Trump’s Tax Breaks: Senate GOP Passes Framework Amid Opposition

Trump’s tax breaks have once again become a focal point of political debate in Washington, following the Senate GOP’s late-night approval of a framework that promises significant tax cuts. Characterized by Republican leaders as a key element of their agenda, these tax incentives are projected to deliver over $5 trillion in economic benefits, predominantly favoring wealthier Americans. The legislative push, aligned with Trump spending cuts, faces staunch opposition from Democrats who argue that it infringes upon essential social safety programs. As the budget reconciliation process unfolds, critics emphasize how Trump’s tax cuts for the wealthy threaten to deepen the fiscal divide, leading to increases in costs for lower and middle-income households. With the backdrop of the Senate GOP tax plan gaining momentum, the implications of these fiscal policies will be scrutinized as the nation approaches another critical election cycle.

The recent legislative endeavors surrounding President Trump’s fiscal policies, particularly the newly ratified tax incentives, encapsulate a pivotal moment in American economic strategy. These proposed adjustments to the tax code, often described as extensive tax cuts, primarily target affluent individuals and corporations. As Republican lawmakers rally around this framework, they simultaneously advocate for significant reductions in public spending that critics claim will undermine critical social services. This push is further intertwined with budget reconciliation measures aimed at harmonizing varying fiscal philosophies within the party. Navigating this complex landscape, Republicans seek to balance the appeal of tax benefits for the wealthy with the necessity of fiscal responsibility, creating a contentious arena for public discourse.

Trump’s Tax Breaks: A Boost for the Wealthy or Necessary Economic Reform?

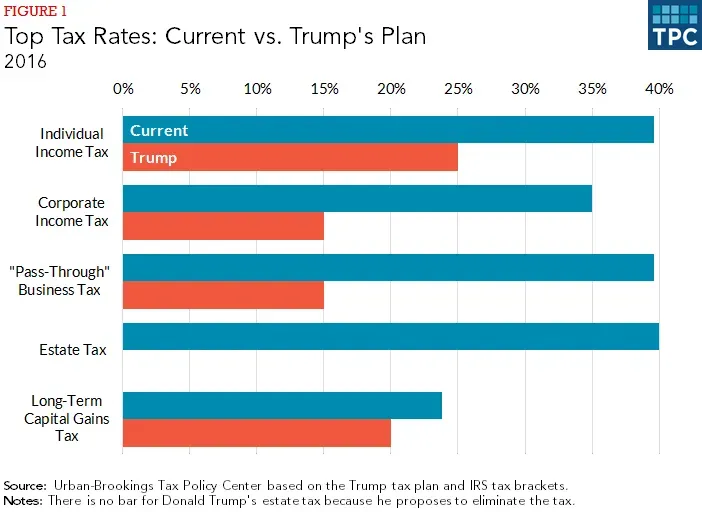

The recent approval of Trump’s tax breaks has stirred significant debate among economists and political analysts. Supporters argue that these tax cuts are essential for stimulating economic growth and increasing disposable income for American families. They contend that the proposed relief, aimed particularly at the middle class, can lead to higher consumer spending, which in turn fuels business growth and job creation. Proponents of the plan claim that by extending the individual and estate tax cuts initiated during Trump’s first term, the economy can be revitalized, especially in the wake of inflationary pressures and rising living costs.

On the other hand, critics assert that the tax cuts primarily benefit the wealthy, exacerbating income inequality in the U.S. By analyzing the potential outcomes, it becomes evident that nearly 45% of the overall benefits will flow to households earning around $450,000 or more by 2027. This reality raises questions about the fairness of the tax policy and whether it aligns with Republican promises to support average Americans. As the Senate GOP pushes forward with this framework, the discourse remains polarized, leading to concerns over its long-term implications for economic stability and social equity.

