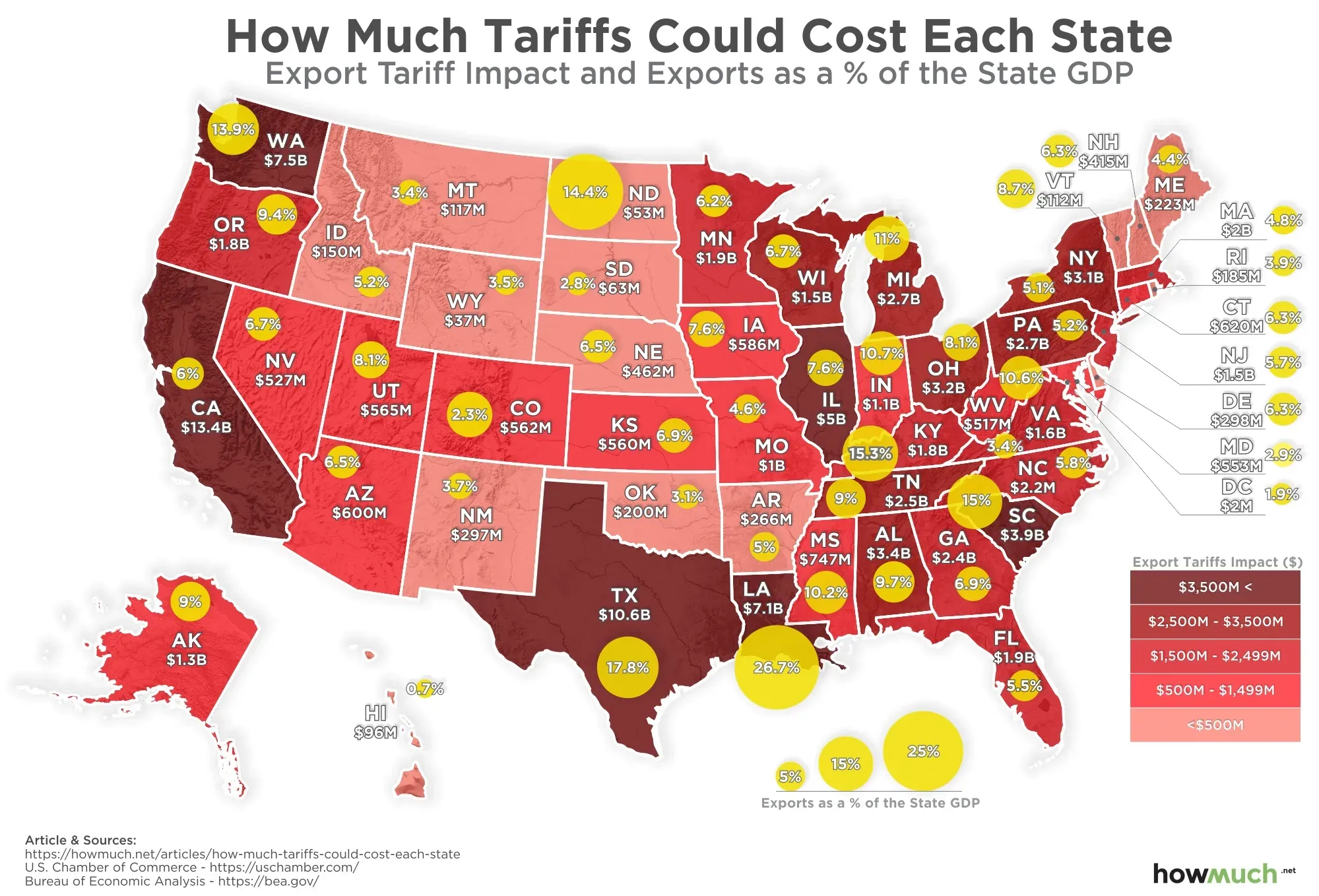

New York Tariffs Impact: Job Risks and Economic Fallout

The impact of New York tariffs is drawing significant attention as they threaten the stability of the state’s economy and job market. Recently, U.S. Senate Majority Leader Chuck Schumer highlighted the potential loss of hundreds of thousands of New York jobs due to imposing federal tariffs on imported goods. With the implementation of these new import taxes by the Trump administration, concerns have arisen about the cascading effects on the cost of living and the overall economic environment in New York. Schumer warned that the economic impact of tariffs could extend well beyond just pricing, jeopardizing investments and causing a spike in unemployment rates. As New Yorkers brace for a possible $20 billion increase in costs, the urgency for dialogue and potential action against these trade restrictions has never been more critical.

