaffirming the importance of sophisticated oracle solutions.

Impact of RedStone Oracles on DeFi Ecosystem

The integration of RedStone Oracles signifies a pivotal shift in the ways that DeFi platforms can operate. By leveraging advanced oracle technology, HyperLend is able to improve not only its own lending capabilities but also contribute to the overall advancement of the DeFi ecosystem. With every successful integration that utilizes dependable price feeds, the industry as a whole becomes more resilient, capable, and trusted by a broader audience of users.

RedStone’s influence extends beyond just HyperLend; it has been instrumental in several other prominent DeFi protocols, proving its versatility and reliability. The continuous growth in adoption rates of RedStone by various platforms underlines its significance in the DeFi landscape, enhancing operational capabilities while ensuring security and accuracy. This push towards standardizing high-quality oracle services is critical for building sustainable financial solutions in the decentralized world.

The Future of DeFi Lending Protocols

As the DeFi market continues to expand, the role of innovative lending protocols like HyperLend will be paramount. The integration of cutting-edge oracle technologies such as RedStone will not only set new industry standards but also pave the way for more sophisticated financial instruments. Looking ahead, the convergence of advanced price feeds and user-friendly interfaces will drive adoption among both retail and institutional investors, thereby unlocking unprecedented levels of liquidity and participation within the DeFi space.

In this future landscape, DeFi lending protocols could become the norm for accessing credit and liquidity in a decentralized manner. As regulatory clarity improves and technological advancements unfold, platforms like HyperLend are likely to emerge as leaders in the field, continuously adapting to meet the evolving needs of users. The focus on secure, accurate price data, as provided by RedStone, will be fundamental in building robust and scalable protocols that prioritize user trust and operational excellence.

Navigating Risk in Crypto Lending

Risk management is a critical facet of any lending protocol, especially in the volatile world of cryptocurrency. HyperLend, in collaboration with RedStone, has developed mechanisms that aim to mitigate risks associated with price volatility and market dynamics. By leveraging reliable price feeds, HyperLend can implement more effective liquidations and better manage collateralization ratios, ultimately protecting users’ investments and the integrity of the lending platform.

An enhanced focus on risk management also reflects a broader trend in the DeFi space, where users are becoming increasingly aware of the potential pitfalls of decentralized lending. By utilizing the data provided by RedStone, HyperLend aims to create an environment where users can engage in lending and borrowing with greater confidence, thus promoting a healthy, flourishing ecosystem. The ongoing advancements in oracle technology will play a pivotal role in recognizing and addressing the ever-evolving risks within crypto lending.

The Significance of Deep Liquidity in DeFi

Deep liquidity is an essential criterion for any successful lending platform in the DeFi space. HyperLend emphasizes this aspect, ensuring that users can easily access large amounts of capital without causing significant price slippage. This is crucial not only for individual users but also for maintaining the overall stability of the platform, as higher liquidity levels can help absorb market shocks.

Moreover, platforms that prioritize deep liquidity, supported by precise price data from RedStone Oracles, are likely to attract more users, which in turn fosters a competitive environment that benefits all stakeholders. As the DeFi landscape evolves, the emphasis on liquidity and price stability will shape the future of lending protocols, solidifying their positions as pivotal players in the broader cryptocurrency ecosystem.

Exploring the Role of Modular Oracle Protocols

Modular oracle protocols like RedStone represent an innovative approach to data provision in the DeFi sector. By allowing for greater customization and adaptability, these solutions enable lending platforms such as HyperLend to tailor their data feeds according to specific operational requirements. This flexibility makes it easier for new and existing protocols to integrate sophisticated pricing mechanisms that can respond swiftly to the ever-changing crypto market conditions.

As more platforms adopt modular oracle solutions, we can expect a shift toward more user-centric designs that prioritize operational efficiency and risk mitigation. With benefits such as lower costs and enhanced speed, modular protocols will likely become the foundation for future advancements in the DeFi landscape, allowing lending protocols like HyperLend to thrive in a competitive environment that demands innovation and stability.

Frequently Asked Questions

What is HyperLend and how does it relate to RedStone Oracles?

HyperLend is a DeFi lending protocol that operates on the Hyperliquid Ethereum Virtual Machine (EVM). It integrates RedStone’s modular oracle protocol to provide secure and accurate cryptocurrency price feeds, ensuring reliable operations for lending activities.

How does the integration of Aave enhance the functionality of HyperLend?

HyperLend utilizes Aave’s proven infrastructure to offer dynamic interest rates, real-time leverage, and deep liquidity. This integration aligns HyperLend with established practices in the DeFi space, providing users with a robust lending platform optimized for the Hyperliquid ecosystem.

What benefits does HyperLend offer by using RedStone’s pricing feeds?

By incorporating RedStone’s oracle feeds, HyperLend ensures that lending operations are backed by secure and accurate cryptocurrency price data. This helps mitigate risks associated with price volatility, enhancing the overall user experience in the lending process.

Who are the key players in the HyperLend ecosystem?

Key players in the HyperLend ecosystem include RedStone Oracles, which supply price feeds, and Aave, which provides the foundational infrastructure. Together, they create a secure and efficient environment for DeFi lending on the Hyperliquid platform.

When did HyperLend officially launch its mainnet on Hyperliquid EVM?

HyperLend’s mainnet was officially launched on March 24, 2025, marking a significant milestone in the integration of RedStone Oracles to enhance its lending functionalities within the Hyperliquid ecosystem.

What other DeFi protocols has RedStone Oracle integrated with?

RedStone Oracles has integrated with various DeFi lending protocols, including Venus Protocol, Morpho, Fraxlend, Lombard, ZeroLend, DeltaPrime, and Spark Protocol, highlighting its commitment to enhancing lending platforms across the DeFi sector.

What features make HyperLend unique in the cryptocurrency lending space?

HyperLend is distinguished by its use of RedStone’s modular oracle for reliable price feeds, its Aave integration for secure lending infrastructure, and features like real-time leverage and dynamic interest rates tailored for high-frequency traders and market makers.

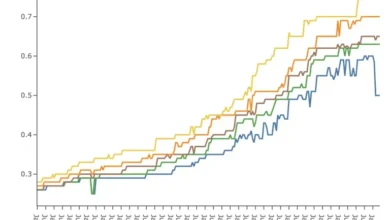

Can you explain the price trends of the RedStone token (RED) and its significance for HyperLend?

The RedStone token (RED) has seen fluctuations, gaining 12% recently but remains below its peak of $0.82. For HyperLend, the performance of RED is significant as it reflects the health and adoption of the RedStone Oracle protocol which underpins its lending operations.

| Key Features | Details |

|---|---|

| Integration with RedStone | HyperLend uses RedStone’s modular oracle protocol to ensure secure and reliable price feeds. |

| Foundation | Built on Hyperliquid EVM, HyperLend adapts the Aave protocol for enhanced functionality. |

| Mainnet Launch | Launched on March 24, 2025, focusing on security and accuracy in lending operations. |

| Unique Features | Real-time leverage, dynamic interest rates, and deep liquidity tailored for traders. |

| Price Action of RED token | RED token has increased by 12% in the last 24 hours; currently trading at $0.36. |

Summary

HyperLend is revolutionizing the lending landscape by leveraging RedStone’s advanced oracle technology for its operations. This integration not only enhances the security and reliability of the platform but also ensures that traders and market makers have access to real-time, accurate price data. As HyperLend continues to develop within the Hyperliquid ecosystem, it solidifies its role as a significant player in the DeFi space, offering users enhanced features and improved infrastructure.