The Senate GOP Tax Plan: Balancing Budgets and Priorities

The recent Senate GOP tax plan has focused on balancing significant tax breaks with around $2 trillion in budget cuts, showcasing the delicate dance Republicans are navigating in a highly polarized political environment. Notably, Republican leaders emphasize the importance of fulfilling their promises to voters from the last midterm elections, and this plan is seen as a vital step toward that goal. Proponents argue that these fiscal strategies are aimed at securing essential services while simultaneously promoting economic growth through tax relief initiatives.

However, this balancing act has not come without controversy. Many Democrats have fiercely opposed the plan, arguing that it targets crucial safety net programs in an attempt to fund tax cuts ostensibly designed for wealthy Americans. The priority placed on tax cuts over social services has led to accusations that Republicans are preparing to dismantle vital programs such as Medicaid and food assistance. The ongoing budget reconciliation process will likely reveal significant rifts between the two parties, as Democrats aim to safeguard these programs while Republicans push to realize their long-standing tax policy goals.

The Debate Over Trump Spending Cuts: Prioritizing National Security or Social Welfare?

Central to the Senate GOP’s tax framework is a controversial proposition to allocate $175 billion towards Trump’s mass deportation effort and an equal amount to bolster military funding. Republican leaders, such as Senator John Barrasso, confidently assert that these spending cuts and priorities reflect voters’ desires to secure the border and reinforce national security. By presenting these initiatives as integral to restoring peace and security, the GOP aims to solidify its base while pushing for significant reforms that resonate with conservative voters.

In stark contrast, critics question the moral and economic implications of prioritizing these spending cuts. The concerns about allocating funds towards deportations rather than supporting essential programs like Medicaid and Social Security underscore a critical debate. Are these measures truly reflecting the public’s priorities, or are they part of a broader strategy that neglects vulnerable populations for military and border security interests? The diverging perspectives challenge lawmakers to reconsider their fiscal responsibilities and social obligations as they navigate the pressures of political expedience.

Republican Tax Policy: Strategies and Controversies

The Republican tax policy being proposed is a multifaceted approach designed not only to provide significant reductions for taxpayers but also to enact funding for government priorities. This strategy follows the blueprint established during the Trump administration, aiming to invigorate the economy while reducing tax pressure on households. With the Senate now pushing forward with this expansive budget package, key elements such as extending tax cuts for the wealthy and reducing the burden on certain estates remain at the forefront of the discussion.

Amid this push, there are growing concerns over the ramifications of Republican tax policy, particularly regarding its implications for the federal deficit. As fiscal conservatives within the party voice worries over increased government spending and potential debt accumulation, the GOP is confronted with the challenge of presenting a united front. As the nation rebounds from economic turbulence, the outcomes of these tax policies will be closely scrutinized amid debates about fiscal responsibility and their broader societal impacts.

Budget Reconciliation: The Tension Between Compromise and Ideology

As the Senate Republicans navigate the budget reconciliation process, tensions have escalated, particularly regarding how tax cuts will be funded and the cuts to social programs. The effort to achieve a unified budget plan has been met with resistance from both sides, making it clear that compromises will be crucial. The GOP’s strategy to consider tax cuts while proposing significant budget cuts reflects their aim to appeal to their base while managing the delicate balance of bipartisan negotiations.

Opposition from Democrats surrounding the Senate GOP tax plan underscores the ideological divide, particularly when it comes to safeguarding social programs. Amendments aimed at protecting essential services have been proposed, highlighting the pressing concern about the impact of potential cuts. As the reconciliation process unfolds, the dialogue will evolve, revealing whether consensus can be reached or if partisan battles will dominate the legislative landscape in the lead-up to crucial midterms.

The Role of Senate Leadership in Shaping Republican Tax Policy

Senate leadership plays a pivotal role in shaping the direction of Republican tax policy, especially amid the complex negotiations surrounding Trump’s tax breaks and spending cuts. With influential figures like Senate Majority Leader John Thune steering the agenda, the GOP is focused on maintaining cohesion within the party while pushing through significant fiscal reforms. Thune’s declaration to “let the voting begin” sets a tone of urgency, indicating the party’s commitment to fast-tracking the approval process despite facing considerable opposition.