The recent introduction of tariffs on imported goods has sparked a critical discussion around economic policy in New York. With the looming threat of elevated import taxes, local industry leaders are voicing their concerns about the broader implications for businesses and employment. As Chuck Schumer noted, the repercussions could extend far beyond immediate financial burdens, affecting the very fabric of the state’s job market and economic viability. Small businesses, in particular, are feeling the pinch as their profit margins tighten under the weight of these new financial pressures. The ongoing dialogue regarding the ramifications of these trade policies will be vital in determining the trajectory of New York’s economy.

The Economic Implications of New York Tariffs

The introduction of new federal tariffs is poised to have significant economic implications for New York. U.S. Senate Majority Leader Chuck Schumer has underscored the dire consequences, predicting that the state could face staggering costs upwards of $20 billion. The import taxes aimed at goods from abroad threaten the very fabric of New York’s economy, as critical sectors like retail, restaurant services, and automotive dealers depend heavily on imported materials. The economic impact of tariffs could stretch far beyond mere price hikes, influencing the employment landscape and challenging the stability of numerous businesses throughout the state.

Furthermore, as Tariff policies unfold, local job markets are at a heightened risk of disruption. The alarming forecast suggests that up to 260,000 jobs may be jeopardized, with small businesses feeling the brunt of these economic shocks. According to reports from the chamber of commerce, panic is already setting in among local enterprises, especially those juggling thin profit margins. The fluidity of supplies and costs resulting from federal tariffs may force business owners to make tough decisions, affecting everything from staffing to operational hours.

Chuck Schumer’s Stance on Tariffs

Chuck Schumer has been a vocal opponent of federal tariffs, advocating for policies that would protect New York jobs and economic stability. He passionately opposed the tariffs, asserting that they could harm the already fragile economic recovery experienced post-pandemic. Schumer’s amendment to halt the tariffs, supported by his colleague Senator Amy Klobuchar, reflects a broader concern about the ability of these taxes to derail progress made toward achieving robust employment figures and economic growth in New York. His statements resonate with many stakeholders who fear the adverse effects on industries vital to New York’s economic ecosystem.

In defending his position, Schumer pointed out that New York is not only a significant national economic player but also a global trade hub. By imposing tariffs, the federal government risks undermining the competitive edge of the state’s businesses, potentially leading to increased import costs and diminished foreign investment. The implications of these tariffs stretch far beyond individual business losses; they encapsulate a wider threat to economic diversification and stability, which are crucial for New York jobs and the overall economic landscape.

The Impact of Tariffs on Local Businesses

Local businesses in New York are already facing the unpleasant repercussions of the new federal tariffs. With skyrocketing import taxes imposed on goods from various nations, industries that rely on international supplies—including restaurants, auto dealerships, and medical providers—are particularly vulnerable. The chamber of commerce indicated that many businesses, especially smaller ones with tight margins, are beginning to experience immediate effects, including increased costs and operational challenges. As these tariffs take hold, there is a risk that businesses may pass on increased expenses to consumers, pushing grocery and retail prices even higher.

Moreover, the uncertainty surrounding tariffs creates a climate of instability that discourages business investment. Potential expansion projects may be put on hold, deterring foreign investment and impacting tourism, which is vital for New York City. The interplay of these factors can lead to a contraction in local economies, making it more challenging for businesses to thrive. Without significant intervention, New Yorkers could face a new normal of reduced economic vitality and employment opportunities, which underscores the urgency of addressing the ramifications of import taxes.

