Bitcoin Surge: Impact of Fake News on Financial Markets

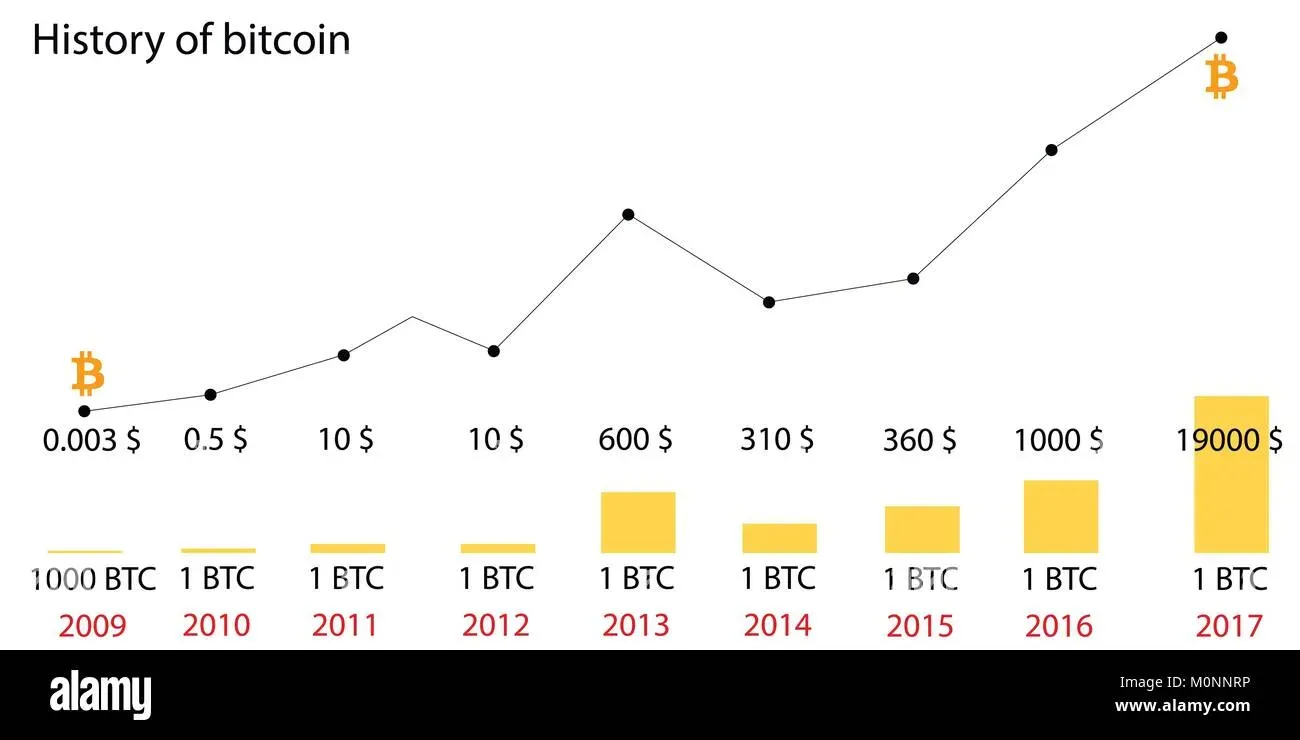

The recent Bitcoin surge has captured the attention of investors and analysts alike, sparking discussions about its implications for the cryptocurrency market. Triggered by a sensational fake news report, this spike in value has highlighted the volatility of digital currencies, showcasing how external factors can dramatically influence prices. With Bitcoin now dominating over 62% of the crypto market, it’s clear that shifts in sentiment can lead to significant investment opportunities. Amidst this backdrop, concerns about security threats such as Bitcoin address poisoning also loom, drawing attention to the need for investor vigilance. Additionally, news surrounding other cryptocurrencies like Shiba Inu adds to the uncertainty, reminding investors to tread carefully in this rapidly changing landscape.

In recent times, the rapid increase in Bitcoin’s value has proven to be a focal point for discussions in the realm of digital currencies. This unexpected upward trend, largely fueled by misinformation circulating in the financial news, illustrates how intertwined Bitcoin is with broader market fluctuations. As the overall value of cryptocurrencies escalates, Bitcoin’s prominence remains undisputed, often reflecting the sentiments and conditions of the market at large. Amid ongoing concerns such as the threats of address poisoning and the plight of cryptocurrencies like Shiba Inu, the dynamics of investing in virtual currencies continue to evolve. Investors must stay abreast of developments to not only navigate but also capitalize on the changing tides of the digital currency landscape.