The efforts made by Senate leaders to unify the party on tax issues will ultimately determine the outcomes of these legislative maneuvers. As they navigate dissent, particularly from more moderate voices within the GOP, leadership will be essential in quelling fears and fostering a collective strategy. The political landscape is shifting, and with looming midterm elections on the horizon, the Senate’s ability to articulate clear objectives and a robust vision for tax policy will be crucial in shaping voter perceptions.

Potential Challenges Ahead for Trump’s Tax Framework

While the Senate GOP has made progress in approving Trump’s tax framework, significant challenges lie ahead, particularly as the package moves to the House for consideration. The differences between the Senate’s proposal and the House’s vision, especially regarding the extent and types of tax cuts, will necessitate delicate negotiations. House Republicans have expressed concerns about the potential fallout of such broad fiscal strategies, worried about how these tax breaks will affect federal deficits and long-term budget sustainability.

Additionally, dissenting voices within the Senate, such as Senators Collins and Paul, indicate a growing unease about the far-reaching implications of these proposed cuts. As details emerge from both chambers, the extent to which each party will bend or maintain their stances could be instrumental in shaping the final legislation. The GOP must account for shifting public sentiments and the potential consequences of unpopular or divisive policies if they wish to solidify their hold on power in the upcoming elections.

Public Reaction to Republican Tax Breaks and Spending Cuts

Public reception of the Republican tax breaks and proposed spending cuts has been mixed, with many Americans grappling with the implications of such measures. Polling data reflects a divide between those who feel burdened by their tax obligations and those who see value in reduced taxation for wealthier individuals. As the GOP frames these tax breaks as essential for both helping everyday families and stimulating economic growth, public sentiment remains volatile, particularly amid ongoing economic instability.

As lawmakers prepare for the midterms, public opinion will be crucial for both Republican and Democratic strategies. Voters are increasingly aware of the consequences of allowing tax policies to favor the wealthy while potentially jeopardizing essential services. The challenge for Republicans will be to convey the benefits of these tax reforms to the broader public, particularly in the shadow of criticisms labeling them as catering exclusively to affluent Americans. Engagement with constituents and addressing their concerns will be vital for ensuring that these measures gain the approval needed for implementation.

The Future of Tax Policy: Lessons from the Past

Reflecting on the trajectory of Republican tax policy, the current proposals can be seen as a continuation of the patterns established during Trump’s presidency, when similar tax policies were enacted. The lessons gleaned from past tax reforms underscore the complexities inherent in balancing economic incentives with responsible governance. The push for extending tax cuts while simultaneously proposing budget cuts highlights an ongoing struggle between the desire for short-term fiscal relief and long-term economic planning.

As lawmakers consider the future of tax policy, the ramifications of these decisions will resonate well beyond their immediate impacts. Evaluating past legislative successes and failures can provide valuable insights into crafting sustainable fiscal solutions that address the needs of diverse constituencies. In navigating the challenging landscape of tax reform, the GOP has an opportunity to learn from history while aligning policies that not only stimulate the economy but also promote social equity and responsible governance.

Frequently Asked Questions

What are Trump’s Tax Breaks and how do they relate to the Senate GOP tax plan?

Trump’s Tax Breaks refer to the significant tax cuts enacted during President Trump’s administration, primarily through the Republican tax policy known as the Senate GOP tax plan. This plan aimed to reduce taxes for individuals and corporations, with estimates suggesting that it would disproportionately benefit wealthier households, sparking controversy and debate about its implications for income inequality.

How do Trump’s Tax Breaks potentially affect the budget reconciliation process?

Trump’s Tax Breaks play a crucial role in the budget reconciliation process as they involve substantial alterations to tax laws that can impact government spending and revenue. This process allows Senate Republicans to pass tax cuts with a simple majority, emphasizing the urgency to maintain these breaks to prevent tax increases for many American families.

What are the criticisms of Trump’s Tax Breaks regarding tax cuts for the wealthy?