Senate Response to Tariff Concerns

Despite Chuck Schumer’s urgent appeals to halt the implementation of federal tariffs, Senate Republicans voted against his amendment, raising concerns about the bipartisan effort required to address economic issues. The lack of consensus on the tariff policies signifies a deeper divide in legislative priorities, making it challenging to craft solutions that could safeguard New York jobs. This partisan dynamic not only impedes immediate responses but also complicates the predictability and assurance businesses seek in a turbulent economic environment.

The Senate’s response to tariff concerns highlights a critical need for dialogue and collaboration among lawmakers. With the stakes rising for hundreds of thousands of local jobs, the necessity for effective governance that prioritizes economic stability is clearer than ever. Stakeholders across all industries are advocating for more comprehensive discussions focused on mitigating the adverse effects of trade policies and fostering environments conducive to economic growth, thereby ensuring that New York can remain competitive on a global scale.

Long-term Effects of Tariffs on New York Economy

The long-term effects of federal tariffs will likely resonate throughout New York’s economy for years to come. As businesses grapple with the immediate fallout of increased import costs and dwindling consumer spending, the structural changes required to adapt to these economic challenges may alter New York’s competitive landscape fundamentally. The potential loss of an estimated 260,000 jobs calls into question not only the health of local economies but also the state’s ability to attract and retain talent in a shifting job market.

In the face of such economic turmoil, New York might have to rethink its strategic approach towards trade, workforce development, and cross-border partnerships. Embracing innovative solutions and feedback from the business community will be crucial for cultivating resilience against volatile trade conditions. By fostering collaboration between public and private sectors, New York can prioritize not just recovery from the immediate impacts of tariffs but also set a roadmap for sustainable growth that can withstand future fluctuations in federal trade policies.

The Role of Small Businesses Amid Tariff Increases

Small businesses play a pivotal role in New York’s economy, yet they often lack the financial resources to pivot quickly when faced with the rising costs presented by new tariffs. Unlike larger corporations that may have more flexibility to absorb costs, small businesses frequently operate on tighter margins, making them especially susceptible to economic shifts brought on by import taxes. Therefore, the recent tariff changes could disproportionately impact these local enterprises, potentially leading to closures and job losses that would ripple through the community.

Moreover, the compounding effects of tariffs can create barriers to entry for new businesses, stifling innovation and entrepreneurship in the region. Entrepreneurs may hesitate to invest in ventures within a climate marked by escalating costs and uncertainty surrounding international trade. The vitality of New York’s small business landscape, a key driver of job creation and economic growth, depends on active measures to mitigate the impacts of tariffs, emphasizing the need for supportive policies that can sustain small businesses through turbulent economic times.

Local Government Response to Tariff Effects

As the implications of federal tariffs begin to unfold, local governments in New York are being called to take proactive measures in mitigating the fallout. With the potential loss of jobs and rising costs of living on the horizon, municipalities are exploring options to support affected industries and workers. Efforts might include developing relief programs for small businesses facing hardships due to increased import taxes, as well as engaging in advocacy at the federal level to push back against damaging tariff policies.

Moreover, local governments can foster partnerships with economic development organizations to provide resources and training for workers displaced by tariff impacts. By equipping the workforce with new skills and knowledge, municipalities can help facilitate transitions into sectors less affected by trade disruptions. This multifaceted approach can help stabilize the local economy while also enhancing resilience against future economic shocks that could stem from ongoing tariff fluctuations.

Tourism at Risk Due to Tariffs

Tourism is a vital economic driver for New York City, contributing billions to the local economy and supporting countless jobs. However, the newly instituted federal tariffs pose a risk not only to local businesses but also to the vibrancy of the tourism sector. Increased costs of imported goods may lead to higher prices for attractions, dining, and retail experiences that tourists seek. Consequently, this could dissuade both domestic and international visitors, leading to a decline in foot traffic across popular tourist destinations.