Understanding the Impact of Fake News on Financial Markets

The financial markets are often sensitive to news and information, demonstrating a fragile interconnectedness that can provoke significant responses within a short time frame. The recent fake news story regarding President Trump’s trade policy exhibited this vulnerability, showcasing how misinformation can lead to sharp fluctuations in both traditional and cryptocurrency markets. When traders and investors wake to headlines suggesting sudden shifts in government policy, such as tariff suspensions, their immediate reflex is often to act—the result being a surge or drop in the affected market segments.

Such events illustrate the growing influence of information, both accurate and misleading, on trading behaviors. In the case of Bitcoin’s sudden surge, it became evident that speculators reacted not just to the news itself but also to the underlying concern over economic stability and future trade conditions. With the cryptocurrency market catching wind of potential favorable policies, prices spiked temporarily, underscoring the critical need for investors to check the credibility of news sources before making significant financial moves.

Frequently Asked Questions

How did fake news impact the Bitcoin surge recently?

The recent surge in Bitcoin’s price can be attributed to the fallout from a fake news report regarding U.S. trade tariffs. This misinformation temporarily disrupted global financial markets and highlighted how sensitive the cryptocurrency market, including Bitcoin, is to public sentiment and news reports.

What is the current situation in the cryptocurrency market following the Bitcoin surge?

Following the Bitcoin surge, the cryptocurrency market has shown significant positivity, with a total market value reaching approximately $2.529 trillion. Bitcoin holds a dominant market share of 62.73%, reflecting the overall recovery of digital currencies.

How can Bitcoin address poisoning impact users during a Bitcoin surge?

During periods of high market activity, such as a Bitcoin surge, users should be cautious of Bitcoin address poisoning attacks. Fraudsters may create fake addresses that mimic legitimate ones, tricking users into sending funds to the wrong place, thereby risking their investments amidst market fluctuations.

Is the Shiba Inu news affecting the Bitcoin surge and overall market sentiment?

Negative developments in the Shiba Inu market can influence overall sentiment in the cryptocurrency market, including Bitcoin. Currently, only 5% of Shiba Inu holders are in profit, which may create a ripple effect leading to cautious trading behavior that can affect markets that include Bitcoin.

What FDUSD concerns are arising in relation to the Bitcoin surge?

Concerns regarding FDUSD, particularly accusations of mismanagement of customer assets by First Digital Trust, have cast a shadow over the cryptocurrency market. Such concerns can lead to increased volatility, especially during surges in Bitcoin and other major cryptocurrencies, as investors reassess their portfolios.

| Key Points | Details |

|---|---|

| Impact of Fake News on Markets | A fake news report about Trump’s trade policies temporarily disrupted financial markets, highlighting the interconnectedness of cryptocurrency markets. |

| Market Performance (April 7, 2025) | Cryptocurrency market value reached $2.529 trillion, with Bitcoin at 62.73% market share. |

| Shiba Inu Profitability | Only 5% of Shiba Inu holders are currently in profit as prices fall to $0.0000107. |

| Bitcoin Address Poisoning Attacks | Increased attacks targeting Bitcoin users aimed at stealing cryptocurrencies through deception. |

| FDUSD Issues and Justin Sun’s Warnings | Justin Sun warns about potential risks involving First Digital Trust and FDUSD, claiming customer assets are endangered. |

| Coinbase Fraud Crisis | Concerns arise as Coinbase deals with a $46 million theft and issues related to customer identity verification. |

| Trump’s Trade Policies | Bill Ackman’s call for a 90-day halt on U.S. tariff increases indicates market anxiety. |

Summary

The recent Bitcoin surge has been influenced by a combination of factors, including a fake news report that shook global financial markets. Despite the volatility, Bitcoin remains a dominant player in the cryptocurrency realm, commanding a significant market share. Meanwhile, issues like address poisoning attacks and regulatory concerns hint at the risks involved in this nascent industry. As the market reacts to political developments, investors should remain vigilant regarding both opportunities and threats in the world of cryptocurrencies.