Critics argue that Trump’s Tax Breaks provide significant tax cuts for the wealthy while potentially harming essential services through budget reductions. Democrats have consistently argued that the framework for these breaks disproportionately favors high-income earners, calling for amendments to protect safety net programs like Medicaid and Social Security.

How do Trump spending cuts balance out the cost of his tax breaks?

Trump spending cuts are designed to offset the financial impact of his tax breaks by reducing federal expenditures on various programs. However, many critics fear that these cuts could harm vulnerable populations and essential services, igniting debate about the true fairness and sustainability of his tax policy.

What is the estimated fiscal impact of Trump’s Tax Breaks over the next decade?

Estimates suggest that Trump’s Tax Breaks could add as much as $5.5 trillion to the national debt over the next decade, including interest. This significant figure highlights the fiscal challenges and debates surrounding the sustainability of such tax cuts, especially concerning their effects on federal budget balances.

Why did some Republicans oppose Trump’s Tax Breaks in the recent Senate vote?

Some Republicans, like Senators Susan Collins and Rand Paul, opposed Trump’s Tax Breaks due to concerns about their long-term ramifications on federal deficits and the potential for deep cuts to safety net programs. Their dissent reflects the party’s internal divisions on balancing tax cuts for the wealthy with the need to protect vital public services.

How do the proposed tax cuts under Trump’s Tax Breaks impact different income levels?

Proposed tax cuts under Trump’s Tax Breaks are designed to benefit approximately 75% of households, but they have been criticized for leading to potential tax increases for about 10% of Americans. Most of the financial benefits of these cuts are projected to accrue to households earning $450,000 or more, raising questions about equity within the tax policy.

What are the implications of Trump’s Tax Breaks on state and local taxes?

Trump’s Tax Breaks involve proposals to increase the deduction for state and local taxes, which is significant for residents in high-tax states like California and New York. This change aims to garner broader support among Republicans in those regions, reflecting the political maneuvering surrounding the tax policy.

What role does the House of Representatives play in shaping Trump’s Tax Breaks?

The House of Representatives plays a crucial role in shaping Trump’s Tax Breaks as they must approve the Senate’s framework, which includes proposals for extensive tax cuts and spending priorities. The House’s version may differ in scope and specifics, highlighting the importance of inter-chamber negotiations to finalize comprehensive tax reform.

What could be the long-term effects of Trump’s Tax Breaks on federal budgets?

The long-term effects of Trump’s Tax Breaks on federal budgets could include increased national debt due to projected revenue losses from tax cuts. Critics warn that this could necessitate further spending cuts, impacting critical services and programs, while advocates argue that stimulating economic growth could ultimately balance the fiscal impact.

| Key Point | Details |

|---|---|

| Senate Approval | Senate Republicans approved a multi-trillion-dollar framework for tax breaks and spending cuts with a vote of 51-48. |

| Republican Support | Despite dissenting votes from Senators Collins and Paul, GOP leadership secured Trump’s backing to push the tax cut bill. |

| Democratic Opposition | Democrats introduced amendments to protect crucial services and criticized the tax cuts for benefitting the wealthy. |

| Economic Context | The framework follows an unsettled economy impacted by new tariffs leading to stock price drops. |

| Tax Benefits | The tax cuts are estimated to total $5 trillion, with most benefits projected to go to high-income households. |

| House Version | The House proposes $4.5 trillion in tax breaks and $2 trillion in budget cuts with modifications to safety net programs. |

| Further Challenges | A contentious path remains ahead with differing views on debt limit increases and budget cuts. |

Summary

Trump’s Tax Breaks are a pivotal aspect of current legislative discussions, as Senate Republicans have advanced a multi-trillion-dollar framework aimed at providing extensive tax reductions amidst significant economic concerns. This initiative, requiring bipartisan collaboration, seeks to solidify Trump’s economic agenda while facing vigorous Democratic opposition concerned about the potential impacts on essential social services. As the process moves to the House, further negotiations will be critical in determining the future of these tax reforms.