Furthermore, the perception of instability due to trade policy changes can discourage foreign investment, which often fuels tourism initiatives in major cities. Should international travelers perceive New York as a less welcoming market due to the economic tension created by tariffs, the overall tourism experience and revenue can severely diminish. Therefore, measures must be taken to safeguard tourism against the economic backlash of tariffs, ensuring that the city retains its appeal as a premier destination for visitors worldwide.

Addressing the Broader Impacts of Tariffs

The broader impacts of federal tariffs on New York extend into various facets of daily life, from basic commodity prices to employment opportunities. Understanding the intricate network of how tariffs affect not only businesses but also consumers themselves is crucial for eliciting community responses and adjustment strategies. As families face rising costs at grocery stores and service providers, the potential erosion of consumer confidence could lead to reduced spending, hampering economic recovery efforts.

In addressing these broader impacts, collaborative dialogues that incorporate insights from various stakeholders—businesses, consumers, labor groups—are essential. By fostering open discussions on how tariffs impact different demographics, solutions can be tailored more effectively to mitigate adverse effects while balancing the need for trade policies that support domestic industries. Through community engagement, New York can work towards resilient strategies that account for the complexities and challenges presented by federal tariffs.

Frequently Asked Questions

How will the new federal tariffs impact New York jobs?

The new federal tariffs on imported goods are predicted to put approximately 260,000 jobs at risk in New York. U.S. Senate Majority Leader Chuck Schumer has warned that these import taxes could severely affect one of the largest trade hubs in the world, leading to job losses across various sectors.

What is Chuck Schumer’s stance on the economic impact of tariffs in New York?

Chuck Schumer has expressed significant concern regarding the economic impact of tariffs imposed by the federal government. He argues that these tariffs could lead to increased costs for New Yorkers, totaling around $20 billion, and adversely affect the state’s economy, especially in key industries.

What industries in New York are most affected by the import taxes?

Several industries in New York are expected to be heavily impacted by the new import taxes. These include restaurants, retailers, auto dealers, and medical providers, all of which rely on imported goods. The financial strain from these tariffs could disrupt their operations and profitability.

What are the predicted effects of New York tariffs on the stock market and economy?

The predictions indicate that the new tariffs may negatively affect the stock market and broader U.S. economy. With potential cost increases in various sectors, concerns have been raised regarding unemployment rates and the overall global economic standing of the United States.

How might the new tariffs influence tourism and foreign investment in New York City?

The implementation of new federal tariffs could deter tourism and foreign investment in New York City due to anticipated increased costs and economic uncertainty. Local business leaders have warned that international backlash could exacerbate these challenges, threatening the city’s financial stability.

What measures have been proposed to counteract the impact of tariffs in New York?

In response to the potential risks posed by the tariffs, Chuck Schumer and Senator Amy Klobuchar introduced an amendment to halt the proposed import taxes. However, this amendment was defeated by Senate Republicans, which highlights the ongoing debate regarding the management of federal tariffs and their local effects.

| Key Points |

|---|

| Hundreds of thousands of jobs at risk in New York due to new federal tariffs, according to Senator Chuck Schumer. |

| President Trump’s proposed taxes on imports have taken effect, potentially wreaking havoc on the U.S. economy. |

| Senate Democrats attempted to stop the tariffs but were voted down by Senate Republicans. |

| Tariffs expected to affect grocery prices, unemployment rate, and the stock market. |

| New Yorkers face an estimated $20 billion in increased costs and 260,000 jobs under threat due to the tariffs. |

| Tariffs could raise transit project costs in New York, which already has the highest construction expenses globally. |

| City businesses, especially small ones, are panicking due to the impact of tariffs on profit margins. |

| Industries such as restaurants, retailers, and medical providers likely to be hardest hit by the tariffs. |

| International backlash from tariffs could negatively affect tourism and foreign investment in NYC. |

Summary

The New York tariffs impact is significant as it threatens to endanger a substantial number of jobs and raise costs for consumers across the state. With federal tariffs now in effect, New Yorkers are facing economic turmoil that could ripple through various sectors, affecting everything from small businesses to large industries. The potential ramifications on employment, investment, and prices are stark, highlighting the importance of addressing these tariffs to protect jobs and the economic standing of New York.